Gold price to see wild $100+ daily gains, Bitcoin rally to follow, if Middle East tensions escalate and spillover into 'unmitigated disaster' – Larry Lepard

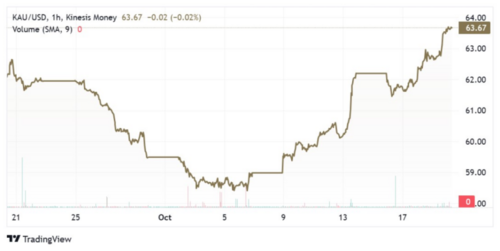

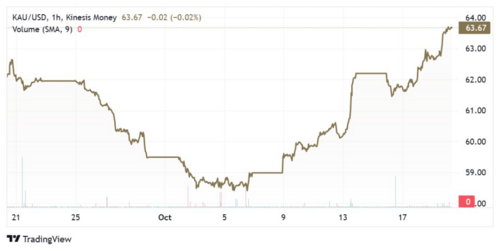

Turmoil in the Middle East is keeping investors on edge, and gold is one of the first assets to react — rising above the critical psychological level of $2,000 an ounce and trading near 2.5-month highs on Friday.

It won’t be surprising to see gold witness daily gains of $100+ as the Israel-Hamas war escalates, Larry Lepard, Managing Partner and Founder of Equity Management Associates, told Michelle Makori, Lead Anchor and Editor-in-Chief at Kitco News.

"Gold has gone up a lot in a very short period of time," Lepard said Thursday. "And that’s a combination of the war and also sniffing out the underlying problem in the bond market. When geopolitical trouble arises, gold tends to smell it first."

Gold has gained over $160 since the terrorist group Hamas attacked Israel on October 7, killing more than 1,400 people, mostly civilians. Since then, the conflict has been escalating, with gold crossing the $2,000 an ounce level Friday and December Comex gold futures last trading at $2,005.90, up 1.28% on the day.

Markets are digesting the latest developments ahead of another uncertain weekend, including the Pentagon stating that the U.S. Navy warship intercepted three cruise missiles and several drones launched by the Iran-aligned Houthi movement from Yemen. Also, Iran called for an embargo against Israel, including an oil embargo on the country. Iran has also warned that if Israel proceeds with a ground operation into Gaza to retaliate against Hamas and rescue the hostages, it will activate its terrorist proxy groups on multiple fronts.

There is a 20% chance that this conflict will escalate into an "unmitigated disaster," said Lepard, with economic consequences that would "probably be bigger than 2008, and it's probably bigger than in 2020. What could happen that would be bigger than those two things? It'd be a really major war. It doesn't strike me as impossible," he pointed out.

The United States has been living in a false narrative that everything is well. But the regional banks still have $600 billion of commercial real estate losses, according to Lepard.

"You know something is going to break, and then it's going to cascade very similar to the way it did in 2008," Lepard described. "It would be an unmitigated disaster. And I don't think there's any way the Federal Reserve wouldn't be called upon to quote-unquote do the patriotic thing and print the money necessary to keep the system going, inflation be damned."

This could mean a major stock market selloff between 30% and 50%. For gold, this would translate into $100+ daily price moves, with Bitcoin likely following at some point.

Lepard envisions similar-sized price moves as in March 2020 after the Federal Reserve stepped in to support the U.S. economy, and gold surged, hitting record highs. "Gold went up a hundred dollars a day, two days back to back. You never see that. And that's what would happen again this time. So I think everybody has to be prepared for that," Lepard noted.

.jpg) The monetary system today: 'Council of elders deciding the price of money' – Lyn Alden

The monetary system today: 'Council of elders deciding the price of money' – Lyn Alden

Best-case and worst-case scenarios

Even in the best-case scenario, in which the Israel-Hamas war does not escalate into a major regional conflict or a WWIII-type situation, gold is looking to hit $2,500 an ounce after it goes through $2,100, Lepard told Kitco News.

"Gold will get through $2,100, which is a very important level. And when it goes through that, people will chase a new all-time high. We'll be at $2,500, maybe even $3,000," he said. "Assuming an absolute best case in the war, we're still screwed monetarily and economically."

Bitcoin will also likely catch the safe-haven bid and follow gold’s rally. "My target for mid to the tail-end of next year is $2,500 to $3,000 gold and $50k-$100k Bitcoin," he added. "That’s assuming a best case scenario in the war — that things calm down and nothing gets worse."

To learn when Bitcoin is likely to start rallying, watch the video above.

At the same time, the worst-case scenario, in which the Israel-Hamas conflict turns into a major war, is not all that implausible either, according to Lepard.

The Fed’s easing cycle is near, what it means for markets

There's a high probability that the Fed is done hiking because the bond market is signaling that something is close to breaking, Lepard said.

The yield on the benchmark 10-year Treasury, which moves inversely to prices, is trading above 4.9% — a level last seen in 2007.

"The Fed knows that if they continue to raise rates, they're going to break the bond market. They may have already broken it, but they're going to break it to the point that it's irreparable. So I think what we're moving towards is monetary easing," Lepard said. "And that's what gold smells. Gold also smells war, and gold always goes up when there's instability."

Watch the video above to get Lepard’s take on the Fed’s next step and what the central bank’s Chair Jerome Powell is afraid of going into the year-end.

Lepard also explores the idea of sound money and which safe haven assets are the best to hold during heightened geopolitical uncertainty and makes the case for Bitcoin as well as gold. Watch the video above for details.

By

Anna Golubova

For Kitco New

David

.jpg) Time to increase allocation to gold – JPMorgan's Kolanovic

Time to increase allocation to gold – JPMorgan's Kolanovic

.gif)

Rising tail risks in the market warrant holding more than 6% of your portfolio in gold – BIS' Zöllner

Rising tail risks in the market warrant holding more than 6% of your portfolio in gold – BIS' Zöllner

(2).gif)

.gif) September sell-off presents buying opportunity for gold investors – WGC

September sell-off presents buying opportunity for gold investors – WGC