Analysts turn bearish on gold, while retail investors remain bullish

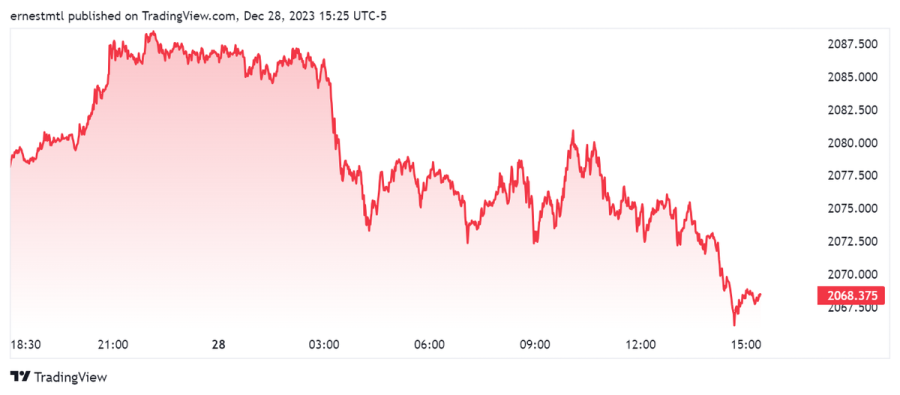

Gold gave up much of its recent gains during the first full week of December trading. After posting its first-ever monthly close above $2,000 last Friday, then opening Monday's Asian trading session with a new all-time high of $2,150 per ounce, the precious metal trended steadily downward in the following days, and was clinging to support around the $2,000 level on Friday afternoon.

The latest Kitco News Weekly Gold Survey shows most retail investors are still expecting price gains next week, while the overwhelming majority of market analysts have turned bearish or neutral on the yellow metal's near-term prospects.

Mark Leibovit, publisher of the VR Metals/Resource Letter, has moved from bullish to neutral on gold for next week. "With the US Dollar upticking and following last week's blow-off to the upside, I think we have to be cautious here," he said. "So, I am voting NEUTRAL for now."

Colin Cieszynski, Chief Market Strategist at SIA Wealth Management, said he's bearish on gold prices for the coming week.

"The market reaction to today's nonfarm payrolls and wage inflation data pushed up treasury yields and USD while knocking gold back a bit," he said. "I think the Fed is going to be less dovish than the street is hoping which may continue the correction in Gold that started after the overnight spike that started this trading week."

James Stanley, senior market strategist at Forex.com, sees gold prices rising next week. "Gold has had a tendency to set bear traps this year and the reversal seen earlier in the week may be setting up something similar," he said. "If the weekly bar of spot Gold closes below $2k that's going to look like an aggressive reversal candle. But, really, I'm not sure the risk backdrop supports such a thesis at the moment, and there are two major drivers next week with CPI and FOMC, so matters can change quickly."

"What we have seen so far was bulls showing up with support at or around that $2k level even after the massive reversal move to open the week," Stanley said.

Adrian Day, President of Adrian Day Asset Management, has switched his stance on the precious metal from neutral to negative. "Though the fundamental longer-term outlook is very positive, gold is vulnerable to bad news after such a strong run up, as I wrote last week. And we seem to have got that bad news with a stronger-than-expected official U.S. jobs report, destroying the optimism of other recent reports, and mitigating expectations of rate cuts any time soon."

Day said he sees "further downside" for the yellow metal. "Gold could easily fall back under $2,000, to support around $1975," he said. "However, the fundamental premise is that the Fed and other central banks will stop tightening in the face of deteriorating economies and unmanageable debt burdens while inflation remains stubborn, and this scenario is very bullish for gold."

This week, 15 Wall Street analysts participated in the Kitco News Gold Survey, and only three experts, or 20%, expected to see higher gold prices next week. Eight analysts, or 53%, predicted a drop in price, while the remaining four experts, representing 27%, were neutral on gold for the coming week.

Meanwhile, 729 votes were cast in Kitco's online polls, and market participants are maintaining their bullish outlook for the coming week despite this week's decline. 428 retail investors, or 59%, looked for gold to rise next week. Another 167, or 23%, expected it would be lower, while 134 respondents, or 18%, were neutral on the near-term prospects for the precious metal.

