Gold appears unstoppable as it hits record highs above $2,250, capping off a solid month and quarter

The gold market continues to be an unstoppable juggernaut as it closes out the month and quarter near a record high, solidly above $2,200 an ounce.

Analysts note that gold’s performance on Thursday, which wraps up a shortened trading week ahead of the Easter long weekend, is even more impressive when compared to the U.S. dollar Index, which is trading near a six-week high above 104 points.

Gold prices last traded at $2,241 an ounce, up 2.7% from last week. For the month, gold is up 9%, and for the quarter, the precious metal is up 8%.

Gold’s further push into blue sky territory also comes ahead of important inflation data. Although markets are closed for Easter, it is not a recognized government holiday, so the U.S. Bureau of Economic Analysis will be releasing its Personal Consumption Expenditures (PCE) Index. According to consensus estimates, economists expect inflation to have risen 0.3% in February.

Some analysts have said that gold is attracting new momentum because inflation is less of a threat than it was. Last week the Federal Reserve signaled that it still looks for three rate cuts this year even as they see inflation holding above its 2% target.

Darin Newsom, Senior Market Analyst at Barchart said that the gold rally is a signal that investors are worried that the Federal Reserve won’t be able to get inflation under control as it starts to cut interest rates.

He added that he also sees gold well supported as a geopolitical risk hedge.

“Geopolitical fears are still out there and will only continue to grow as we approach the November U.S. election,” he said. “If the Fed starts cutting rates, bond yields will fall, which makes gold a more attractive safe-haven.”

At the same time, some analysts note that the U.S. dollar is losing its grip on the gold market as U.S. government debt continues to spiral higher.

“Gold is not expensive. The truth is that the U.S. dollar is cheap as the government floods the global economy with it,” said Julia Khandoshko, CEO at the European broker Mind Money, in an interview with Kitco News.

Although the Federal Reserve has been tightening its balance sheet as part of its aggressive monetary policy, some analysts have noted that the nation’s money supply continues to grow.

David Kranzler, precious metals analyst and creator of the The Mining Stock Journal said in a comment on social media that the U.S. The Monetary Base, as measured by Money Zero Maturity (MZM), is up nearly 10% since March 2023.

“Gold smells a massive money-printing program coming at some point. In fact, low-grade money printing has already occurred,” he said.

MZM represents money readily available within an economy for spending and consumption. and includes M2 money supply, less the time deposits, plus all money market funds.

Regardless of what is driving gold at its record highs, Adam Button, Chief Currency Strategist at Forexlive.com said that he expects this is only the start of the rally.

Despite gold’s historic rally, Button said that the precious metal sector continues to be ignored in the broader marketplace. He added that the mining sector, while off its lows is still significantly undervalued compared to gold prices.

“This quiet rally is extremely encouraging for gold investors,” he said. “This is not an exhausted bull market. The time to sell is when everyone is talking about gold and the miners are taking off.”

