Experts even more bullish on gold than retail

Kitco NEWS has a diverse team of journalists reporting on the economy, stock markets, commodities, cryptocurrencies, mining and metals with accuracy and objectivity. Our goal is to help people make informed market decisions through in-depth reporting, daily market roundups, interviews with prominent industry figures, comprehensive coverage (often exclusive) of important industry events and analyses of market-affecting developments.

(2).jpeg)

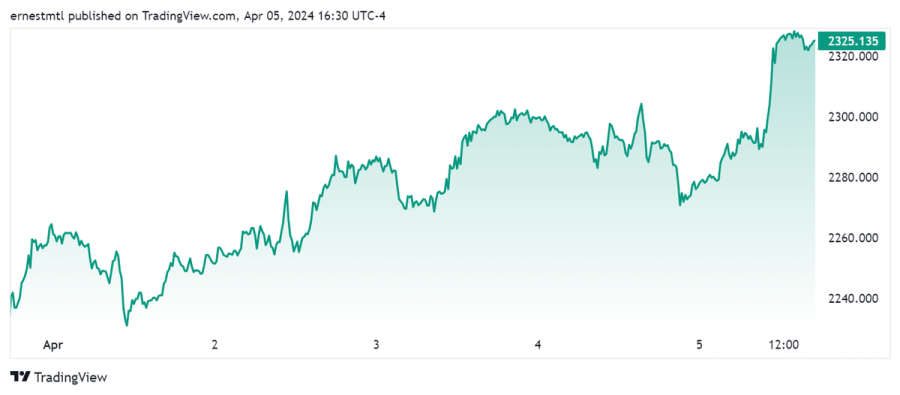

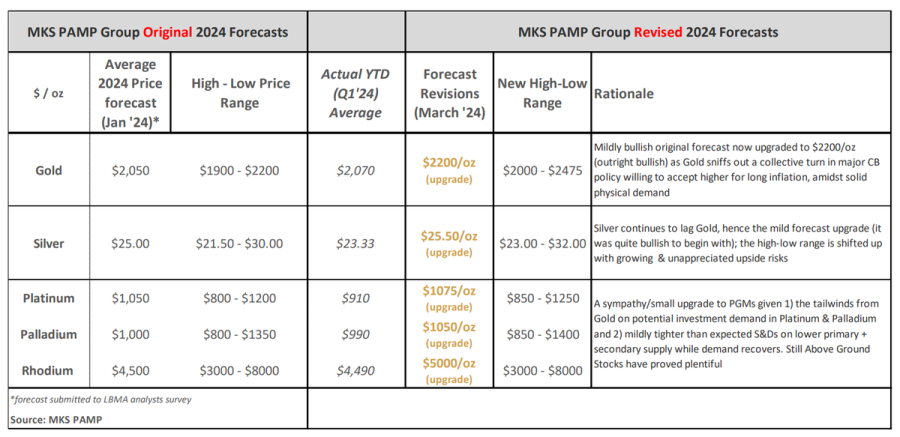

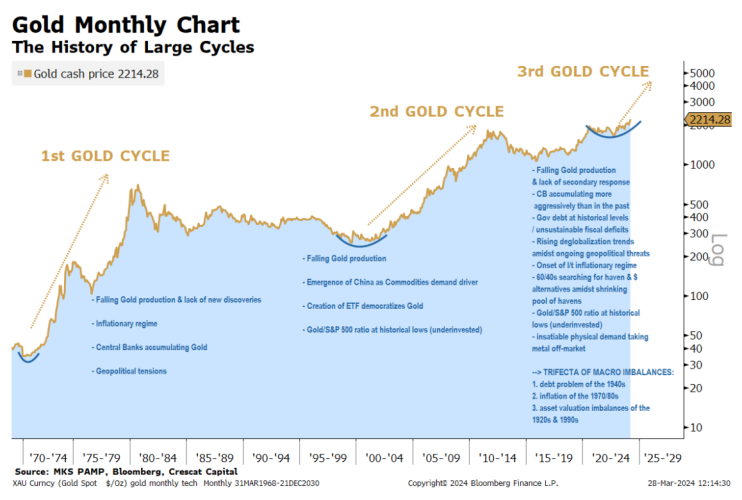

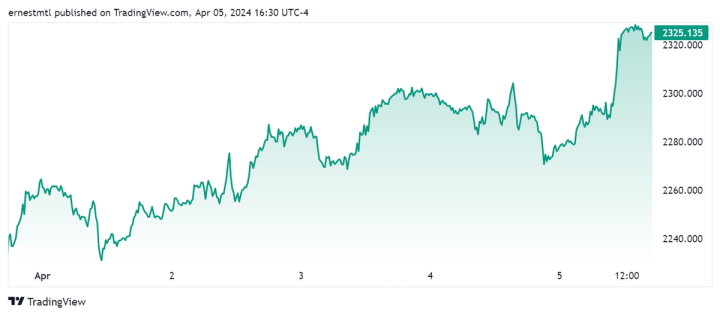

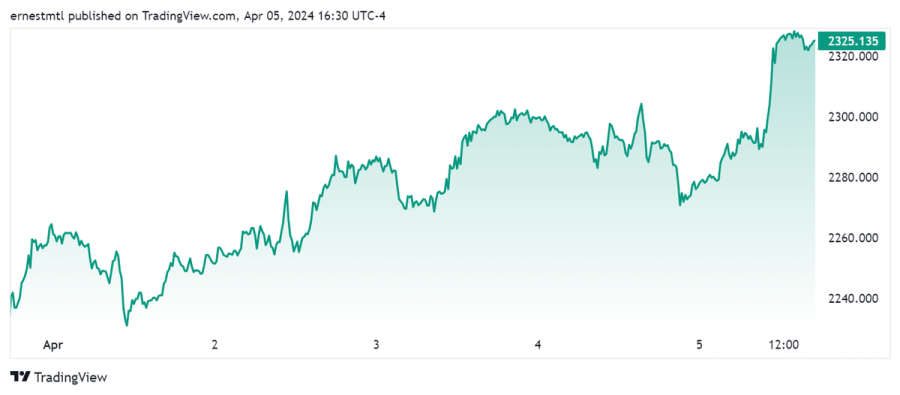

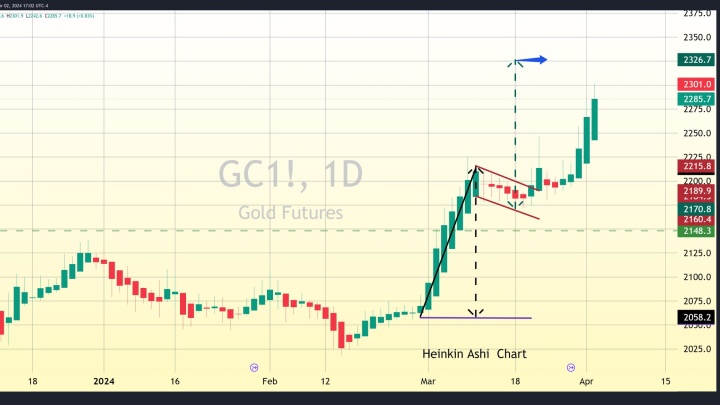

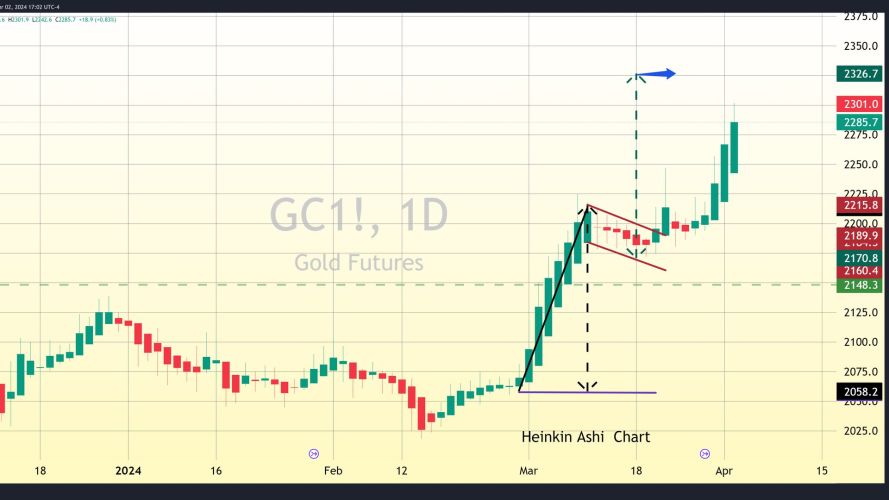

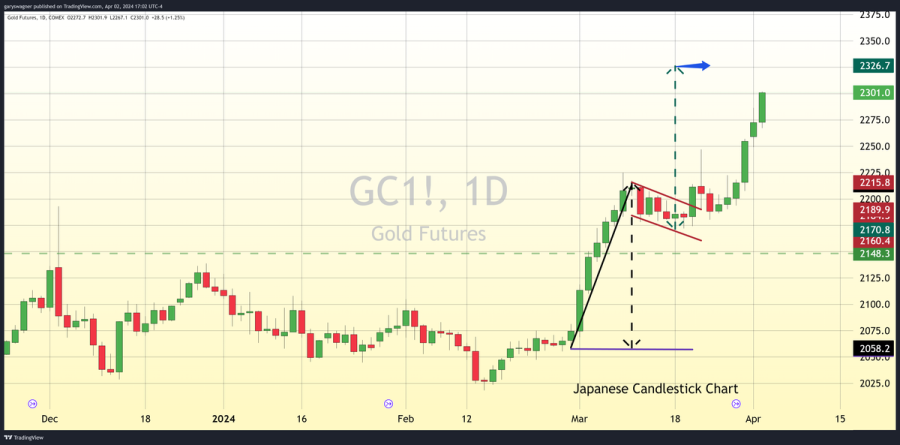

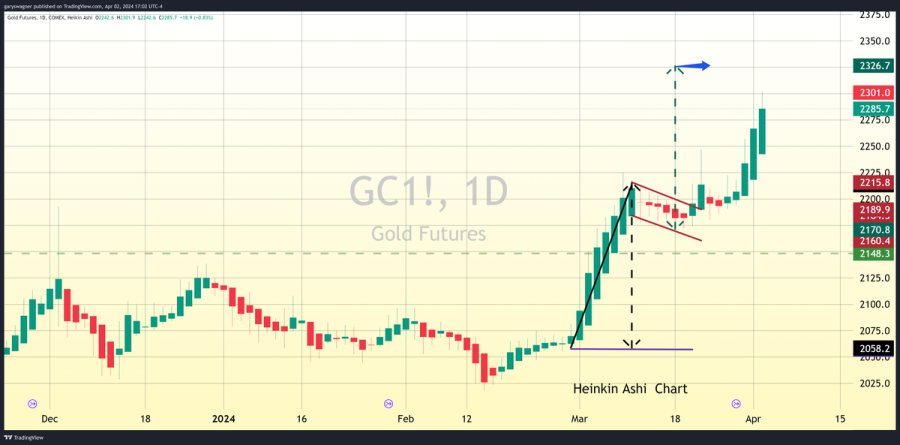

As has been the case for much of the new year, this week once again witnessed another steady climb in gold prices. Following last week’s spike to new all-time highs around $2,220 per ounce ahead of the Easter long weekend, the yellow metal shot to $2,265 just before the clock struck midnight on Sunday, and even a steady stream of hawkish Fed speakers couldn’t hold it back, as it set new successive highs as the week wore on.

