Bitcoin Sparks PE Fund to Back Wind Farm on Manhattan-Sized Plot

Brookstone Partners is planning a 900 megawatt wind farm in southern Morocco to power a data center and Bitcoin mining operation

as assets attractive to fund managers is breathing life into a spit of land the size of Manhattan located on the southern coast of Morocco.

New York’s Brookstone Partners, a private equity company with $150 million in assets, says it’s raising cash to develop the first phase of a 900-megawatt wind farm near Dakhla, Morocco. The remote location, wedged between the Sahara Desert and Atlantic Ocean some 1,400 kilometers (870 miles) south of Marrakesh, has gained in value for its potential to mine cryptocurrencies and manage data using clean energy.

“We have exclusive rights to the area for a wind farm, but the issue was there’s no real place to put” the electricity, said Michael Toporek, managing general partner at Brookstone, “These days, what you can do with stranded power is set up a computing center, develop this as an off-grid project.”

Renewables have become the preferred means of mining digital currencies like Bitcoin after the cost of electricity surged last year, forcing the industry to spend more money on computing power. While traditional fuels like coal remain staples for many utility grids, some of the biggest miners have tapped into cheap renewable power from Canada to Iceland and Georgia as a way to lure investors worried about the industry’s carbon footprint.

Brookstone founded Soluna earlier this year to develop the wind farm after acquiring rights to the property from Germany’s Altus AG. It plans to raise $100 million this year in an initial coin offering to build the first 36 megawatts of turbines. Those will feed crypto-mining and data centers processing blockchain transactions, which run on 18 megawatts of power, according to itswhite paper. Completing the entire project could cost as much as $3 billion.

A challenge common to data center operators that Soluna may struggle to overcome is the issue of intermittency. Even when the wind doesn’t blow, all the company’s machines processing currencies and data will still need power to function.

“The power from the wind farm is intermittent and will probably reduce the utilization factor of the data center as long as it is off-grid,” according to Itamar Orlandi, head of frontier power analysis at Bloomberg New Energy Finance. “Their revenue from the mining operation will be unpredictable and possibly volatile. It’s not clear to me how they make a 20- to 30-year infrastructure investment backed against that kind of revenue stream.”

Soluna is part of a trend led by technology giants including Facebook Inc. and Google to power operations solely with renewables. Tech giants have as contracted more 9 gigawatts of clean electricity to date, signing purchase agreements with solar and wind farm developers worldwide.

“When we say we’re matching our energy, we mean that for every terrawatt of power that we consume at Alphabet, we’re matching that by a physical terrawatt-hour that’s being generated somewhere else,” said Neha Palmer, head of energy at Google’s parent company. “We are looking at ways on how to match our actual consumption.”

Soluna says it wants to combine its data processing even more tightly with renewables by co-locating wind generation next to their servers.

“Our power cost will be among the lowest in the world,” said John Belizaire, Soluna’s chief executive officer. “That gives us benefits and allows us to keep participating in the ecosystem while others might not be able to sustain their businesses.”