Kitco Gold Survey

Wall Street

Bullish20%

Bearish53%

Neutral27%

VS

Main Street

Bullish59%

Bearish23%

Neutral18%

The latest survey shows that retail investors expect gold prices to trade around $2,056 per ounce next week.

Central banks will once again take center stage in the coming week, with the FOMC rate decision on Wednesday, followed by the ECB and Bank of England decisions on Thursday. All three are expected to hold interest rates unchanged, though investors will still be watching to see if there is a shift in their tightening biases and projections.

Other noteworthy data releases include U.S. CPI on Tuesday, U.S. PPI on Wednesday, and the Empire State manufacturing survey and Flash PMI on Friday.

Daniel Pavilonis, Senior Commodities Broker at RJO Futures, said the pause in the gold price rally this week coincided with the pause in the slide in yields. "The yields stopped going down, and are starting to look like maybe they're overdone," he said. "I think gold as a market is questioning whether or not this thing can have the momentum to go higher."

Pavilonis believes the catalyst for the spike to all-time highs was geopolitics, "the Red Sea situation, aircraft carriers, some U.S. vessel was shot at," he said. "Then it sold off pretty quick, and now we're just range-bound."

"This market has so many reasons to trade at a much higher level, and it just really hasn't, although it has stayed at elevated levels," he added. "I think now you have another competing force with Bitcoin. The cryptocurrencies have started to take off again, and we've seen this last time cryptos took off. Are cryptos stealing some of that purchasing power away from gold?"

"My call for next week would be range-bound sideways," Pavilonis said. "It just seems like $2,000 is a magnet. We fall below it, we get back up there. We thought we'd rise above it, we fall back down to $2,000. I think it's the target, that's where the market is comfortable right now."

Adam Button, head of currency strategy at Forexlive.com, believes gold can move higher next week. "The weak hands have been shaken out of gold after the squeeze to start the week, but the fundamental picture remains intact," he said.

"I like gold lower next week," said Marc Chandler, Managing Director at Bannockburn Global Forex. "The massive key reversal on Monday sets the technical tone. A break of $2006 could see $1985. Moreover, five G10 central banks meet next week, and most will likely push against the aggressive rate cuts and early timing the market is discounting."

Darin Newsom, Senior Market Analyst at Barchart.com, has joined the bears for the near term. "February gold completed a bearish key reversal on its daily chart Monday, December 4, and did it in a big way," he said. "The contract consolidated for much of the rest of the week, but still remains in a short-term downtrend."

Heading into next week's trading, Newsom pegs initial short-term support at Tuesday's low of $2,027.60. "A break below that mark could trigger a selloff to test the next downside target of $1,997.40, the 50% retracement level of the previous uptrend from $1,842.50 (October 6 low) to $2,152.30 (December 4 high)," he said.

Frank McGhee, head precious metals dealer at Alliance Financial, also expects to see lower gold prices over the coming week, as the precious metal is "still reacting to the High Volume, Exhaustion Highs @ 2150+/-."

And Kitco Senior Analyst Jim Wyckoff expects gold prices to trade in a range next week. "Sideways and choppy as bears have gained some technical momentum late this week," Wyckoff said.

After kicking things off with a bang, gold prices slid steadily lower during the week, with spot gold falling 3.29% since Monday. The precious metal traded below $2,000 between Noon and 1:30 pm EST on Friday, but has since pulled back above that level, last trading at $2,001.71 per ounce, down 1.32% on the day at the time of writing.

By

Ernest Hoffman

For Kitco News

Time to Buy Gold and Silver

David

.png)

.png)

Fed's Powell confirms FOMC believes terminal rate has been reached, says outlook reflects latest CPI and PPI data

Fed's Powell confirms FOMC believes terminal rate has been reached, says outlook reflects latest CPI and PPI data

Gold to outperform silver and platinum as weak growth forces the Fed to cut rates in 2024 – Heraeus

Gold to outperform silver and platinum as weak growth forces the Fed to cut rates in 2024 – Heraeus

Gold is poised for new all-time highs in 2024 – World Gold Council

Gold is poised for new all-time highs in 2024 – World Gold Council