Friday morning’s nonfarm payrolls report provided the exclamation mark to conclude a dramatic narrative for the precious metal, as even a blowout jobs report, which could serve to delay rate cuts even further than the Fed had threatened, was no match for gold’s upward momentum.

Buoyed by the escalation prospect of multiple global conflicts, spot gold saw its strongest move of the week, settling above $2,330 per ounce for the first time in history.

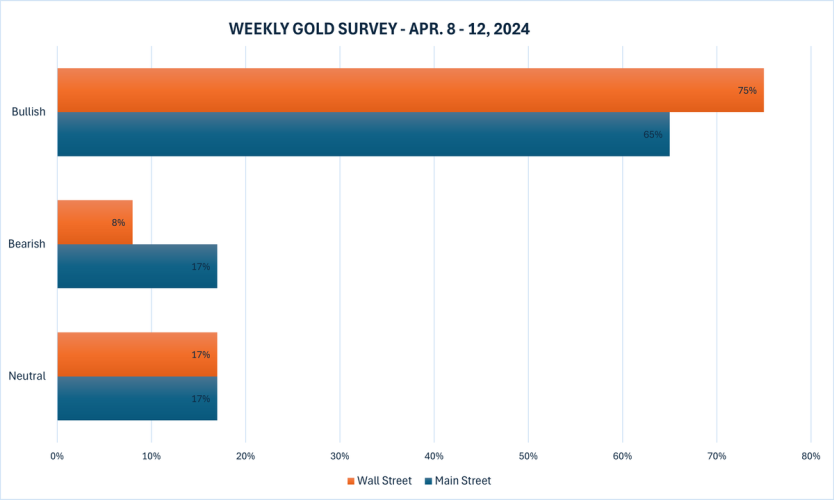

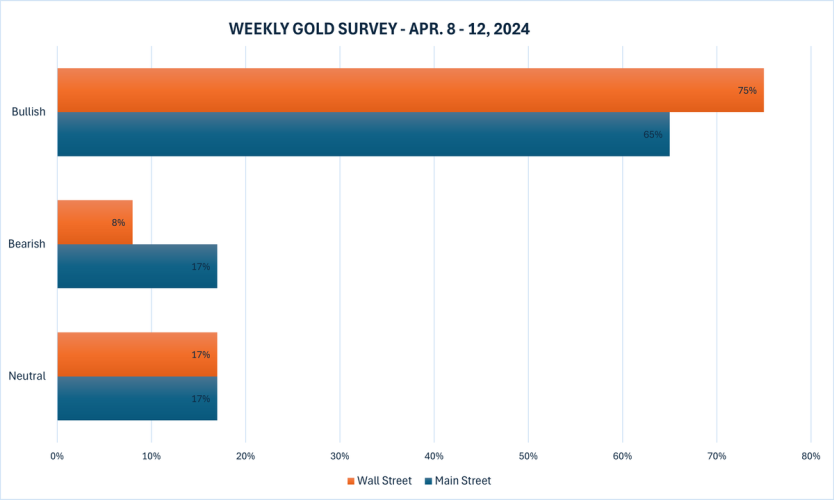

The latest Kitco News Weekly Gold Survey showed Wall Street sentiment outstripping even the unsinkable optimism of Main Street traders next week as fears of a pullback from the latest new highs were drowned out by still greater fears of geopolitical turmoil.

Adam Button, head of currency strategy at Forexlive.com, said whatever qualms traders may have about gold at these levels, resistance is futile. “Gold is stretched but the trend is impossible to fight right now,” he said. “Asia is buying almost every day.”

Darin Newsom, Senior Market Analyst at Barchart.com, said he’ll also be going with the flow. “It’s a tough call again this week, but for now I’ll stick with Newton’s First Law of Motion applied to markets: A trending market will stay in that trend until acted upon by an outside force, with that outside force usually investment money,” Newsom said. “For now, money seems to be flowing into gold, for whatever reason.”

