Gold, silver prices gain as coronavirus fears quickly return

Gold and silver prices are higher, with silver posting solid gains, in early U.S. futures trading Thursday. Marketplace focus Thursday is right back on the coronavirus outbreak that is spreading. February gold futures were last up $7.10 an ounce at 1,577.50. March Comex silver prices were last up $0.263 at $17.75 an ounce.

The U.S. economic data point of the day Thursday saw the advance estimate of fourth-quarter GDP come in at up 2.1% on an annual basis, which is in line with market expectations. Markets showed little reaction to the report.

Asian and European stock markets were mostly lower overnight. Mainland China markets remain closed for the Lunar New Year holiday. U.S. stock indexes are pointed toward solidly lower openings when the New York day session begins.

After Tuesday and Wednesday shrugging off the coronavirus outbreak that is still not at all contained and apparently escalating, the marketplace on Thursday is again on edge and risk averse regarding the matter. The latest reports say over 7,700 Chinese are afflicted and over 170 have died. Global businesses located in China are closing their doors there and worldwide flights to China are being cancelled. The coronavirus outbreak is now being deemed more expansive than the SARS outbreak that occurred in Asia over 15 years ago.

U.S. traders are wondering if the seriousness of the coronavirus situation in China will give China a legal “out” on its recent signed trade-deal pledge to buy significantly more U.S. agricultural products in the next couple years.

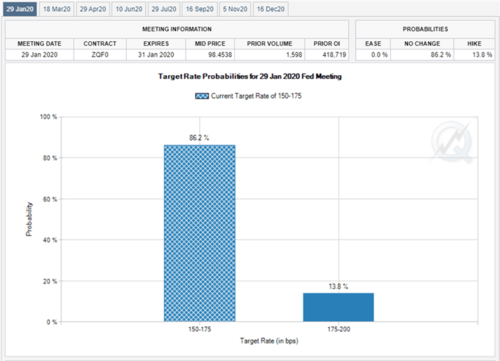

At his press conference after the FOMC meeting conclusion Wednesday afternoon, Fed Chairman Jerome Powell said the coronavirus outbreak could have consequences for global economic growth and said the Fed is monitoring the situation closely. That comment along with other less upbeat remarks on the U.S. economy from Powell, including saying U.S. business investment and U.S. exports are weak, boosted the gold and Treasury markets and pushed U.S. stock indexes off their daily highs. Crude oil prices also sunk at the same time. There is now talk in the marketplace that the Fed will be forced to lower U.S. interest rates later this year.

The FOMC at this week’s meeting held U.S. interest rates steady during its first policy meeting of the year and of the new decade, as expected. The benchmark federal funds rate remains in a range between 1.5% to 1.75%, where it has been for the past few months. The FOMC statement said the U.S. economy and labor market are growing moderately amid inflation that is non-problematic. Annual U.S. inflation remains below the 2% level that the Fed would like to see.

The key outside markets today see crude oil prices lower and trading around $52.25 a barrel. Meantime, the U.S. dollar index is slightly lower on a corrective pullback after hitting a two-month high earlier this week.

Technically, the gold bulls have the overall near-term technical advantage, but the January spike high is still strong chart resistance to overcome. A price uptrend is in place on the daily chart. Bulls’ next upside price objective is to produce a close in February futures above solid resistance at the January high of $1,613.30. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $1,550.00. First resistance is seen at today’s high of $1,582.40 and then at this week’s high of $1,588.40. First support is seen at the overnight low of $1,574.90 and then at $1,570.00. Wyckoff's Market Rating: 6.5

.gif)

March silver futures bears have the slight overall near-term technical advantage. Silver bulls' next upside price breakout objective is closing prices above solid technical resistance at this week’s high of $18.375 an ounce. The next downside price breakout objective for the bears is closing prices below solid support at $17.00. First resistance is seen at $17.85 and then at $18.00. Next support is seen at the overnight low of $17.52 and then at this week’s low of $17.28. Wyckoff's Market Rating: 4.5.

By Jim Wyckoff

For Kitco News

Thursday January 30, 2020 08:38

David

PRECIOUS-Gold rises to over 2-week high as China virus spreads

PRECIOUS-Gold rises to over 2-week high as China virus spreads