Gold market is in 'buy the dip' mentality until Fed's messaging, analysts watching Powell's banking sector comments – analysts

Gold is stuck in a tight range, with the "buy the dip" mentality dominating the market. Investors are keenly watching the Federal Reserve's widely expected 25-basis-point rate hike next week. But if markets interpret the messaging as a "hawkish pause," gold's rally could re-start, according to analysts.

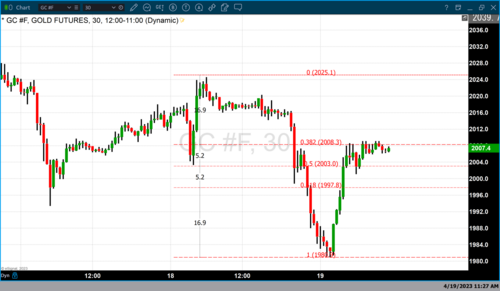

The gold market is looking to wrap up April with a slight gain of 0.7% after reaching a 13-month high of above $2,050 an ounce earlier in the month. At the time of writing, June Comex gold futures were trading up 0.13% on the day at $2,001.60 an ounce.

"Gold is going to remain a buy-the-dips market until we get a few things ironed out as far as the economy is concerned," Walsh Trading co-director Sean Lusk told Kitco News.

Gold's rally failed at an important level, which might mean there is still a deeper setback to come, Michael Boutros, senior technical strategist at Forex.com, told Kitco News.

"Gold reached the 2022 high-day close at $2,049 and then posted a reversal lower," Boutros said Friday. "The $1,966 is the line in the sand, and we tested it last week. If we fall below that, a deeper washout to $1,912-$1,919 is possible. I would love to see that hold."

The objective in May is to find that exhaustion low before the next leg up in the gold price rally, said Boutros.

The Fed meeting: 'The devil is in the detail'

Markets are currently pricing in an 83% chance of a 25-bps hike on Wednesday, according to the CME FedWatch Tool.

"From the Fed's standpoint, the devil is in the details. The 25 bps is heavily priced in," Boutros said. "Commentary will be key. The big thing to look for is if the Fed will start to mention the banking system and issues like the First Republic Bank troubles."

The banking sector turmoil is not over yet, Boutros warned. "The heavy emphasis will be on whether the Fed sees cracks or risk of contagion," he noted.

Media reports were circulating at the end of the week that the U.S. government was leading rescue talks for First Republic Bank.

Markets are still pricing in rate cuts later in the year, but the majority of analysts are having trouble reconciling the market's expectations versus the Fed's obligation to keep fighting the elevated inflation.

"Inflation won't be going away any time soon, which is why the Fed is not going to cut rates," Lusk said.

What the Fed can do is sit on its hands, which will be viewed by the gold market as the much-needed pause in its rate hike cycle.

"Gold positioning is at less than 50% of its peak, suggesting upside risk once the Fed signals the end of the current hiking cycle," said Suki Copper, precious metals analyst at Standard Chartered. "We expect a hawkish pause."

Many see the May hike as the last one in this tightening cycle, with Boutros stating that a June rate increase is likely off the table.

Gold's fundamentals are bullish: Analysts look for $2,100 on the upside

The gold sector is the safe place many choose to go into for cover amidst all the market uncertainty, said Lusk.

"There is the perfect storm to the upside for gold still. Some headwinds for the economy here are housing and growth. The stock market will have a lot of trouble navigating to where it was. A lot more flows will go into gold sooner rather than later. Gold is a great asset to park money and find some safe haven within the market. Dips will be bought here," he explained.

From a technical perspective, gold's first major support is at $1,950-40, and then $1,925, said Lusk.

On the upside, Lusk's targets are $2,060 and then $2,100, which will be 15% up on the year. "Above that, the $2,190 area is 20% on the year — that's my ultra-bullish upside target," he said.

Another event to watch next week is the U.S. employment report from April, with markets looking for job growth to slow to 178,000 positions added from March's 236,000. The unemployment rate is expected to tick up to 3.6%.

Other supportive gold drivers in the longer term are the debt-ceiling suspense and geopolitical tensions, analysts added. "Geopolitics is not at the forefront right now, but it will be an X-factor moving forward," Boutros said.

Data next week

Monday: U.S. ISM manufacturing PMI

Tuesday: U.S. factory orders, JOLTS job openings,

Wednesday: Fed meeting, Powell press conference, U.S. ISM services PMI, U.S. ADP nonfarm employment

Thursday: ECB meeting, U.S. jobless claims,

Friday: U.S. nonfarm payrolls

By

Anna Golubova

For Kitco News

David

.gif) Gold consolidates but remains on a 'golden cross path' higher – NDR's Tim Hayes

Gold consolidates but remains on a 'golden cross path' higher – NDR's Tim Hayes

]

]

QE isn't over and will drive gold to $3,000 and Bitcoin to $100,000 in the next decade – Crossborder Capital

QE isn't over and will drive gold to $3,000 and Bitcoin to $100,000 in the next decade – Crossborder Capital

.gif) Gold remains well positioned to protect investors from further market turmoil – MarketVector's Yang

Gold remains well positioned to protect investors from further market turmoil – MarketVector's Yang

.gif) Inflation may moderate, but pension funds aren't taking any changes as they increase their exposure to gold and commodities – Ortec Finance

Inflation may moderate, but pension funds aren't taking any changes as they increase their exposure to gold and commodities – Ortec Finance

.png)