“Could I make a technical argument the market could go lower next week? Yes, but gold is in a phase at this time where charts don’t mean anything,” he added. “It’s all fundamentals, and for now, central banks around the world continue to buy.”

Adrian Day, President of Adrian Day Asset Management, said the demand now extends beyond sovereign purchases and Asian investors, and he sees no signs of it slowing just yet.

“Notwithstanding Western investors generally not participating in the gold market – as evidenced by ETF outflows, low coins sales – there are clearly some big fish in the market buying and likely not only central banks,” he said. “Wealthy individuals and families, as well as savvy investors, are accumulating in response to awareness of the growing fragility in the global financial, economic, and geopolitical system.”

“As the financial markets stumble, more investors will turn to gold.”

SIA Wealth Management Chief Market Strategist Colin Cieszynski expects further volatility from gold prices, which is why he’s adopted a wait-and-see approach.

“I'm going to stay neutral,” Cieszynski said. “To me, gold still looks like it's had a big run and Treasury yields are still climbing, and that's going to push up the dollar. But on the other hand, gold also has these big tailwinds behind it, and that's why I went neutral for next week.”

He also pointed to next week’s U.S. consumer price report as something that could go either way. “Is it soon enough that we're going to start seeing the higher oil prices work their way in, or is that another month down the road? I'm, not sure,” he said. “There's a bunch of factors that say gold should go higher. There's a bunch of factors that say gold could go down a little bit. It's going to probably be a tug-of-war kind of week, is what I'm expecting.”

“My feeling of neutrality for gold is less about gold itself and it's more about everything going on around it,” he added. “So even though gold itself is looking good, I think gold could have some pretty big moves in both directions depending on what happens around it. I'm neutral not because I think it's going nowhere, but more because I'm not convinced on which way it's going to end up at the end of the week.”

“If you go bullish, you could look smart for half the week,” Cieszynski concluded. “If you go bearish, you could look smart for half the week.”

This week, 12 Wall Street analysts participated in the Kitco News Gold Survey, and their responses showed that bullish sentiment has fully captured the institutional imagination. Nine experts, or 75%, expected to see gold prices climb even higher next week, while only one analyst, representing a paltry 8%, predicted a price decline. The remaining two experts, or 17%, said headwinds and tailwinds were too close to call next week.

Meanwhile, 240 votes were cast in Kitco’s online poll, with 75% of Main Street investors anticipating further gains or sideways trading. 159 retail traders, representing 65%, looked for gold to rise next week. Another 41, or 17%, predicted it would be lower, while 40 respondents, or 17%, said they were neutral on gold’s near-term prospects.

Next week is a relatively thin one as far as economic data is concerned, though military and political conflict should provide plenty of grist for gold’s mill. Highlights include Wednesday’s U.S. CPI report for March, followed by PPI and weekly jobless claims on Thursday, and Friday’s preliminary University of Michigan Consumer Sentiment Survey.

Markets will also be watching the Bank of Canada’s and the European Central Bank’s monetary policy decisions on Wednesday and Thursday respectively, as there’s always a chance they may preempt the Fed with a rate cut.

Marc Chandler, Managing Director at Bannockburn Global Forex, doesn’t see the coming week’s consumer data slowing gold.

“Rising rates and US dollar have not dented gold’s surge,” Chandler said. “Next week’s US CPI should be firm but the demand for gold does not seem related to US inflation. Rather there appears to be a strong retail bid from Asia, notably Chinese investors and a few other countries with capital controls and/or shaky financial systems.”

Chandler said that trend followers and momentum traders also seem to be participating. “The price action reflects buying on pullbacks and breakouts, hallmarks of a bull market,” he added. “As the yellow metal is in uncharted waters, tough to talk about resistance. Maybe potential toward $2350. Support looks like $2225-50.”

Daniel Pavilonis, Senior Commodities Broker at RJO Futures, was parsing the gold rally even as it set new highs on Friday.

