Analysis of Bitcoin, Ethereum, and Litecoin

* All the market data is provided by the HitBTC exchange.

The cryptocurrency universe is showing nervousness at the current levels, having recovered anywhere between 50% to 78% of the fall. After having sucked in the eager bulls at lower levels, is a retest of the lows on the cards?

What should be the future plan of action? To hold out or sell now? Let’s uncover the possibilities

In our previous analysis, we had recommended booking partial profits at about $4459 levels. We are not yet bearish on bitcoin, but we believe that the pullback has reached a significant resistance zone of $4546 to $4680.

So, how far can the digital currency fall?

Bitcoin has significant support from the 20-day exponential moving average (EMA), the 50-day simple moving average (SMA) and the trendline in the zone of $4121 to $4200.

Therefore, a bounce from these levels is likely.

We may see an intraday dip below the trendline, but the closing is likely to be above it. Aggressive traders can initiate long trades close to $4150, if there are clear signs of support kicking in. Please watch for an hour to establish a strong support and then buy. If the cryptocurrency continues to fall, no trade should be taken.

This is a risky trade, therefore, we recommend a smaller position size.

In order to protect our investment, a stop loss of about $3950 can be kept. The target objective of this trade is $4480 and higher.

While bitcoin is yet to breakdown of the trendline, its junior partner, ethereum has already done so, albeit on an intraday basis. Until the digital currency breaks and closes below the trendline, we will not consider it a valid breakdown.

Ethereum has significant support at the $280 levels, where we expect some buying to emerge.

Nevertheless, we believe that the digital currency is stuck in a tight range of $280 to $310. This range is unlikely to hold out for long. Soon, price will either breakout or breakdown of it. Therefore, we recommend waiting until the digital currency reaches $317, which is a clear indication of demand because if the cryptocurrency breaks down of $280, it can plunge to $240 levels.

We are not recommending a trade within the range, as price is below both the moving averages, which is a bearish sign.

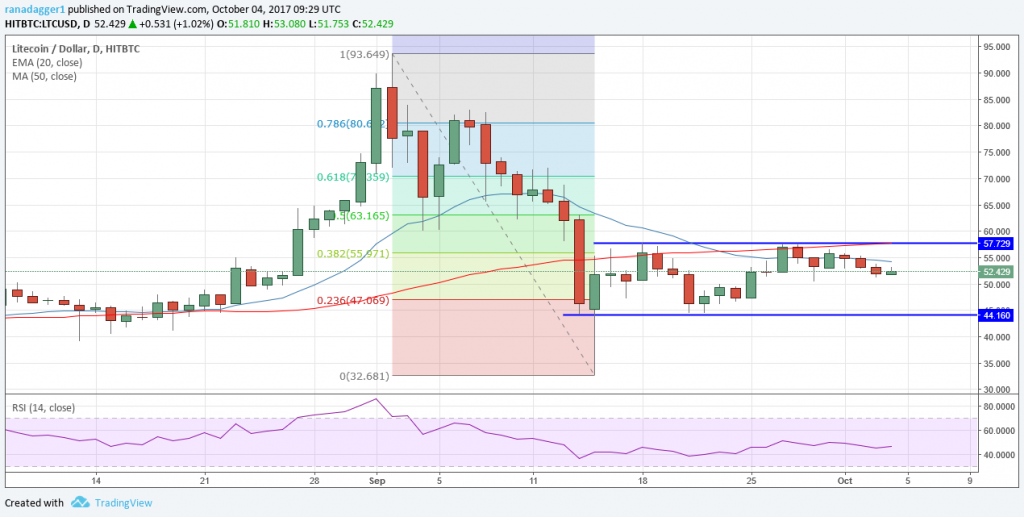

Litecoin has formed a clear range of $44 on the lower end and $57.7 on the upper end. The best way to trade within a range is to buy at the bottom and sell at the top.

Currently, the cryptocurrency is trying to hold the psychological level of $50. If this level beaks, a fall to $44 is likely, where the traders can initiate long positions with a SL at $40. However, please don’t buy in a falling market. Wait for prices to bounce off the lows before buying around $44 to $46 levels.

On the other hand, if litecoin finds support at $50 and rallies above $58, we recommend a long position with the stop loss just below $50. A breakout of the range has a minimum target objective of $71.

Guest Writer on 05/10/2017

Posted by David Ogden Entrepreneur

David