Wall Street sees higher gold prices next week, Main Street gets pessimistic with NFP, Fed decision on the docket

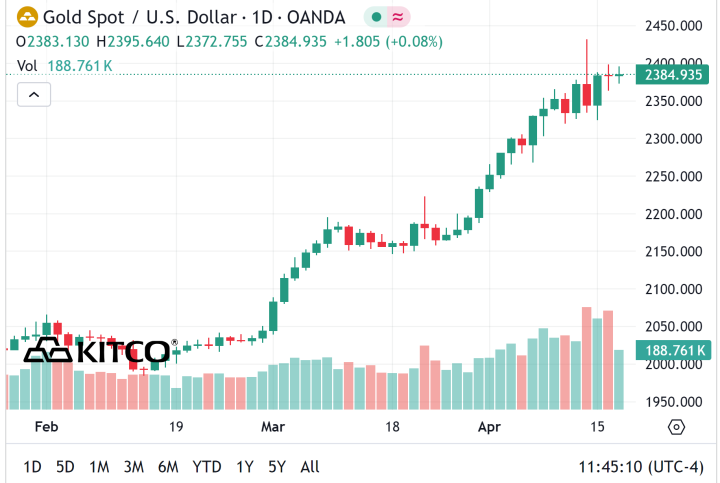

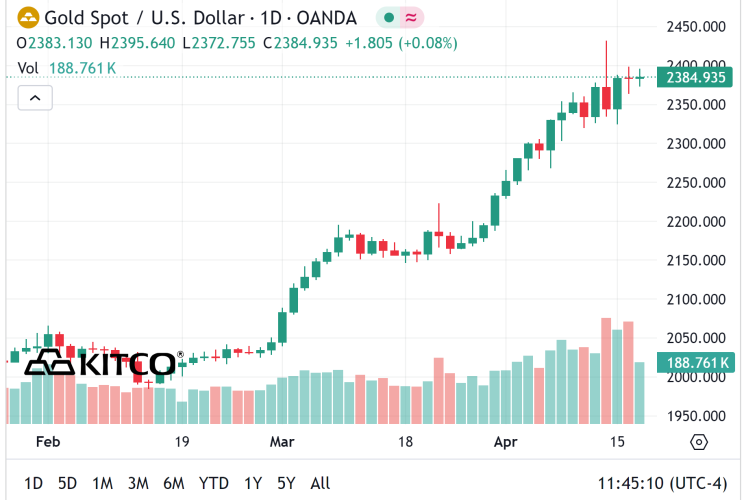

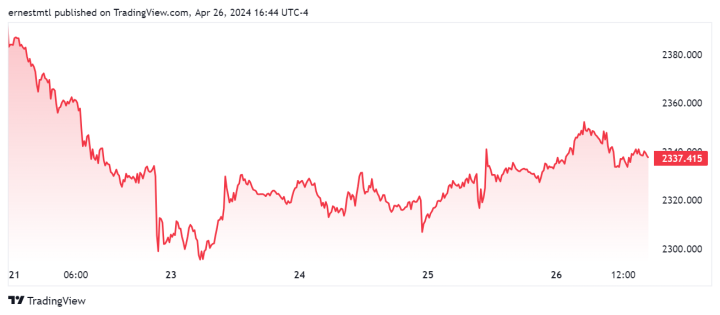

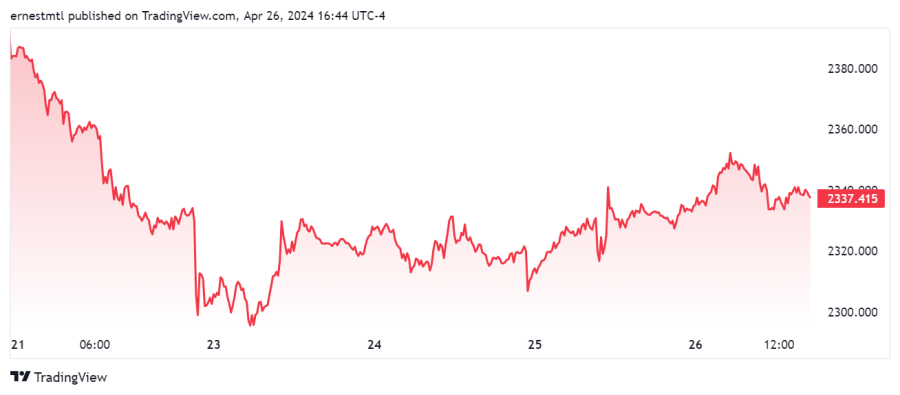

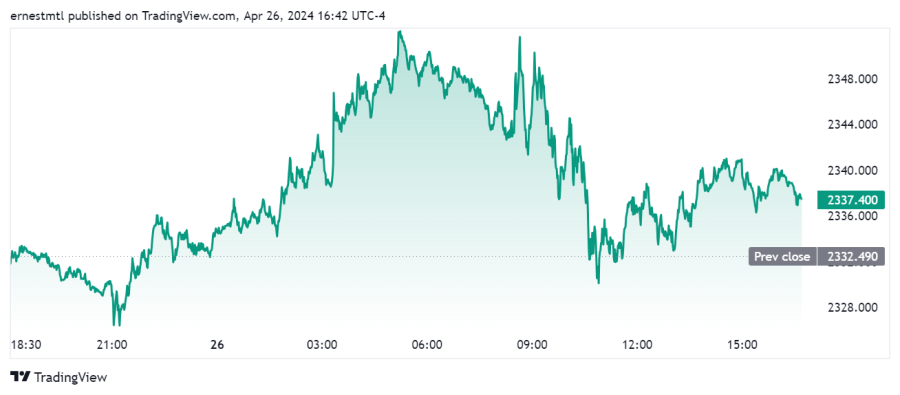

While gold would appear to have had a poor week, down over 2% since the open on Sunday night, a cursory