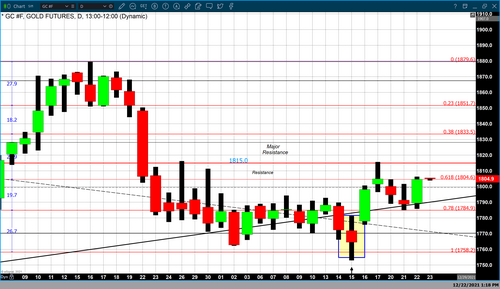

The bullish season for gold price begins, can gold tackle $1,850?

Gold price is looking to get a boost from a seasonably favorable time that began in mid-December. And analysts are eyeing whether the momentum will be strong enough to take gold above $1,850 an ounce — the next hurdle in the price trend.

"From a seasonal perspective, demand for physical gold is a big aid in driving prices higher from mid-December to Valentine's Day. In the next 6-8 weeks, gold and silver could thrive," Walsh Trading co-director Sean Lusk told Kitco News. "With the new variant coming in, easy money policies will remain. Granted, the Fed signaled that they would start rate hikes. But there is still a lot of uncertainty out there — global economic recovery and new geopolitical tensions."

This is why gold held the $1,780-$1,800 range, Lusk noted. At the time of writing, February Comex gold futures were ending the week at $1,809.50.

The Federal Reserve's more aggressive tapering and the potential of three rate hikes in 2022 have already been largely priced in. This means that any new fear could change the outlook and benefit gold.

"The trend is turning higher into next year. It seems like the new COVID-19 variant could give the Fed more pause on the aggressive taper and rate hikes. Geopolitical risks or a crude oil disruption could impact markets' perceptions," Lusk added.

Before committing one way or the other, investors need to make sure the current move higher in gold is not a head fake, warned RJO Futures senior market strategist Frank Cholly.

"The gold market keeps making these head fakes. It breaks out and rallies, but then the move fades quickly. I can't get too excited about gold until we hit $1,835 or maybe even above $1,850," Cholly told Kitco News.

From a technical perspective, funds don't have a strong long position in gold going into next year. And that might be changing, Lusk pointed out. Gold could challenge the $1,880 an ounce level last seen in mid-November.

"Head and shoulders could be forming, and we might start to shoot higher. We are getting higher lows. That ultimately brings about higher highs. In the near term, a spike up to $1,815 on the February contract could be hit. If we blow through that, it is clear sailing up to $1,833, and then $1,875," Lusk described.

If gold manages to close the year at $1,850, the next target would be up at around $2,000 an ounce, he added.

Tide will turn for gold price in 2022 as real yields remain low despite Fed rate hikes

Problematic inflation is one of the macro drivers that will finally kick in and help drive prices higher in 2022, said Cholly.

"There is going to be a point that gold begins to get a lift from the idea that this inflation is heating up. As we move into Q1 2022, we will see further price pressures. And when gold gets above $1,850 this time around, the path of least resistance will be higher," he noted.

Once gold is comfortably above $1,850, more people will jump in on the fear of missing out, Cholly added.

Even though the initial reaction to the Fed tapering and higher interest rates might be negative for gold, once processed, it could trigger another rally, according to Cholly.

"Often, higher rates will mean a stronger dollar. But the Fed's tightening cycle in 2022 could be bullish for gold. It may not be the initial reaction, but as inflation hits all other commodities, gold will be in demand," he said. "When prices go up, most commodities see a curb in demand. For gold, this creates demand — the fear of missing out. The inflation hedge narrative is something people are going to want."

Data during the last week of the year

It will be a fairly quiet data week because of the holidays. Some releases to keep a close eye on next week include Tuesday's CB consumer confidence, Wednesday's pending home sales, and Thursday's jobless claims.

By Anna Golubova

For Kitco News

Buy Gold and Silver on Dips and earn monthly yields on holdings

David

.png)

.png)

(1).png)

.gif)

.gif)

.gif)