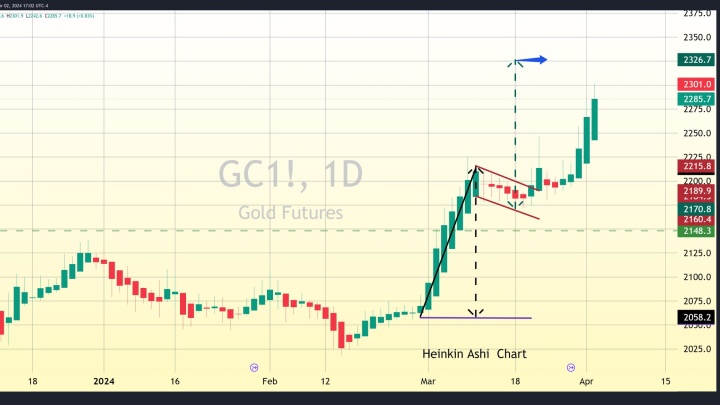

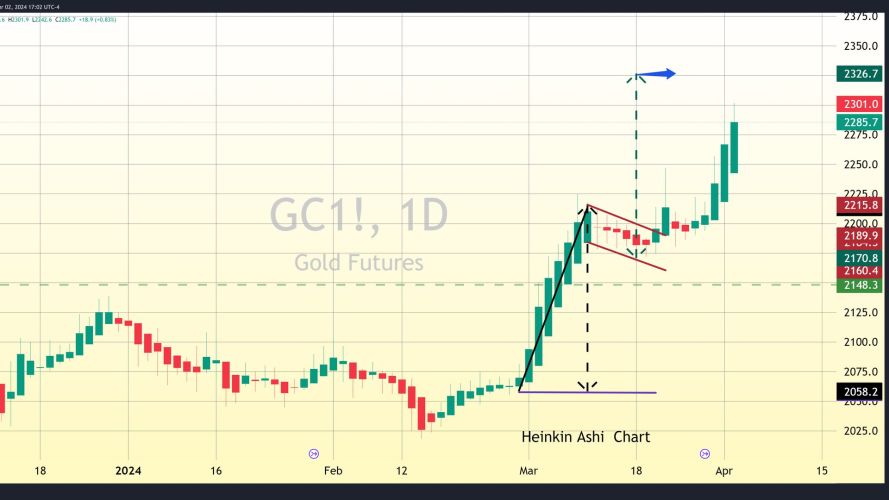

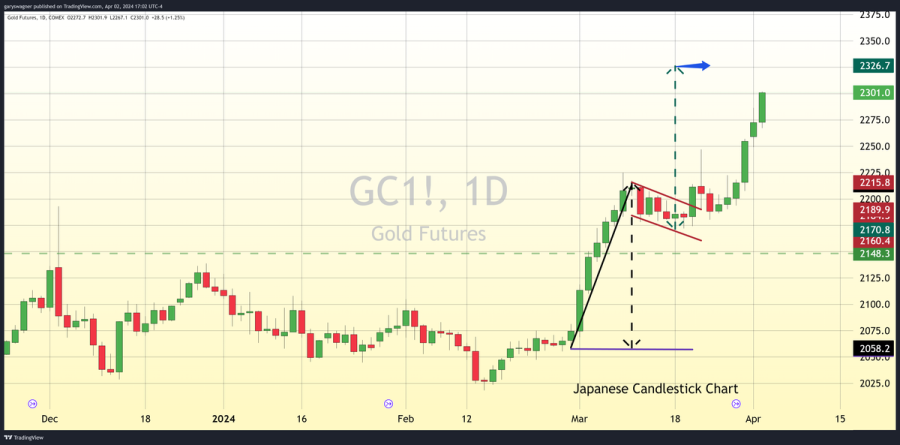

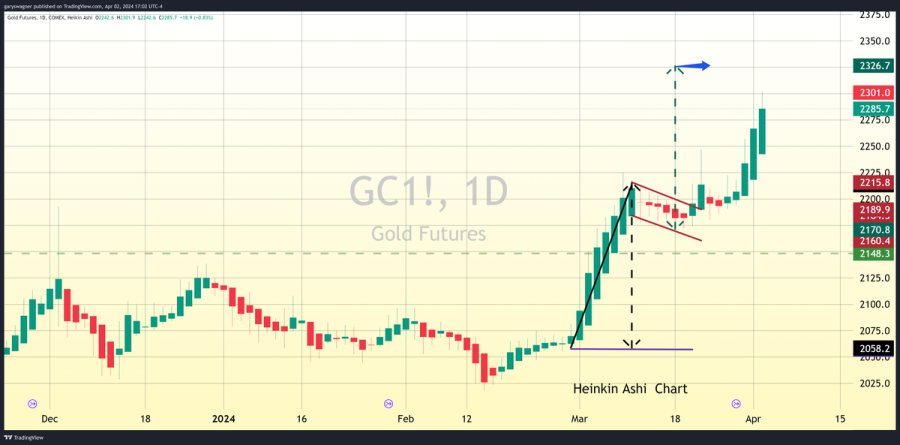

Although Button is bullish on gold, he added that investors should wait for a pullback before jumping in. He pointed out that there appears to be some initial support at $2,150 that could attract some buyers.

Ole Hansen, Head of Commodity Strategy at Saxo Bank said that he expects the gold market to have further upside potential. He added that it's more than just momentum that is pushing gold prices higher.

“Gold’s continued ability to withstand headwinds from dollar and yield movements is nothing but impressive and it highlights a market that continues to attract demand making it a relatively easy task for hedge funds to defend their huge long positions,” he said. “My main concern during the past couple of weeks has been the risk of weakness forcing a cascade of long liquidation, but with prices now above $2,200 that risk continues to fade.”

Although gold is ending a shortened trading week on a strong note, next week does present new risks. The economic calendar next week will focus on the U.S. labor market with March’s nonfarm payrolls report on Friday as the highlight.

The week also features a solid lineup of central bank speakers including Federal Reserve Chair Jerome Powell, who will be speaking at Stanford's Business, Government, and Society Forum.

Some analysts have said that stronger employment numbers, coupled with stubborn inflation may force the Federal Reserve to push back the start of its approaching easing cycle.

“Macro traders certainly still have scope to add to their gold length — but only if rates market expectations notably firm. This places the onus on upcoming data to corroborate the Fed's outlook for three cuts this year, but continued strength in the data with little change in tone from the FOMC also raises the risk of a buyer's strike in Treasuries, leading to higher rates that could mechanically weigh on the yellow metal through the re-accumulation of macro trader short acquisitions,” said commodity analysts at TD Securities.

Economic data for the week

Monday: ISM Manufacturing PMI

Tuesday: JOLTS job openings

Wednesday: ADP nonfarm employment change, ISM Service Sector PMI, Powell to speak

Thursday: Weekly jobless claims

Friday: Nonfarm payrolls

Kitco Media

Neils Christensen

Time to Buy Gold and Silver

David

.png)