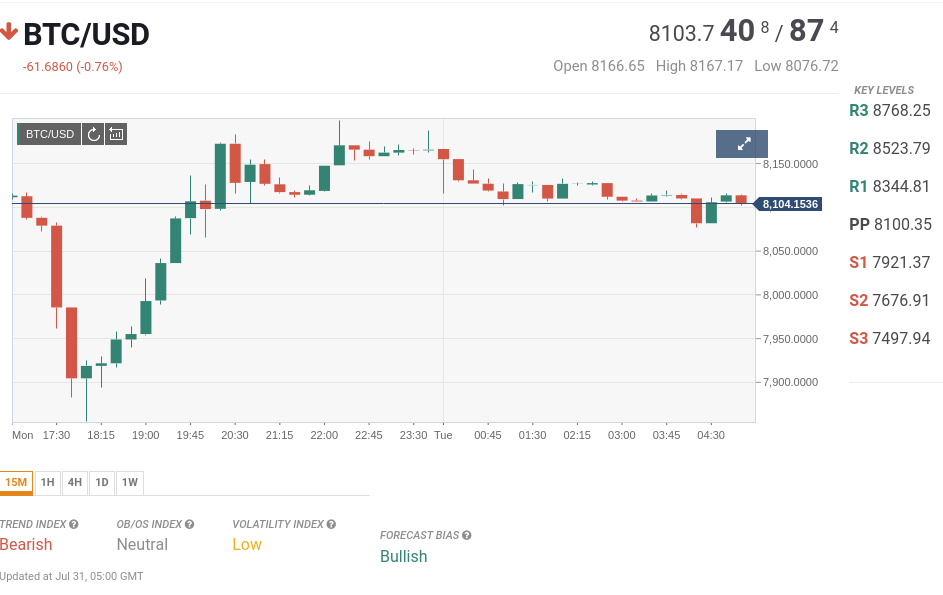

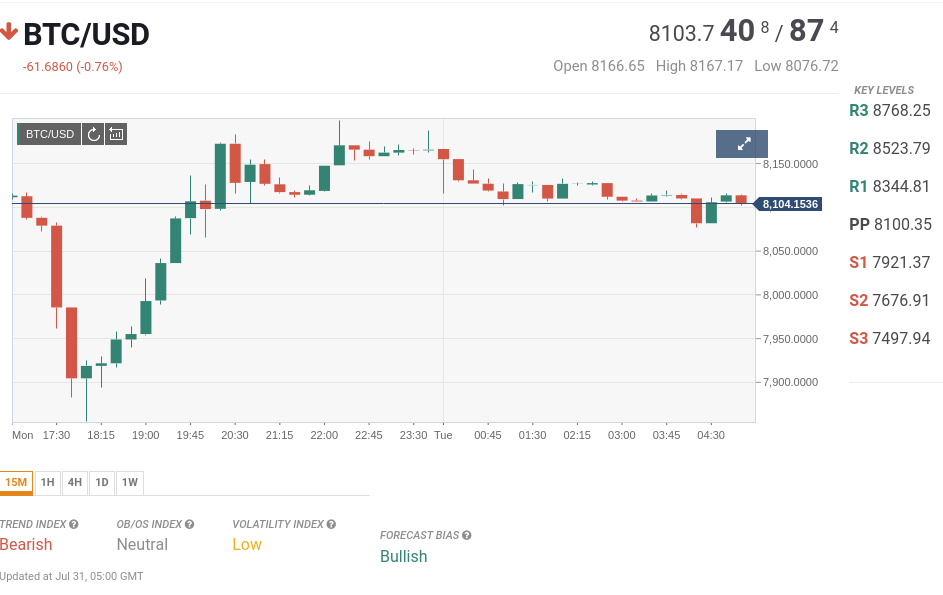

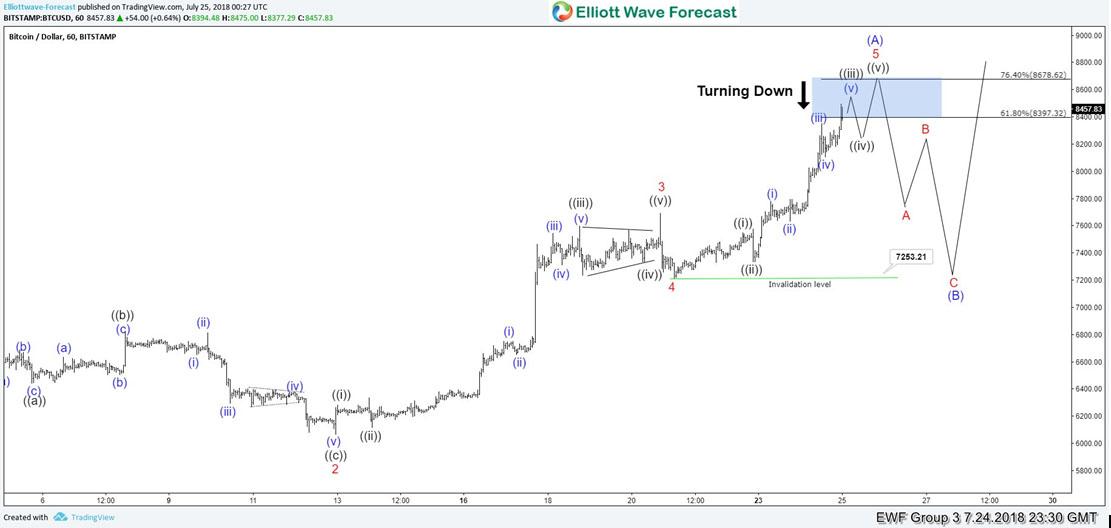

With the price of Bitcoin down more than 60 percent down from its peak in December, the power price that miners pay to mint new currency is becoming more important.

The increasingly difficult computations for creating new blockchains — the encrypted digital ledgers that underpin cryptocurrencies — require ever-more powerful computers. And many of the big server farms need air conditioning to keep from overheating.

The industry’s electricity use has increased exponentially over the last year and can consume as much as 60 percent of mining revenues, Bloomberg New Energy Finance estimates.

“All of those machines are consuming at least as much as Ireland and probably a lot more, especially by the end of the year,” said Alex de Vries, the PwC consultant who founded Digiconomist, a website that calculates the energy consumed by bitcoin. “It could be as much as the whole of Austria in terms of energy consumption.”

By Anna Hirtenstein

27 July 2018, 05:00 BST

David