Gold and silver start the European session mixed

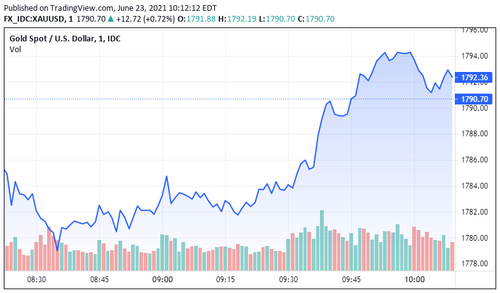

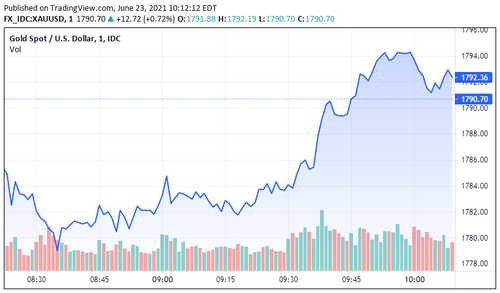

Gold and silver are trading mixed this morning. The yellow metal suffered from more losses on Tuesday after hitting a low of $1750.78/oz and this morning the price is around $9 higher. Silver on the other hand trades at $25.81/oz 0.28% higher overnight after also dropping in yesterday's session. In the rest of the commodities complex, copper has moved to $4.25/lb 0.14% higher and spot WTI is trading just under flat at $73.40/bbl.

Indices in the Asia Pac area were slightly mixed. The ASX (0.16%) and Shanghai Composite (0.30%) closed higher while the Nikkei 225 dropped -0.07%. Futures are pointing towards a negative open in Europe.

In the FX markets, the antipodeans were the best performers overnight as AUD/USD (0.14%) and NZD/USD (0.15%) both traded higher. The dollar index lost 0.08% in value. In crypto markets, BTC/USD has dropped -2.48% after a decent session on Tuesday.

Looking at the news from overnight, Japanese industrial production (MoM) (May) hit -5.9% vs the analyst expectations of -2.4%.

ECB's Villeroy thinks inflation should go up a bit this year then down again in 2022, 2023.

U.K. prelim Q1 GDP printed at -1.6% vs expectations of -1.5% q/q.

China official PMIs for June. Manufacturing 50.9 (vs. expected 50.8), Services 53.5 (expected 52.7).

Fed's Waller says the U.S. jobs market has not quite come back to pre-COVID. Waller added he has a very optimistic outlook for the economy and he is not ruling out a 2022 rate hike.

There are newspaper reports that double-vaccinated people in the U.K. will not have to isolate if they come into contact with someone who has COVID-19.

Looking ahead to the rest of the session highlights include German employment numbers, EU CPI, U.S. ADP jobs numbers, Canadian GDP, U.S. pending home sales and weekly oil DoE's. We could also hear from Fed's Barkin, Bostic, BoE's Haldane and ECB's Panetta.

By Rajan Dhall

For Kitco News

Kinesis Money the cheapest place to buy/sell Gold and Silver with Free secure storage

David