glance at the weekly chart shows that virtually all of the losses were traders selling off their weekend insurance after the Middle East conflict didn’t escalate beyond Israel’s retaliatory strikes on Friday.

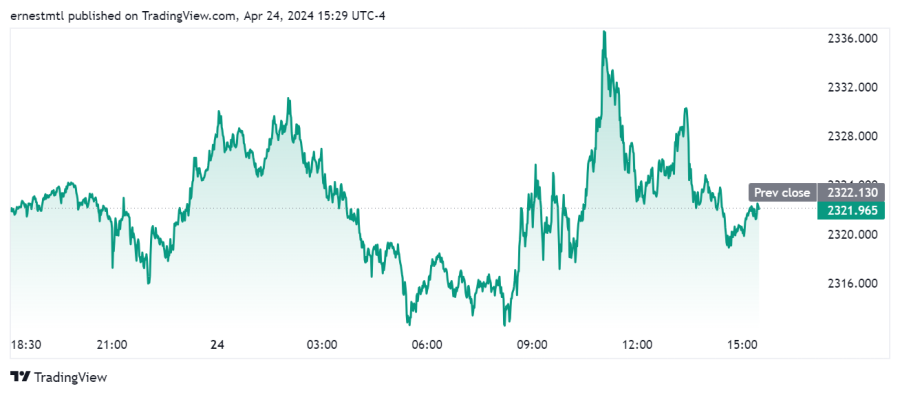

If we subtract this move, gold prices traded in a narrow $30 band since dipping briefly below $2,300 Tuesday as markets digested worrisome but not earth-shattering economic data.

