Gold is in a good place no matter what the Fed does in 2022 – Axel Merk

With gold prices holding above $1,800 an ounce, the metal is building a solid foundation for the new year, and according to one fund manager, the precious metal remains an attractive asset no matter what the Federal Reserve plans to do with monetary policy.

In a telephone interview with Kitco News, Axel Merk, president of Merk Investments, said that he expects gold to weather expected rate hikes as a risk and inflation hedge.

"Gold should continue to do just fine as real interest rates will remain in negative territory," he said. "When I look at inflation protection, I am not looking for the next meme stock; that is no inflation protection. If rates were to move higher, then the 'funny season' may be over. And some of the meme stocks and other phenomena might deflate."

Looking at inflation, Merk said that the U.S. central bank's current stance of incremental rate hikes means that they will never be able to get in front of the inflation curve. He added that if the Federal Reserve were serious about inflation, it would have to raise interest rates to 5% or 6%, according to the Taylor Rule.

Although inflation is expected to ease from last month's 7% annual increase, Merk said that even between 3% and 4% is still too high for consumers.

According to the CME FedWatch Tool, markets are pricing in four rate hikes this year, with liftoff coming in January. There are also growing expectations that the Federal Reserve could start to unwind its bloated balance sheet before the end of the year.

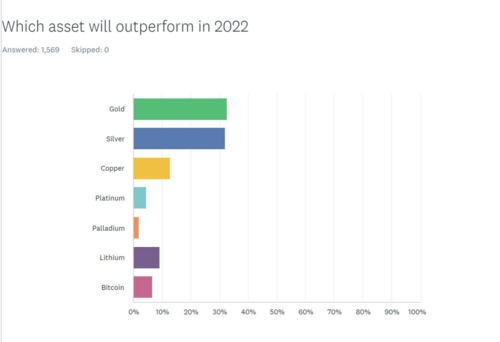

Retail Investor see gold hitting record highs above $2,000 in 2022

However, Merk said that meeting these expectations is unlikely to impact the growing inflation fears.

"Inflation is spreading from being more than just COVID-related supply shocks and the longer this last the hard it gets to put the genie back in the bottle," he said. "If they want to get ahead of the curve, then they need to surprise markets. If they don't do something big now, then they run the risk of having to do something even bigger down the road."

Merk said that the Federal Reserve's current predicament could be a win for gold either way. He noted that gold will remain well supported in the Fed's expected "salami-style" approach to interest rates will keep real rates in negative territory.

Meanwhile, if the Fed acts aggressively, he said it could push the economy into a recession.

Merk said that if the Federal Reserve wanted to show markets that it was taking the current inflation threat seriously, it would be looking to surprise the market with a potential move in January.

"I am very happy where gold is right now. I think gold has found a solid base here," he said.

With so much uncertainty surrounding the economy and U.S. monetary policy, Merk said that gold remains an attractive portfolio diversifier. Although he is not expected to see any major market crash in 2022, Merk added that it might be prudent for investors to take some profits off the table and have some protection from uncorrelated assets.

By Neils Christensen

For Kitco News

Time to buy Gold and Silver on the dips

David

.gif)

.gif)

.gif)

.gif)