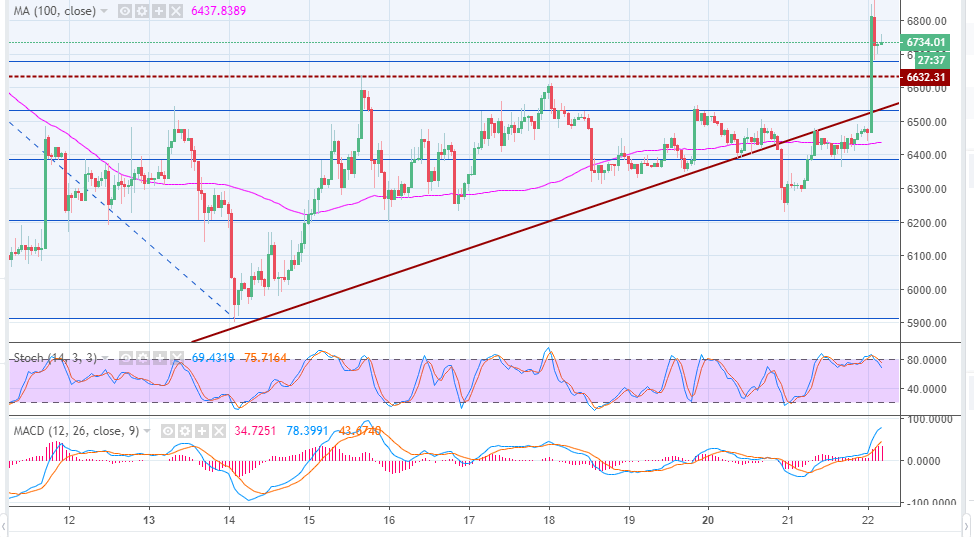

Bitcoin (BTC) Price Watch- Bulls Defend Uptrend Line, Aiming Higher

Bitcoin Price Key Highlights

-

Bitcoin price pulled back to the area of interest marked previously and bounced off support.

-

Price is setting its sights back on upside targets indicated using the Fibonacci extension tool.

-

Technical indicators are giving mixed signals in terms of direction, but bearish pressure appears to be fading.

Bitcoin price is resuming its climb after testing the rising trend line connecting the lows since mid-August.

Technical Indicators Signals

The 100 SMA is still below the longer-term 200 SMA on the 4-hour time frame to indicate that the path of least resistance is to the downside. In other words, there’s still a chance for the selloff to resume at this point.

However, the gap between the moving averages is narrowing to indicate slowing selling pressure. The 200 SMA, which lines up with the trend line, also held as dynamic support and could continue to do so moving forward.

In that case, bitcoin price could aim for the 38.2% extension at the swing high next or the 50% extension just past the $7,200 major psychological resistance. Stronger bullish momentum could bring it up to the 61.8% extension at $7,315 or the 78.6% extension at $7,457.70. The full extension is just above the $7,600 mark.

RSI is on the move up so bitcoin price could follow suit while buyers have the upper hand. This oscillator has some room to climb before hitting overbought levels, which means that buyers could stay in the game for a bit longer.

Meanwhile, stochastic just pulled up from the oversold area to indicate a return in bullish pressure. This has more room to head north, also suggesting that the bounce could be sustained.

A bit of month-end profit-taking flows could be seen so be mindful of any sharp dips as traders try to book profits off recent positions. In the meantime, traders still seem optimistic that the SEC could have a more positive decision in the pending bitcoin ETF applications.

SARAH JENN | AUGUST 31, 2018 | 4:32 AM

David