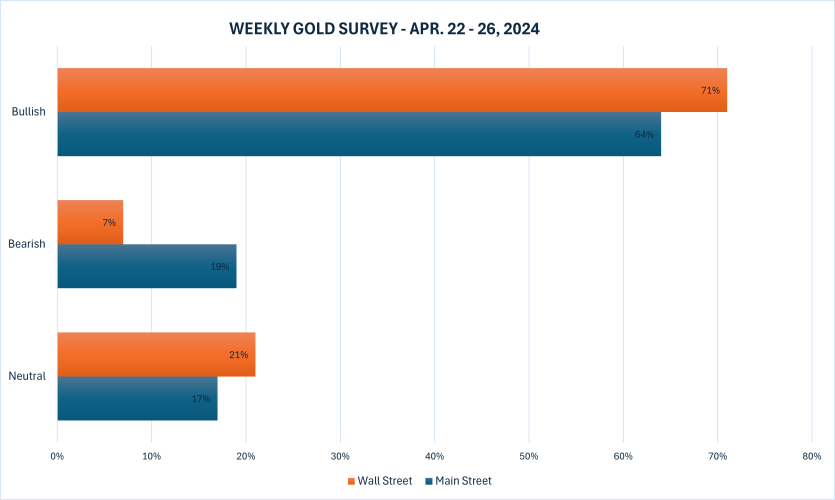

The latest Kitco News Weekly Gold Survey showed retail investors increasingly losing faith in the precious metal, while analysts and institutional players see this week’s consolidation as a harbinger of further gains.

Mac Chandler, Managing Director at Bannockburn Global Forex, was among those who saw this week’s price performance in a positive light.

“Gold in the cash market found support near $2300,” he said. “I think it can test $2370 in the coming days. I suspect the real test is with the US jobs data next week. The FOMC meeting comes first, but a hawkish hold is widely anticipated. The service PMI and small business surveys warn of downside risk.”

“A disappointing jobs report could send the dollar and rates lower and lift the yellow metal,” Chandler said.

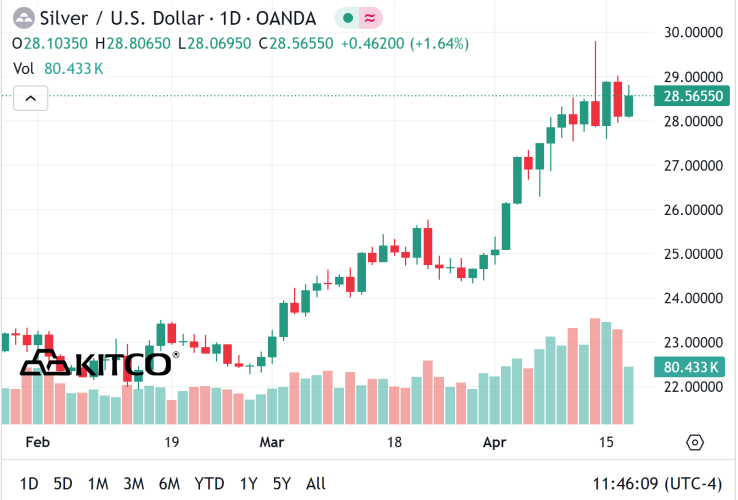

Adrian Day, President of Adrian Day Asset Management, also sees gold trading higher next week. “Buying worldwide is picking up,” he said. “Central banks continue to be net buyers of gold, in size, if so far this year at a somewhat slower rate than the last two years.”

“Chinese consumer buying is up this year, as investors and savers look for a safe place to put their money amid a weakening economy and threatened yuan devaluation,” Day said. “Now buying in North America is turning, albeit at a slow pace, but turning none the less. Gold ETFs are beginning to see some inflows, after steady and relentless selling most of last year and earlier this year.”

“Investors, both individuals and institutions, are extremely underweight gold assets, so even a slight shift in buying patterns could be dramatic,” Day added.

Adam Button, head of currency strategy at Forexlive.com, was parsing gold market demand for clues about its future direction.

“The open question is how much of the bid is safe haven and how much of it is driven by the same fundamentals that have been underpinning gold for the past seven weeks,” Button said. “One thing to look at is oil. Many people are still estimating there's a five-dollar premium in oil from the Middle East. I think that's aggressive, but oil hasn't come down that much this week either, so either the premium is still there, or it's not that big of a factor at all.”

“I lean towards that the geopolitical premium is small,” he said. “At this point, at the risk of being wrong on the weekend, but the Iran-Israel tensions appear to be dwindling. It's clear the U. S. doesn't want a war, and Iran doesn't want a war. I don't think Israel's going to go it alone.”

Button said that as the pressure drops in the region, the market should return its focus to the real driving force behind gold’s price action.

