Slightly cooler U.S. inflation report boosts gold, silver

Gold and silver prices are solidly higher in midday U.S. trading Tuesday, but down from daily highs, following a slightly tamer-than-expected U.S. inflation report. Gold surged to a five-month high and silver a seven-month high right after the report’s release. February gold was last up $26.70 at $1,818.90 and March silver was up $0.407 at $23.81.

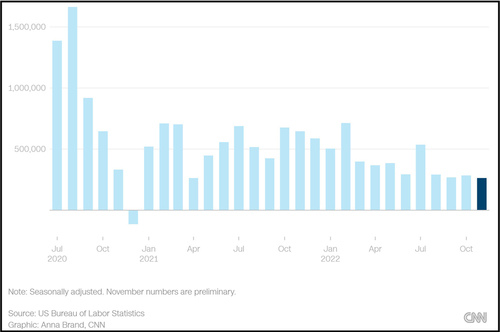

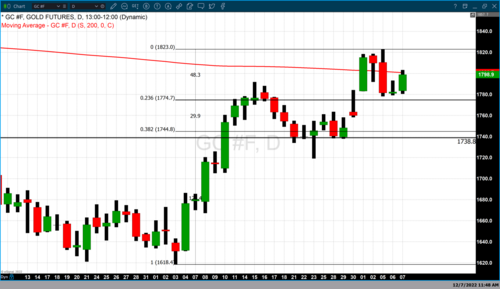

The U.S. consumer price index report for November showed a rise of 0.1% from October and was up 7.1%, year-on-year. CPI was forecast to come in up 0.3% from October and up 7.3%, year-on-year. The slightly cooler-than-expected inflation data was enough to rally the stock and financial markets, and the metals, while tanking the U.S. dollar index. The CPI report lands in the camp of the U.S. monetary policy doves, who want to see the Federal Reserve back off the accelerator on its aggressive monetary policy tightening path.

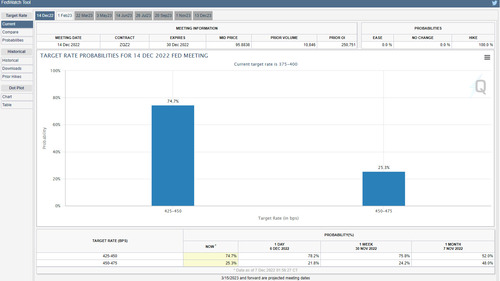

U.S. stock indexes are mixed at midday and have lost early strong gains in the aftermath of the CPI report. After the initial euphoria from the CPI report, traders and investors realized the Federal Reserve still has some tightening of monetary policy in their sights. The Fed’s Open Market Committee (FOMC) meeting began Tuesday morning and ends Wednesday afternoon with a statement and press conference from Fed Chair Powell. The FOMC is very likely to raise U.S. interest rates by 0.5%. The European Central Bank and the Bank of England meet on Thursday and are likely to follow the U.S. Federal Reserve with half-point rate hikes.

Deutsche Bank wants back in the gold market after eight-year absence

Deutsche Bank wants back in the gold market after eight-year absence

The key outside markets today see the U.S. dollar index sharply down and hitting a 5.5-month low. Nymex crude oil prices are sharply higher and trading around $75.85 a barrel. A major oil pipeline in the U.S. has been shut due to a leak, and that’s supporting Nymex crude oil prices this week. Meantime, the yield on the benchmark U.S. 10-year Treasury note is presently 3.492% and fell after the cooler CPI report.

.gif)

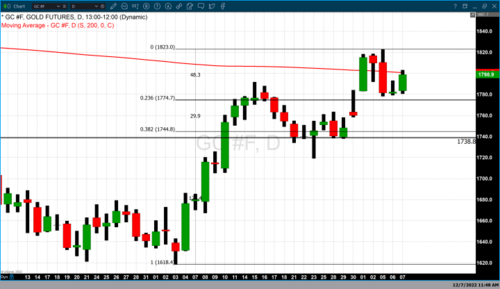

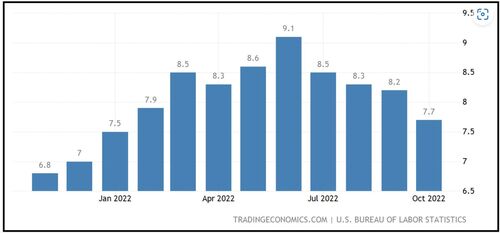

Technically, February gold futures prices hit a five-month high today. The gold futures bulls have the firm overall near-term technical advantage. Prices are in a five-week-old uptrend on the daily bar chart. Bulls’ next upside price objective is to produce a close above solid resistance at $1,900.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $1,775.00. First resistance is seen at $1,822.90 and then at today’s high of $1,836.90. First support is seen at $1,800.00 and then at this week’s low of $1,789.00. Wyckoff's Market Rating: 7.0

March silver futures prices hit a seven-month high today. The silver bulls have the firm overall near-term technical advantage. Prices are in a choppy 3.5-month-old uptrend on the daily bar chart. Silver bulls' next upside price objective is closing prices above solid technical resistance at $25.00. The next downside price objective for the bears is closing prices below solid support at $22.00. First resistance is seen at today’s high of $24.39 and then at $25.00. Next support is seen at this week’s low of $23.32 and then at $23.00. Wyckoff's Market Rating: 7.0.

March N.Y. copper closed up 425 points at 364.25 cents today. Prices closed nearer the session low today. The copper bulls have the overall near-term technical advantage. Copper bulls' next upside price objective is pushing and closing prices above solid technical resistance at 400.00 cents. The next downside price objective for the bears is closing prices below solid technical support at 354.70 cents. First resistance is seen at today’s high of 392.90 cents and then at the November high of 394.70 cents. First support is seen at this week’s low of 378.60 cents and then at 370.00 cents. Wyckoff's Market Rating: 6.0.

By Jim Wyckoff

For Kitco News

David

Outlook 2023 LIVE with Gareth Soloway

Outlook 2023 LIVE with Gareth Soloway

Sentiment in gold evenly split as prices end the week at a four-month high

Sentiment in gold evenly split as prices end the week at a four-month high

.png)

.png)

.gif) JPMorgan, HSBC to share custody of GLD's 900 tonnes of gold

JPMorgan, HSBC to share custody of GLD's 900 tonnes of gold.gif)

.gif) Bitcoin price dips below $17K as recession fears rise to the surface

Bitcoin price dips below $17K as recession fears rise to the surface