Gold rallies on financial stability risks as investors rush to safety, analysts are watching inflation report, Fed reaction

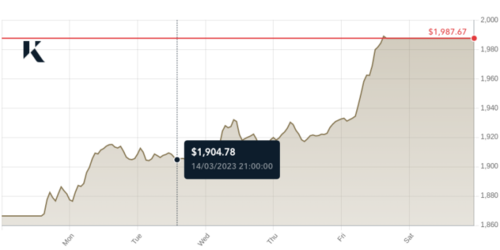

The gold market posted an unexpected weekly gain on potential contagion risks from the Silicon Valley Bank (SVB) meltdown.

The precious metal is once again the safe-have trade, with investors rushing in after Friday's SVB collapse. California banking regulators moved quickly to close SVB Financial Group in what is the largest bank failure since the financial crisis.

SVB was one of the leading technology financiers, and its failure showcases potential unintended consequences of the aggressive hiking cycle pursued by the Federal Reserve in its fight against inflation, according to analysts. The fear is that the startup-focused lender's troubles could ripple through the rest of the global markets.

"Gold is seeing safe-haven flows on these financial instability concerns," OANDA senior market analyst Edward Moya told Kitco News. "Startups and debt refinancing are some of the biggest financial risks that traders are analyzing."

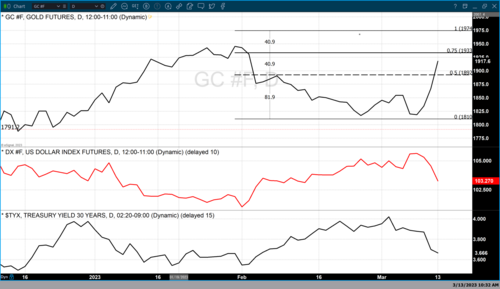

It is a dramatic turnaround for gold. Earlier this week, the precious metal was steadily falling on the outlook that the Federal Reserve will hike rates by 50 basis points at its March meeting.

Gold is now rallying and it is reacting to several drivers — the SVB and financial stability risk, the higher unemployment rate from February, and a reversal of the 50-basis-point hike expectations.

"The NFP report had a strong headline beat, but the rest of the report supported the idea that the labor market is ready to cool. Wage pressures came in much softer than forecasts, and the unemployment rate rose from 3.4% to 3.6%," Moya said. "Gold is surging as Fed rate hike bets get scaled down and as SVB contagion risks trigger some safe-haven buying. The bond market is now starting to price in rate cuts by the end of the year, and that is triggering a major collapse with yields."

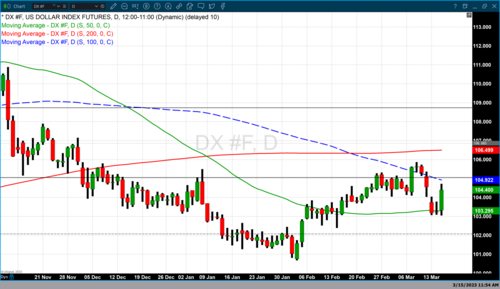

The U.S. dollar index fell, and the two-year yield posted its biggest two-day decline since 2008, which is very supportive of higher gold prices.

"Gold is becoming everyone's favorite trade again, and that could continue as liquidity risk concerns won't be quickly answered for that corner on Wall Street," Moya added.

One thing to keep in mind is how sustainable this move in gold is, Gainesville Coins precious metals expert Everett Millman told Kitco News.

"This is broadly a short-term reaction. You do see safe-haven demand come in fits and starts. There is fear over the stability of banking systems, and the dollar is sharply lower today. That is driving gold higher in the short term," Millman said.

Only next week can tell whether gold can hold at these levels, especially in light of Tuesday's inflation report. "I don't think gold bottomed yet, and [prices] might have further to fall during the first half of this year. I wouldn't be surprised to see gold stuck in a range between $1,800 and $1,900," Millman said.

Trading has been very volatile, and with the inflation report coming up, the key thing to pay attention to is how markets react to the data versus the data itself, noted Millman.

"The CPI print itself is not as important as the reaction to it. There has often been a bit of disagreement about whether certain data or comments from the Fed are dovish or hawkish. The Fed will also be watching how markets react and digest the CPI," Millman said.

Market consensus calls are projecting for inflation to slow to 6% from 6.4% in February.

Gold price levels to watch

This flight to safety pushed gold to levels where traders are getting more bullish, RJO Futures senior market strategist Frank Cholly told Kitco News. At the time of writing, April Comex gold futures were trading at $1,869.70 an ounce, up 1.91% on the day.

"I am watching $1,875-$1,880. We might have a bit of trouble getting there. It is the 50-day moving average. The 200-day moving average held for gold, and the $1,800 was good value," Cholly noted.

With the economy probably hitting a rougher patch sooner, Moya remains bullish on gold but anticipates the precious metal will first settle around its current levels.

"I am considering $1,865 right now. The macro backdrop has changed. Immediate resistance is at $1,880. And then everyone will have their eyes on the $1,900 an ounce," Moya said. "If we get a cooler inflation report next week and continued financial instability concerns are still being talked about, we could have a good old fashioned gold rally, with $50-$70 daily moves to the upside."

Next week's data

Tuesday: U.S. CPI

Wednesday: U.S. retail sales, U.S. PPI, NY Empire State manufacturing index

Thursday: ECB rate decision, U.S. jobless claims, building permits and housing starts, Philadelphia Fed manufacturing index

Friday: U.S. industrial production, Michigan consumer sentiment

By Anna Golubova

For Kitco News

Time to Buy Gold and Silver

David

.png)

.png)

.png)

.png)

.gif) Global stock markets were mixed to weaker overnight. U.S. stock indexes are narrowly mixed at midday.Silver mines will likely be bought by automakers like Tesla, silver to $125 per ounce – Keith Neumeyer

Global stock markets were mixed to weaker overnight. U.S. stock indexes are narrowly mixed at midday.Silver mines will likely be bought by automakers like Tesla, silver to $125 per ounce – Keith Neumeyer

Pierre Lassonde: Gold to reach $2,400 by 2028 as geopolitical tensions mount, central banks purchase more bullion

Pierre Lassonde: Gold to reach $2,400 by 2028 as geopolitical tensions mount, central banks purchase more bullion