“I think all roads lead to China in this gold discussion,” he said. “And the question I have is how much of the China bid is retail and how much of it is official or semi-official. And I would split that off and say retail financial flows versus retail physical flows, because if it's physical retail buying, that's not going to unwind, whereas there's a lot of talk about China ETF inflows… that can unwind really quickly if the price starts declining.”

That said, Button sees plenty of signs of continued strength for gold prices.

“The bids keep coming in,” he said. “And the sellers have had a good reason. You've got hot inflation numbers, strong dollar, a rough week in markets with tech there, and a more peaceful kind of resolution [to the Iran-Israel strikes].”

“If you look at the week, gold faced three or four tests of demand. And to my mind, it passed them all.”

Button said that while we’re seeing steady buying and higher lows again, gold will need buyers outside of China to propel prices higher still.

“I think if gold is going to rally further from here, it's going to take more of a global retail demand spike to make it happen,” he said. “There's a little bit more talk on CNBC about gold, but it just gets so easily overshadowed when you have Google up 10% or Meta down 20%. Gold can't seem to grab ahold of that retail bandwidth. And that's fine, because that's probably what's going to lead to a top, is some kind of retail piling in. But for now, the bids are still there, and at wonderful levels. There's a lot of money to be made in the gold space right now.”

Button also believes the market is primed for an overreaction to a disappointing employment report. “The market will move much more than it should on a soft jobs report,” he said. “This week we had the S&P global PMI that was soft and we saw what happened, there were some big moves on that. And that's a second-tier indicator. Nonfarm payrolls is tip-of-the-top.”

“GDP was a little soft, rates are high again, there's some election angst, demand really isn't that strong,” he said. “The market might have a really quick rethink if there is a soft nonfarm payrolls report.”

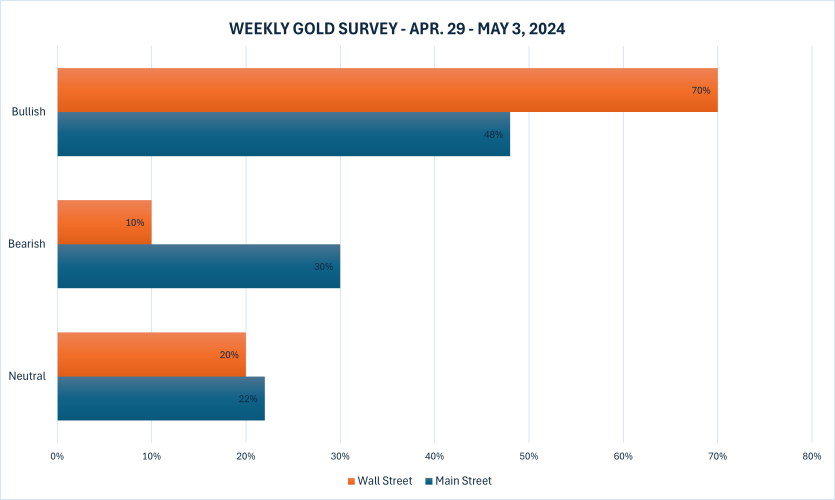

This week, 10 Wall Street analysts participated in the Kitco News Gold Survey, and the views were virtually identical to those shared last week. Seven experts, or 70%, expected to see gold prices climb higher next week, while two analysts, representing 20%, see gold continuing to trade sideways. Once again, only one analyst, or 10%, predicted a price drop.

Meanwhile, 155 votes were cast in Kitco’s online poll, with only a minority of Main Street investors now seeing gains for the precious metal after another week of restrained price action. 74 retail traders, representing 48%, looked for gold to rise next week. Another 46, or 30%, predicted it would be lower, while 35 respondents, or 22%, expect the precious metal to trend sideways in the week ahead.

Next week’s economic news highlights are the Federal Reserve’s monetary policy decision on Wednesday and the nonfarm payrolls report on Friday, but markets will also pay attention to Tuesday’s U.S. Consumer Confidence report, Wednesday’s ADP nonfarm employment, ISM manufacturing PMI, and JOLTS job openings, weekly jobless claims on Thursday, and the Friday release of ISM Services PMI.

Darin Newsom, Senior Market Analyst at Barchart.com, believes gold will finally get its long-overdue pullback next week.