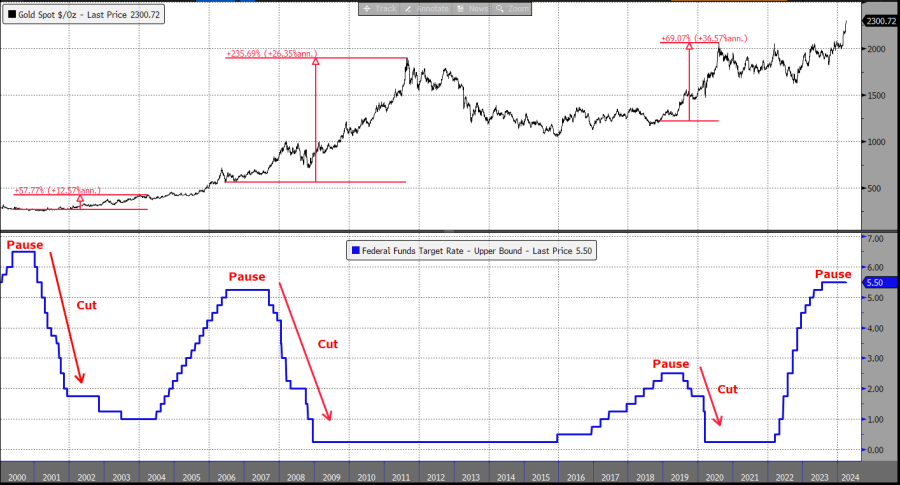

“I think some of the buying is the anticipation of rate cuts, even though we had a strong jobs report,” Pavilonis said. “I think the market is still expecting mild rate cuts going into elections or right around elections at a time when we're still seeing sticky inflation.”

He said the other driver of this move is what's going on with Israel and Iran, and the possibility of that conflict escalating further.

“Iran being backed, or being partnered up with, Russia, China, India. Russia has ships in the Black Sea, and oil prices spiking could cause further inflation at the same time when the Fed, if they don't cut rates, at the very least I think that they would just pause and let inflation run.”

Pavilonis said that the political realities of the United States during an election year are beginning to weigh heavily on markets.

“These guys, Democrat or Republican, want to keep their jobs,” he said. “I think that's part of it. It's the culmination of statistics, this being a strong year under these circumstances, the probability of rate cuts, or at the very least pausing if we do see escalation geopolitically, which would raise energy prices substantially… it's all bullish for gold.”

Zooming in on the near term, Pavilonis said he believes this week’s gold rally, and the moves on Thursday and Friday in particular, is largely on the back of geopolitics. “Iran basically said that they're going to come back and retaliate against Israel,” he said. “Is that going to be within Israel, or is that going to be just Israeli targets around Israel? But that is the expectation, and I think that would be bullish for gold.”

He also believes that Friday’s strong nonfarm payrolls report hasn't ruled out rate cuts either. “That's still on the table,” he said. “I don't think the Fed wants to linguistically condition the market for rate cuts, and then it doesn't happen.”

Pavilonis said that a big part of this calculation is the fact that there's no selling coming into the market despite this week’s steady stream of hawkish comments from multiple Fed speakers. “Now you're adding some geopolitical issues going on with the Middle East,” he said. “And with Ukraine, Blinken coming out and saying that Ukraine's going to join NATO, this thing has a possibility of escalating.”

“I think under these circumstances, that's very bullish for gold in the near term.”

Pavilonis added that if nothing kinetic happens over the weekend, he thinks commodities could see a pullback early in the week. “Energy prices would sell off if there's nothing, and then you might see gold take a little bit of a breather,” he said. “I think gold may come back to a nice round number like $2,000.”

And Kitco Senior Analyst Jim Wyckoff still sees potential gains for gold prices next week. “Steady-higher, as technicals remain bullish,” he said.

Spot gold last traded at $2,325.18 per ounce at the time of writing, up 1.48% on the day and 4.09% on the week.

Kitco Media

Ernest Hoffman

Time to Buy Gold and Silver

David

(2).jpeg)

.png)