J.P.Morgan sees gold price unable to withstand the Fed; falling to pre-pandemic levels in 2022

The gold market will not be able to withstand the Federal Reserve's plan to tighten its monetary policy in 2022, according to commodity analysts at J.P. Morgan Global Research.

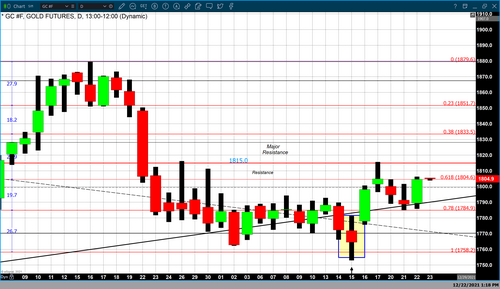

In its recently published 2022 outlook report, the bank expects gold prices to fall to pre-pandemic levels by the end of next year.

"An unwinding in ultra-accommodative central bank policy will be most outright bearish for gold and silver over the course of 2022," the analysts said. "From an average of $1,765/oz in Q1, gold prices are set to steadily decline over the course of next year to a Q4 average of $1,520/oz."

The outlook comes as the Federal Reserve plans to end its monthly bond purchases by March and looks to raise interest rates three times. Currently, markets are starting to price in the first rate hike in May.

However, J.P.Morgan is looking for the U.S. central bank to raise interest rates in September. Weighing on gold prices is the bank's forecast for rising bond yields as long-term inflation expectations remain well-anchored.

"Given the resilient economic environment, the curve has room to steepen for a short period in early 2022, and 10-year yields are projected to rise to 2% by mid-year and 2.25% by the end of 2022. Finally, long-end yields are expected to rise as well, but only barely retracing to the highs observed earlier this year by late-2022," Jay Barry, Head of USD and Bond Strategy.

At the same time, J.P.Morgan expects the U.S. dollar to rise 1.6% next year.

Looking at economic growth forecasts, J.P.Morgan expects the global economy to 4.8% in 2022, with the U.S. economy expanding 3.8%.

While the U.S. bank is bearish on gold through 2022, the bank is bullish on the rest of the commodity complex.

"Commodities are on pace to deliver the strongest year of returns since the early 2000s. A constructive economic outlook, depleted inventory levels and supply still struggling to respond to resurgent demand point to a second consecutive year of positive double-digit commodity returns in 2022," said Natasha Kaneva, Head of the Global Commodities Strategy at J.P. Morgan.

The bank is extremely bullish on oil prices ahead of the new year.

"We believe that oil is set to remain a major beneficiary of a continued economic reopening over the course of 2022. The last time consumption was as high as we forecast next year, U.S. shale drillers were pumping flat out, and the Organization of the Petroleum Exporting Countries (OPEC) and its allies were locked in a battle for market share," said Kaneva in the report.

By Neils Christensen

For Kitco News

Buy, Sell Gold and Silver, with Free Storage and Monthly Yields

David

.gif)

.gif)

.gif)

.gif)

.png)

.png)

(1).png)