The Fed, US dollar may stop gold's record run next week

With so much uncertainty dominating financial markets, most analysts expect it's only a matter of time before gold prices hit new record highs above $2,000 an ounce.

However, with the market looking slightly overstretched, it might be challenging for gold to hit its new target next week. The cautious outlook for gold and silver comes as the precious metals saw significant breakout moves above $2,000 and $25 an ounce, respectively.

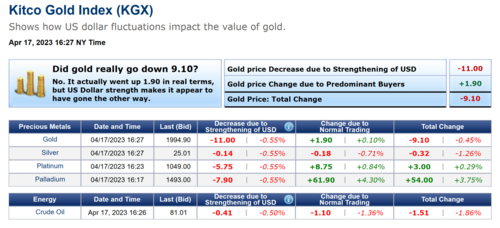

The gold market is looking to end the week up nearly 2% as the June contract last traded at $2,023.70 an ounce; meanwhile, silver continues to outperform, with prices ending the shortened trading week up more than 3% as the May contract trades at $25.04 an ounce.

This past week, gold and silver have significantly benefited from a sharp drop in bond yields, which in turn has weighed on the U.S. dollar. The U.S. dollar Index is looking to end Thursday at critical support around 102 points.

According to some analysts, if the U.S. dollar finds some momentum, it could prompt investors to take some profits on their bullish gold bets.

"It again looks like the U.S. dollar is trying to establish a short-term uptrend on its daily chart while June gold looks a bit top-heavy. We've seen this story before, though, and it usually ends with the greenback falling and gold strengthening," said Darin Newsom, senior market analyst at Barchart.com.

The U.S. dollar's and gold's future could be determined by just a handful of reports next week, starting with Friday's March Nonfarm payrolls report. Markets will be closed Friday for the Easter long weekend; however, the U.S. government will be open and will release the report.

Analysts note that investors and traders will have to wait until markets open Sunday before they can react to the data. According to consensus forecasts, economists expect the economy to create 288,000 jobs last month. Analysts note that anything better than expected will be bullish for the U.S. dollar and gold negative.

"As gold fires, long signals on all gauges of momentum, the upcoming jobs report could be of notable importance. On the one hand, a weak number could be a catalyst to see if the macro investors, who have thus far held notable dry-powder during the latest rally, add to their long positions. On the flip side, a strong report could bolster Fed expectations, and could see CTAs modestly reduce their positions if prices don't hold above $2026/oz," said commodity analysts at TD Securities.

Retail Investors and analysts remain bullish on gold, but the precious metal might need a rest

Retail Investors and analysts remain bullish on gold, but the precious metal might need a rest

While the U.S. labor market has been surprisingly resilient since early 2022, economists note that there are signs the tide is starting to shift, highlighting weakness and raising recession fears.

"If tomorrow's NFPs follow on the steps of recent data releases, showing signs of weakness in the US labor market, then I would expect further dollar weakness and the corresponding upside for the precious metal," said Ricardo Evangelista, senior analyst at ActivTrades. "I can see gold breaking through the previous maximum of $2069 touched during the summer of 2020."

Craig Erlam, senior market analyst at OANDA, said that because of current market conditions and sentiment, Friday's employment data would have to significantly surprise to the upside.

"Any disappointing data or even numbers in line with expectations and we will see gold make a run to its record highs," he said.

Aside from the jobs report, analysts note that inflation data next week could also provide some support for the U.S. dollar. Economists have said that a strong jobs market and persistently high inflation could force the Federal Reserve to continue to raise interest rates.

There are growing expectations that the Federal Reserve's tightening cycle has ended. The CME FedWatch Tool shows that markets see a roughly 50/50 chance that the central bank will leave interest rates unchanged between 4.75% and 5.00%.

While another 25 basis point hike in May would create a headwind for gold, many analysts don't see it as a game changer for the precious metal. Many analysts note that in this environment, investors will just have to wait a little longer before record highs are seen again.

Sean Lusk, co-director of commercial hedging at Walsh Trading, said that even if gold is technically overbought at current levels, there is solid support in the market.

"There are solid reasons why we are trading at these levels. We are seeing significant diversification into precious metals because of major uncertainties in the world," he said.

Lusk added that if gold does test support around $2,000, investors might want to buy micro gold futures to test the waters.

Looking beyond U.S. interest rates, Lusk said the ongoing banking crisis would continue supporting gold as a safe-haven asset.

Next week's data

Wednesday: U.S. CPI, Bank of Canada monetary policy decision, FOMC minutes

Thursday: U.S. PPI, U.S. jobless claims

Friday: Retail Sales, preliminary University of Michigan consumer sentiment

By

Neils Christensen

For Kitco News

Time to Buy Gold and Silver

David

Five reasons why you should be overweight gold in today's uncertain markets – abrdn's Minter

Five reasons why you should be overweight gold in today's uncertain markets – abrdn's Minter

Gold price hits session highs as U.S. CPI sees annual inflation rising 5%, down sharply from 2020 highs

Gold price hits session highs as U.S. CPI sees annual inflation rising 5%, down sharply from 2020 highs

.gif) Bank of America is looking for $2,100 gold price by Q2

Bank of America is looking for $2,100 gold price by Q2

.png)

Retail Investors and analysts remain bullish on gold, but the precious metal might need a rest

Retail Investors and analysts remain bullish on gold, but the precious metal might need a rest