Gold surges as concerns of banking crisis and the debt-ceiling crisis re-emerge

With the FOMC meeting to conclude tomorrow the Federal Reserve will most likely announce a ¼% rate hike and attention has shifted away from the Fed as market participants focus on other potential calamities within the financial markets.

Genuine angst regarding the debt ceiling and concern about the re-emergence of the banking crisis has weighed heavily on the minds of market participants. These concerns are so significant that for the first time, the CME's FedWatch tool is indicating that there is a 15% probability that the Federal Reserve will cut rates at the June FOMC meeting. The CME's FedWatch tool predicts that there is an 85% probability that the Fed will pause rate hikes in June. If so, this would be the first time the Federal Reserve has either not raised rates, or cut rates over the last 10 consecutive FOMC meetings.

Debt ceiling anxiety grows after U.S. Treasury Secretary Janet Yellen in a letter yesterday said, “After reviewing recent federal tax receipts, our best estimate is that we will be unable to continue to satisfy all of the government's obligations by early June, and potentially as early as June 1, if Congress does not raise or suspend the debt limit before that time.”

This means that there is very little time left for a solution and compromise to be reached. Considering that the divide between the desires of the Republican Party and the Democratic Party are so diametrically different it is hard to fathom a compromise will be reached in such a short time.

More alarming is that there are very few days in which members of the House, and the Senate will all be available to meet with the president. Considering the compromise that must be made by both parties there is an extreme uncertainty that a solution can be reached promptly.

The implications of solving the debt ceiling crisis before the government is unable to meet its obligations are profound. The economic effect if the two sides cannot reach an agreement is an unprecedented event. The repercussions are at best an economic recession and according to Secretary Yellen would have profound implications in perpetuity.

Now that the government has less time than previously believed to raise or suspend the debt limit it increases the probability of an 11th-hour showdown. Historically legislators have played kick the can, but in this instance, they are playing chicken.

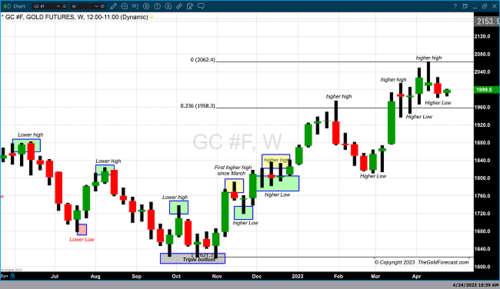

The net result of all of these events occurring at the same time led to in a tremendous upside surge in gold prices. Gold futures traded to a high today of $2026.40. As of 5:30 EST the most active June 2023 contract of gold is currently up over $25 and fixed at $2025.60. Gold broke out of a pattern called a “descending top and a flat bottom” as today's solid gains broke above the upper descending trendline.

By

Gary Wagner

Contributing to kitco.com

David

S&P 500 will crash 20% as 'panic' sets in and gold hits $2,300 in 2023, Fed will cause 'more tremors' in banking sector – Gareth Soloway

S&P 500 will crash 20% as 'panic' sets in and gold hits $2,300 in 2023, Fed will cause 'more tremors' in banking sector – Gareth Soloway

Mastercard has announced the launch of Crypto Credential in an effort to establish a set of common standards and infrastructure that will help attest trusted interactions among consumers and businesses using blockchain networks.

Mastercard has announced the launch of Crypto Credential in an effort to establish a set of common standards and infrastructure that will help attest trusted interactions among consumers and businesses using blockchain networks.

.gif) Gold consolidates but remains on a 'golden cross path' higher – NDR's Tim Hayes

Gold consolidates but remains on a 'golden cross path' higher – NDR's Tim Hayes

]

]

QE isn't over and will drive gold to $3,000 and Bitcoin to $100,000 in the next decade – Crossborder Capital

QE isn't over and will drive gold to $3,000 and Bitcoin to $100,000 in the next decade – Crossborder Capital

.gif) Gold remains well positioned to protect investors from further market turmoil – MarketVector's Yang

Gold remains well positioned to protect investors from further market turmoil – MarketVector's Yang