Gold is just stepping back to build a running start

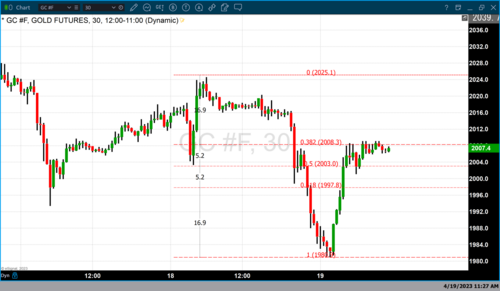

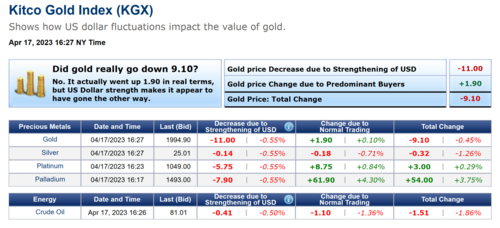

At the height of last month's banking crisis, markets were pricing in a potential rate cut as early as June, so it's no wonder why gold prices are ending below $2,000 an ounce this week. While gold could see further lows in the near term, analysts note that the market is still on track to hit all-time highs this year.

It's not surprising that some investors are taking some profits in gold. Fear of the global economy breaking is being replaced by renewed fears of inflation. While U.S. consumer prices are on a downward trend, inflation is being acutely felt in the United Kingdom. The nation's Consumer Price Index showed annual inflation holding relatively steady at 10.1% last month. This was the seventh consecutive month that inflation has been above 10%.

There are unique reasons why inflation is exceptionally high in Britain. Still, the data indicates that inflation is a global problem that will likely become entrenched in the broader global economy. The British inflation data showed that food prices rose 19.2% in the last 12 months.

Despite specific economic issues, this number does not bode well for the world. The last time I checked, everyone needs to eat.

It's hard to argue that the inflation threat has gone away when agricultural commodity prices are going higher. Sugar prices are at their highest level in 11 years; meanwhile, feeder cattle future prices are at an eight-year high. Consumers better prepare for more expensive barbecues this summer.

Even those who don't eat beef are stuck. This week analysts at Fitch Solutions published a report saying that rice production in 2023 is expected to see its worst annual production in 20 years. According to Fitch, The world could see a rice deficit of 8.7 million tonnes.

These headlines will keep the Federal Reserve from loosening its monetary policies anytime soon, which, as we know, is a negative for gold.

However, while gold could see some near-term selling pressure, many analysts note that the precious metal remains well supported. Last month's banking crisis shows that there is only so much the Federal Reserve can do before the economy breaks.

Many analysts have noted that gold remains an attractive, safe haven and inflation hedge.

"The monetary disorder that we have seen is far from over, and right now, we are just waiting to see how it will spread," said James Robertson, an analyst at Grant's Interest Rate Observer, in an interview with Kitco News. "This will continue to support gold prices."

Looking past global monetary policies, there are other reasons to be bullish on gold, including the fact that it remains an essential monetary metal. The worldwide de-dollarization trend is picking up significant momentum. In a recent report, Stephen Jen, CEO and co-CIO of Eurizon SLJ Capital, said that the U.S. dollar's share as a global reserve currency dropped to 47% last year, down from 55% in 2021. In 2020, 73% of reserves were in U.S. dollars.

.gif) Inflation may moderate, but pension funds aren't taking any changes as they increase their exposure to gold and commodities – Ortec Finance

Inflation may moderate, but pension funds aren't taking any changes as they increase their exposure to gold and commodities – Ortec Finance

“The dollar suffered a stunning collapse in 2022 in its market share as a reserve currency, presumably due to its muscular use of sanctions," Jen wrote in the report.

Central banks have been flocking to gold in this environment, and analysts don't expect this trend to end anytime soon.

Finally, while we talk a lot about gold in this newsletter, we can't ignore what is happening in other precious metals. Silver is outperforming gold as prices hold above $25 an ounce and platinum is the best-performing metal in the complex.

Both silver and platinum are benefiting from growing imbalances in their supply and demand fundamentals.

This week, the Silver Institute said that the silver market hit a record deficit in 2022 and it expects that trend to continue into 2023. Metals Focus, the firm behind the research, noted that the deficits in 2021 and 2022 have more than offset the cumulative surpluses of the previous 11 years.

According to many analysts, this deficit should continue to support higher prices.

By

Neils Christensen

For Kitco News

David

.png)

Five reasons why you should be overweight gold in today's uncertain markets – abrdn's Minter

Five reasons why you should be overweight gold in today's uncertain markets – abrdn's Minter

Gold price hits session highs as U.S. CPI sees annual inflation rising 5%, down sharply from 2020 highs

Gold price hits session highs as U.S. CPI sees annual inflation rising 5%, down sharply from 2020 highs