Bitcoin (BTC) Price Watch – More Buyers Waiting to Join

Bitcoin Price Key Highlights

-

Bitcoin price is still on a tear, making its way up to the top of an ascending channel on the 1-hour chart.

-

Price could be due for a pullback to the channel bottom from here in order to gain more bullish momentum.

-

The Fib levels on the latest swing low and high show the areas where buyers might be waiting.

Bitcoin price could be due for a quick pullback from its ongoing climb as buyers wait to hop in at better prices.

Technical Indicators Signals

The 100 SMA is safely above the longer-term 200 SMA to confirm that the path of least resistance is to the upside. In other words, the uptrend is more likely to resume than to reverse.

The gap between the moving averages is also widening to signal strengthening buying momentum. The 100 SMA lines up with the 38.2% Fib at $6,800 while the 200 SMA is closer to the bottom of the channel, which might be the line in the sand for a bullish pullback.

In addition, this is near the area of interest or former resistance around $6,700 which might hold as support moving forward. If so, bitcoin price could resume the move to the swing high or the top of the channel closer to $7,200.

RSI is on the move down, though, so there may be some bearish pressure left. This oscillator has a bit of room to head south before indicating oversold conditions, so the correction could go on for a bit longer.

Similarly stochastic is pointing down to confirm that sellers are in control for now. Once both oscillators hit oversold levels and start turning back up, buying pressure could return and allow the climb to resume.

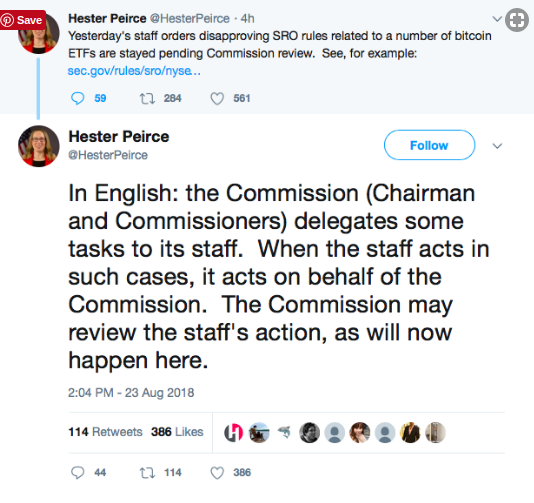

Speculations for a rebound until the end of the year are being revived as traders are now turning their attention to potential approval from the SEC when it comes to bitcoin ETF applications.

SARAH JENN | AUGUST 29, 2018 | 4:03 AM

David