The first trading day of 2022 results in strong declines in both gold and silver

The first trading day contained strong bullish market sentiment for U.S. equities and dollar strength. The dollar gained 0.632 points or a percentage gain of 0.66%. Concurrently U.S. equities all traded to higher ground, with all three major indices closing near their record highs. The Dow Jones industrial average gained 246.76 points, a percentage gain of 0.68%. The NASDAQ composite gained 1.2% or 187.83 points, and the Standard & Poor’s 500 gained 30.38 points taking the index to a record high close at 4796.49.

The combination of a strong performance in U.S. equities, U.S. dollar strength and rising interest rates vis-à-vis U.S. debt instruments pressured the precious metals lower across the board. Palladium had the largest percentage drawdown giving up 4.45% or $85.10, with the most active futures contract currently fixed at $1827. This puts the differential between gold and palladium approximately $26 apart. Silver lost 1.85% in trading today or $0.43 taking the most active March Comex futures contract to $22.92. Platinum also sustained a loss just over a full percentage point with the most active Comex contract currently fixed at $954.90 a decline of 1.17%.

With 2021 behind us, we can see that gold had a fairly strong decline in 2021 of 3.6%. It seems as though the recent rise in treasury yields has not affected U.S. equities with any negative market sentiment. Of course, the U.S. dollar rose as a direct result of higher yields in treasuries. This Friday when the U.S. Labor Department releases its nonfarm payroll report will be the next large catalyst that will move gold in one direction or the other. Currently, economists polled are forecasting a gain of 400,000 jobs and considering that the December report for November’s jobs came in roughly half of the projection. If the economist projections are correct, it will represent a tremendous rise in new jobs added last month.

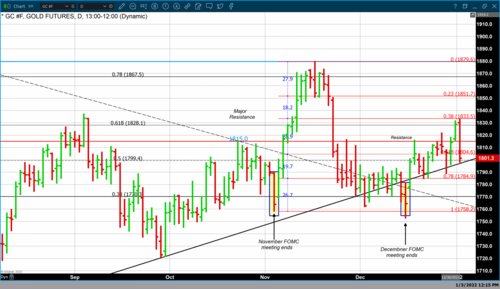

As of 5:05 PM EST gold futures basis, the most active February 2022 Comex contract has sustained a decline of $27.30, or 1.49%. Gold futures are currently fixed at $1801.30. Gold opened in tradingthis morning at $1830, traded to an intraday high of $1833 before falling just below $1800 at $1798.20. Unquestionably gold has traded under dramatic pressure today but, at least for now, was able to close above the key psychological level of $1800 per ounce.

Our technical studies indicate major resistance at $1833.50, which corresponds to the 38% Fibonacci retracement from a short data set beginning at $1758.20. The lows occurred on November 3, which was the day the November FOMC meeting ended. Our Fibonacci data set includes November 16, when market forces took gold to an intraday high of $1879.80. Below that major resistance area is the next level which occurs at $1816, which is a price point that gold traded to before finding resistance on multiple occasions. And the last level of resistance comes in between $1800 and $1804.60 which is the 61.8% Fibonacci retracement level using the same data set as above.

Although gold sold off harshly today if it can hold the price point above $1800, it bodes well for that price point being a key and critical support level. Our studies also indicate a major level of support at $1785 which is based upon the 78% Fibonacci retracement level.

By Gary Wagner

Contributing to kitco.com

Time to buy Gold and Silver on the dips

David

.gif)

.gif)

.gif)

.gif)