Market participants await the November CPI inflation numbers

Tomorrow the U.S. Bureau of Labor Statistics will release the inflationary numbers vis-à-vis the CPI index. This report will be a critical component that the Federal Reserve will review before releasing its adjusted monetary policy. On Wednesday of next week, the Federal Reserve will release the statement including the revised dot plot and a press conference by Chairman Jerome Powell.

Bob Haberkorn, senior market strategist at RJO Futures said, “The stronger-than-expected jobless claims numbers along with a firmer dollar are pulling down on gold, but there are also traders waiting for the CPI data. If inflation numbers are going to be high, then gold will bounce right back up and make a move towards $1,800.”

Inflationary pressures have been spiraling out of control for months. Inflation rates edged higher beginning in June when the CPI came in at 5.4%. Inflation remained right around this level in July, August, and September. However, that all changed in October when the CPI projections indicated a major uptick to 5.8%. But the actual numbers came in well over the projections at 6.2%, the first occurrence of inflationary pressures at this level since November 1990.

Up until October the Federal Reserve maintained an adjusted mandate to let inflationary pressures run hot in place of maximum employment. They based their assumption on the belief that the current inflationary pressures will be transitory and will quickly move back down to acceptable levels.

Recently Chairman Powell acknowledged that that assumption was incorrect by removing the word transitory from the Fed’s vocabulary. However, his explanation was the whole truth, when he said we would remove the word transitory because “transitory means different things to different people.”

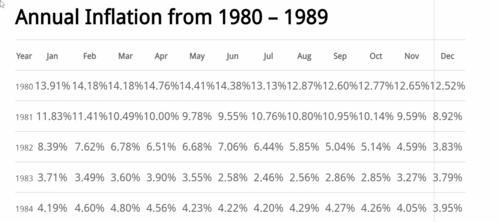

The report is expected to indicate a record level for inflation. Market participants, as well as Federal Reserve, will be intently focused upon tomorrow’s report. Currently, economists polled by various new sources are forecasting for yet a higher level of inflation predicting that inflation will increase by 0.7% taking the year-over-year number to 6.8%. If the economists are correct that would be a level not seen since the 80s.

Today’s decline in gold futures was not a reflection of the anticipated report tomorrow but rather based upon dollar strength and a report indicating strong jobs data in the United States. As of 5:35 PM EST gold futures basis, the most active February contract is fixed at $1775.90, a net decline of $9.60.

To get a better understanding of why gold could enter a major rally tomorrow if the inflationary numbers come in as forecasted or above, we need to look at what caused the record level of inflation in 1980 and what effect that had on the economy. In the early 1980s, countries worldwide including America, experienced one of the most severe economic recessions since World War II.

As Wikipedia puts it, “The early 1980s recession was a severe economic recession that affected much of the world between approximately the start of 1980 and early 1983. It is widely considered to have been the most severe recession since World War II. A key event leading to the recession was the 1979 energy crisis.”

In 1980 the inflationary pressures were between 12.52% to 14.76%. By January 1982, the CPI index fell to 8.39%. It took roughly three years from 1980 to 1983 before inflationary pressures normalized. This brings us to our current dilemma, for the Federal Reserve to effectively bring down inflationary pressures will not occur overnight and, in fact, could well be a long multiyear process. Historically, inflationary pressures at the current levels are the outcome of unique geopolitical or economic circumstances. Because there is an underlying force that drove inflation to these high levels, it is not possible to reverse that trend over a short period.

It is because of those factors that I believe if the CPI report tomorrow indicates higher inflationary pressures than the previous month, it will be clear that the Federal Reserve has a multiyear task to bring inflation back to normal levels. During that multiyear period, gold could experience one of the more dynamic rallies’s witnessed in our lifetime possibly even trading to a new record high based on the time necessary to normalize inflationary rates.

By Gary Wagner

Contributing to kitco.com

Buy, Sell Gold and Silver, with Free Storage and Monthly Yields

David

.gif)

.gif)

.gif)

.gif)

.gif)