Gold price down but not out as Federal Reserve starts tightening cycle and lowers 2022 growth forecast and raises inflation expectations

The gold market remains under selling pressure but has pushed off its session lows as the Federal Reserve starts a new tightening cycle even as it lowers its growth forecasts and raises its inflation outlook.

As expected, the Federal Reserve raised interest rates by 25 basis points, increasing the range to between 0.25 and 0.50%.

Gold prices were testing support just above $1,900 an ounce and have cut some of its losses in initial reaction as the U.S. treads a delicate course within a sea on instability, created by Russia’s war with Urkaine.

“The invasion of Ukraine by Russia is causing tremendous human and economic hardship. The implications for the U.S. economy are highly uncertain, but in the near term the invasion and related events are likely to create additional upward pressure on inflation and weigh on economic activity,” the Federal Reserve said in its monetary policy statement.

Not only is the Federal Reserve rasing interest rates but it is also planning to reduce its balance sheet "at a coming meeting."

Despite the growing uncertainty, the U.S. central bank signals that it continues to move forward with rate hikes in an environment of rising inflation and lower economic growth.

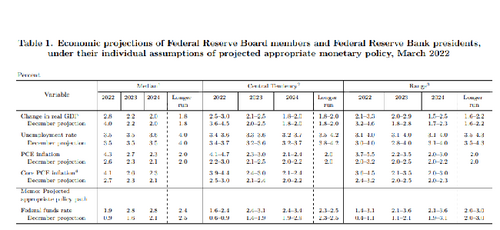

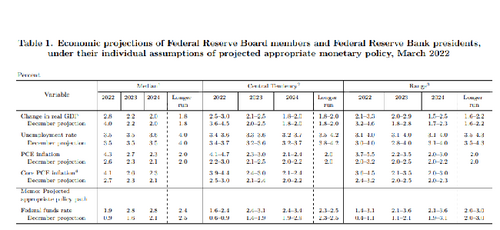

Federal Reserve’s interest rate projections, also known as the dot plots, have jumped from December’s forecast. The committee sees the Fed funds rate at 1.9% by the end of the year, up from December’s projections of 0.9%. The new media rate indicates at around seven rate hikes this year.

The Federal Reserve sees slightly slower growth this year as the conflict in Eastern Europe raises economic uncertainty. The Federal Reserve sees the U.S. gross domestic product growing 2.8% this year, down sharply from 4.0% forecasted in December. However, GDP growth is unchanged in 2023 and 2024 at 2.2% and 2.0% respectively.

At the same time, inflation pressures have risen sharply. The U.S. central bank sees core inflation, which strip out volatile food and energy prices, rising 4.1% this year, up compared to December’s estimate of 2.7%. Core inflation will remain elevated, rising 2.6% in 2023, up from the previous forecast of 2.3%. Looking to 2024, inflation is also higher at 2.3%, up from December’s projection of 2.1%.

Overall consumer prices are expected to rise 4.3% this year, up from December’s forecast of 2.6%. Next year headline inflation is expected to rise 2.7%, up from the previous estimate of 2.3%. for 2024 inflation is expected to rise 2.3%, up from the previous forecast of 2.1%.

The Federal Reserve sees a fairly stable labor market in the next two years with the unemployment rate holding steady at 3.5% this year and next, unchanged from December’s projections. The unemployment rate is expected to tick higher to 3.6% in 2024, up from the previous estimate of 3.5%.

While the Federal Reserve didn’t raise rates by 50 basis points as was expected earlier in the year, economists note that the central bank has come out with a strong hawkish stance.

“The Fed threw down the gauntlet as it confronted a broad inflation upsurge, twinning a widely expected and tame quarter point rate hike with a much sterner message about what lies ahead,” said Avery Shenfeld, senior economist at CIBC.

Shenfeld noted that not only does the Fed see seven rates hikes this year but are expected to rise 2.8% by the end of 2023.

Paul Ashworth, chief U.S. economist, also said that the Federal Reserve’s projections are on the hawkish side.

“The Fed's new economic projections suggest that officials are particularly worried about the potential for core inflation to remain high,” Ashworth said. “Even after the rally in rate expectations in recent days, the Fed's own projections are on the hawkish side.”

By Neils Christensen

For Kitco News

Time to buy Gold and Silver on the dips

David

Gold price and risk: metal off daily lows but surging yields, risk sentiment, and oil price crash weigh

Gold price and risk: metal off daily lows but surging yields, risk sentiment, and oil price crash weigh.gif)

.gif)

.gif) Consolidation after rising above $2,000 an ounce is a good thing for gold, said RJO Futures senior market strategist Frank Cholly.

Consolidation after rising above $2,000 an ounce is a good thing for gold, said RJO Futures senior market strategist Frank Cholly.

Gold prices could hold around $2,000 for the next two years – ABN AMRO

Gold prices could hold around $2,000 for the next two years – ABN AMRO.gif)

.gif)