“Going out on a limb here, but if the June futures contract closes higher Friday and Monday, it would be 3 days against the short-term downtrend that was confirmed with the move to a new 4-day low this past Monday,” Newsom said. “The daily chart would also be showing a bear flag pattern, with the old technical saying being, ‘flags and pennants fly at half-mast.’ If so, and the contract breaks down next Tuesday (theoretically), then the short-term target would be near $2,268.”

James Stanley, senior market strategist at Forex.com, thinks the Fed will send some dovish signals, which should help gold prices.

“I think the Fed will still have some element of a dovish lean, and I think that’ll keep gold bulls in the game,” he said. “That said, the April monthly bar in spot gold could take on a different tone depending on how Monday and Tuesday of next week go. If bulls cannot hold 2300 into month-end, there’ll be a greater build of bearish short-term price action, and when combined with the lower-high last week and the stall at 2400 this month, that can start to open the door to a deeper pullback move.”

Sean Lusk, co-director of commercial hedging at Walsh Trading, was looking through this week’s sideways chop on Friday, and sees geopolitics and inflation continuing to drive gold prices higher.

“It has been hesitant,” Lusk said. “You get a little move overnight and then it's right back to where it came from in the morning, in either direction. Some of the inflation data was a little scary yesterday, now it's reset itself. This is probably an overreaction to the upside of the equity markets, the metals gave back all of the rally from last night, but I still think the path of least resistance is higher.”

Lusk said he doesn’t believe the Middle East situation has really cooled down, and he expects more conflict in the near future.

“You're just getting a little bit of a pause, but my feeling is this is the calm before the storm,” he said. “The actions that have taken place in the last couple of weeks over there, where it's just tit for tat, missile over here, missile over there. There's no consequences, but there's going to be consequences. That's why I think eventually, energy is going to lead a lot of these things up.”

Looking ahead at next week’s April nonfarm payrolls report, Lusk said that while it remains a tradable event, the inflation indicators should really be the market’s focus these days.

“I think the employment report used to be the standard, the most important economic data. And it's very important. But now, when you have rates back up off these historic lows that sat there at 2% for year in, year out, and we sank them to zero for the pandemic, brought them back out of hibernation, finally, to combat inflation.”

“Can we not argue that the GDP, and more importantly, the CPI and PPI, are way more important indicators than unemployment? Because you can,” he said. “The unemployment report is just a simple survey, there's no accuracy there. That's why there's revisions, and the revisions are major.”

“I think the market for gold, for energy, for other things, is going to take its cue from the inflation indicators as they relate to the bond market, and obviously the dollar. Remember the February employment number? Blew away expectations! Real positive! Gold dipped down below $2,000 an ounce. And since then we've taken off. Why? Because inflation started to run hot again, and that took some muscle out of the stock market.”

“The dips, the profit-takes, the unwinds have been limp, maybe $40 here one day, $30 there, and what happens? It just slowly gets bought back,” he said.

“I'd be a buyer of dips in gold until the technicals and the fundamental focus and picture of the market says no more rate hikes,” Lusk added. “Flow is going back in the dollar. Bonds are crashing because yields are soaring. Those really are the traditional enemies of a sustained rally in gold.”

Ole Hansen, head of commodity strategy at Saxo Bank, thinks gold prices will take a breather next week. “Gold needs more time to recover, so next week I’m neutral to lower.”

And Kitco Senior Analyst Jim Wyckoff still sees potential gains for gold next week. “Steady-higher as charts remain overall bullish,” he said.

Spot gold last traded at $2,337.40 per ounce at the time of writing, up 0.22% on the day but down 2.27% on the week.

Kitco Media

Ernest Hoffman

David

.jpeg) The gold market is seeing solid selling pressure after failing to hold its ground at $2,400 an ounce. Although the market has room to fall lower during the summer, one market analyst says that the precious metal remains in a solid position to rally by year-end.

The gold market is seeing solid selling pressure after failing to hold its ground at $2,400 an ounce. Although the market has room to fall lower during the summer, one market analyst says that the precious metal remains in a solid position to rally by year-end..png)

.png)