Why Elon Musk Secretly Loves Silver

It’s no secret that Elon Musk has some revolutionary ideas.

And by most measures, he has been wildly successful. Tesla orders hit a record 97,000 vehicles globally in the third quarter (not to mention 250,000 preorders for the new CyberTruck). The stock has more than doubled since May 1. And you might recall Mike Maloney is a big fan of Tesla cars.

But there’s something you may not know about Elon Musk. He won't admit it publicly. Neither will most “green” company CEOs. But it’s a reality for all of them.

They desperately need silver.

The fact is, the growing green revolution requires the use of silver. Due to its unique chemical makeup, silver is one of the elements that, directly or indirectly, make green technologies what they are.

Whether you know it not, incorporating more green technologies and products into your life means you are, by default, using more silver. Ditto society as a whole.

Here’s where silver plays a key role in the green revolution…

Electricity Generation

Silver is used in most electrical generation today, because it has the highest known electrical and thermal conductivity of all the metals. And when it comes to green electricity, solar is one of the fastest growing segments of the market. Solar is green because it is a renewable energy source and emits no carbon emissions.

The amount of silver used in solar panels can vary, but a fair average is about 20 grams, or 0.643 troy ounce, roughly two-thirds of an ounce. We put 23 solar panels on our roof earlier this year, so we used 14.8 ounces of silver.

That may sound like a small number of ounces, but adds it up quickly…

Consider even if you don’t have solar panels on your home, an increasing number of buildings do. In California, a new law goes into effect January 1 that will require solar on every new building of four stories or less. Other states and countries could easily follow suit.

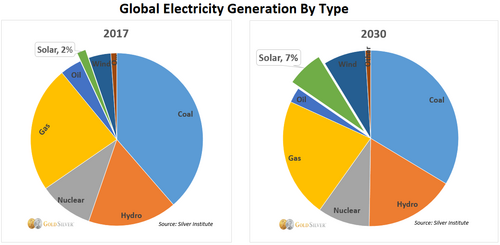

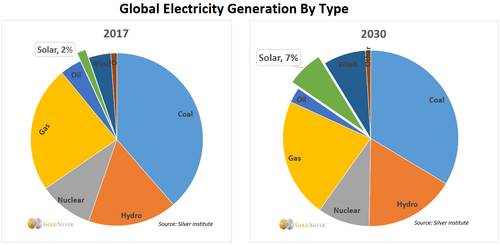

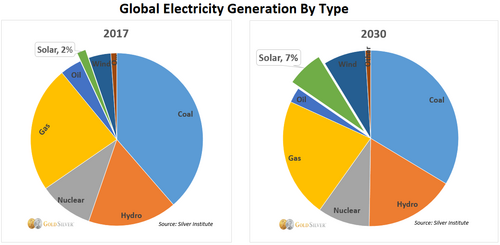

And by any measure, the use of solar in our society is poised to grow significantly:

Electricity from solar power is expected to more than triple in just the next ten years.

This growth is partly due to greater environmental awareness and government policy, but it’s also a result of energy-efficient technologies themselves: solar costs less, and can be installed faster than most other energy sources. This makes it especially appealing to second and third world countries; both China and India are on track to see a significant increase in solar capacity.

It’s not just solar but all renewables; windmills use silver, too. Brushes that contain silver are used in the motors and generators of wind turbines. Copper versions of the brushes have been popular, but many end users are switching to silver brushes, which, although more expensive, perform better long term.

In total, renewables are expected to increase to a whopping 4.5 times their current level by 2030, expanding their share of global electricity generation from 6% to 14%. This means more and more silver will be required.

By 2050, it is estimated that solar panels and wind turbines will require three times more silver than what is used today.

If the silver price gets too high, could it be reduced or even eliminated from renewables? For the most part, no. As CRU International reported, “it bears repeating that silver has remarkable electro-conductive qualities unmatched by other metals, and there is a physical limit on the ability of solar PV manufacturers to continue reducing silver loadings before performance and efficiency losses begin to outweigh whatever benefits are achieved from lower raw material costs.”

So, if your home or business or any establishment you visit gets some or all of its electricity from solar or wind, you can thank silver.

Electric and Hybrid Vehicles

Electric cars and trucks require silver. This category includes electric vehicles (EVs), battery electric vehicles, (BEV), and plug-in hybrids (PHEVs).

These vehicles use more silver than the internal combustion engine (ICE). The electric engine, battery pack, and battery management system all require silver.

While the amount of silver used in a Tesla and other electric vehicles is small, the aggregate total adds up quickly—and will only go higher.

.png)

If you own either type of vehicle, or ride in a car or bus that uses this type of energy, you are using a green technology—which silver helped provide.

It’s not just electric vehicles, either. Autos in general are becoming more “electrified” every year. The majority of electrical connections in a car use silver-coated contacts—silver switches are used to start the engine, control electric seats, and open/close electric windows. Silver is also used in heated seats, window defoggers, and most luminescent displays.

This all means that silver demand for this sector is set to rise at a fast clip. CRU International estimates that by 2030, electric vehicles will account for as much as 17% of global car sales, with hybrids accounting for an additional 20%. As a result…

The amount of silver used by the auto industry alone will reach an estimated 70 million ounces by 2030, up from 45 million ounces in 2017.

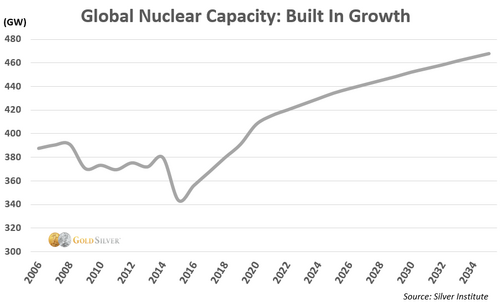

Nuclear Energy

While the use of nuclear power plants may be controversial, nuclear is a zero-emission clean energy source. And unbeknown to many people, nuclear power plants use silver, too.

Silver is used (with other metals) to produce control rods for nuclear reactors. While the amount of silver per rod is small, it is a vital component.

The amount of silver in a reactor can vary, but the average reactor contains 20 individual rods, which amounted to about 56 thousand ounces of silver for the industry last year.

If you are the recipient of electricity generated from a nuclear power plant, silver helped produce that green power.

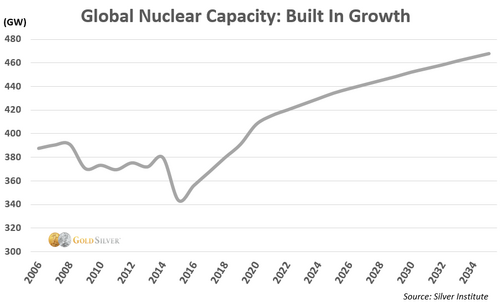

And the nuclear industry is set to grow.

So if you don’t get power from nuclear now, you may in the future.

It’s worth pointing out that the newer nuclear plants use rods that contain more silver. That’s why CRU International says demand for silver from this industry will undoubtedly grow. There is a low rate of replacement for the rods, though, so the growth will primarily come from new nuclear plants being built.

The amount of silver used in nuclear control rods is small, but it is an essential element and will grow with the industry.

Going Green = Going Silver

As the world incorporates more green technologies into society, you will, by default, use more and more silver in your daily life. Silver helps make green technologies what they are.

And as new technologies are discovered, silver’s unique properties will make it a key component in their development and use.

Welcome to the green revolution. And, welcome to silver.

Jeff Clark, Senior Analyst, GoldSilver.com

David

.png)

.png)

.png)

.png)

.png)

.png)