Gold rebounds as ECB gets aggressive, crude pares losses, USDX down

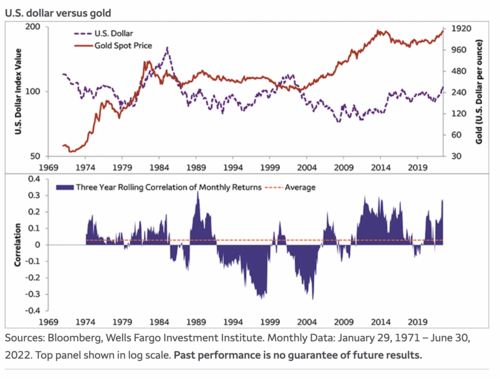

Gold prices are moderately up in midday U.S. trading Thursday, on a short-covering and bargain-hunting bounce after prices hit a 15-month low overnight. Gold prices were also boosted today by crude oil paring sharp early losses, a dip in U.S. Treasury yields and a weaker U.S. dollar index. August gold futures were last up $9.60 at $1,709.60. September Comex silver futures were last up $0.002 at $18.67 an ounce.

The European Central Bank Thursday raised its main interest rate by a more aggressive 0.5%. It was the first rate hike for the ECB in 11 years. The Euro currency rallied and the U.S. dollar index sold off on the news, which helped to lift gold and silver prices. The U.S. Federal Reserve is expected to raise its key interest rate by at least 0.75% at next week’s FOMC meeting.

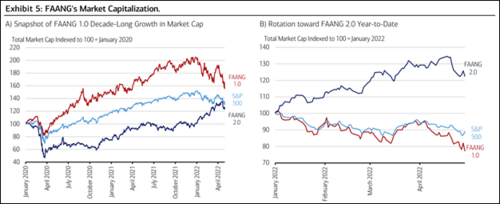

Global stock markets were mostly weaker overnight. U.S. stock indexes are pointed mixed at midday. The U.S. stock index bulls are having a good week and have restarted near-term price uptrends on the daily charts.

In other overnight news, Italian Prime Minister Mario Draghi has tendered his resignation for the second time as his government is close to collapsing. Italian government bond yields rose, with the 10-year at 3.6% Russia has restarted natural gas flowing through the Nord Stream pipeline into Europe. That helped to pressure crude oil prices.

.jpg) Investors lose more than $42 million to fake crypto apps in less than a year, says FBI

Investors lose more than $42 million to fake crypto apps in less than a year, says FBI

The key outside markets today see Nymex crude oil prices down and trading around $97.25 a barrel. The U.S. dollar index is slightly down in midday U.S. trading. The yield on the 10-year U.S. Treasury note is fetching 2.967%.

.gif)

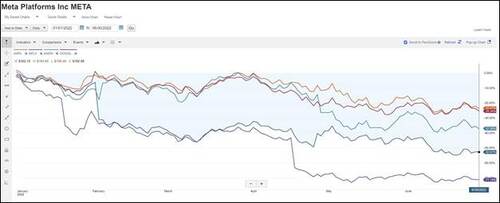

Technically, August gold futures prices scored a bullish “outside day” up on the daily bar chart today, after hitting a 15-month low early on. Short covering and bargain hunting were featured. The gold futures bears still have the solid overall near-term technical advantage. Prices are trending lower on the daily bar chart. The recent “collapse in volatility” on the daily bar chart (whereby at least three price bars in a row are significantly smaller than previous price bars) suggested a bigger price move was coming soon, and it occurred Wednesday afternoon-Thursday morning. Bulls’ next upside price objective is to produce a close above solid resistance at $1,750.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $1,650.00. First resistance is seen at this week’s high of $1,722.00 and then at $1,735.00. First support is seen at $1,700.00 and then at today’s low of $1,678.40. Wyckoff's Market Rating: 1.5.

.gif)

September silver futures bears have the solid overall near-term technical advantage. Silver bulls' next upside price objective is closing prices above solid technical resistance at $20.00. The next downside price objective for the bears is closing prices below solid support at $17.00. First resistance is seen at this week’s high of $19.03 and then at $19.36. Next support is seen at $18.50 and then at $18.00. Wyckoff's Market Rating: 1.5.

September N.Y. copper closed down 210 points at 330.40 cents today. Prices closed nearer the session high today. The copper bears have the solid overall near-term technical advantage. A steep six-week-old price downtrend is in place on the daily bar chart. Copper bulls' next upside price objective is pushing and closing prices above solid technical resistance at 375.00 cents. The next downside price objective for the bears is closing prices below solid technical support at 315.00 cents. First resistance is seen at this week’s high of 337.55 cents and then at 340.00 cents. First support is seen at today’s low of 325.05 cents and then at the July low of 313.15 cents. Wyckoff's Market Rating: 1.5.

By Jim Wyckoff

For Kitco News

Time to buy Gold and Silver on the dips

David

Copper/gold ratio shows Fed monetary policy is too tight – MKS PAMP

Copper/gold ratio shows Fed monetary policy is too tight – MKS PAMP.gif)

.gif)

The gold market has turned bearish

The gold market has turned bearish.gif)

.gif)

.gif)

.gif)

Gold hammered, analysts warn of capitulation event if price drops below pre-pandemic levels

Gold hammered, analysts warn of capitulation event if price drops below pre-pandemic levels.gif)

.gif)

This is why gold is below $1,800 even as U.S. inflation hits a 40-year high at 9.1%

This is why gold is below $1,800 even as U.S. inflation hits a 40-year high at 9.1%