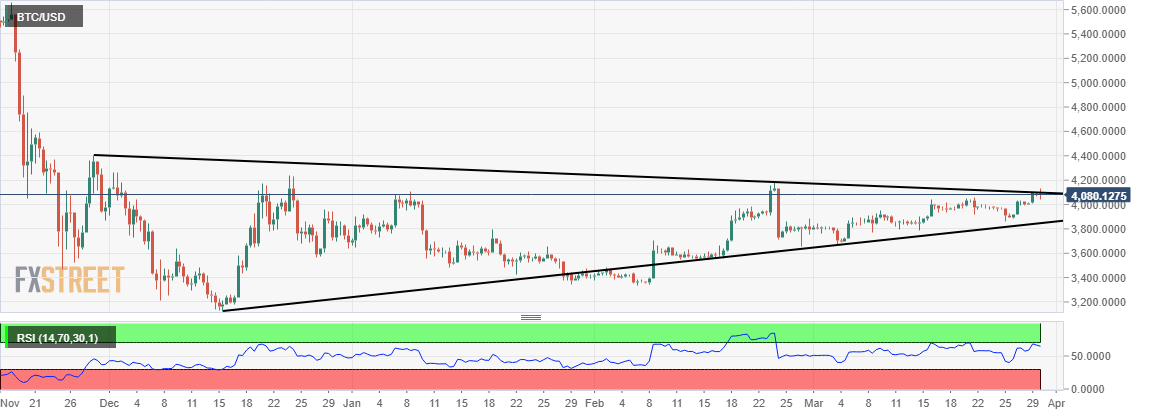

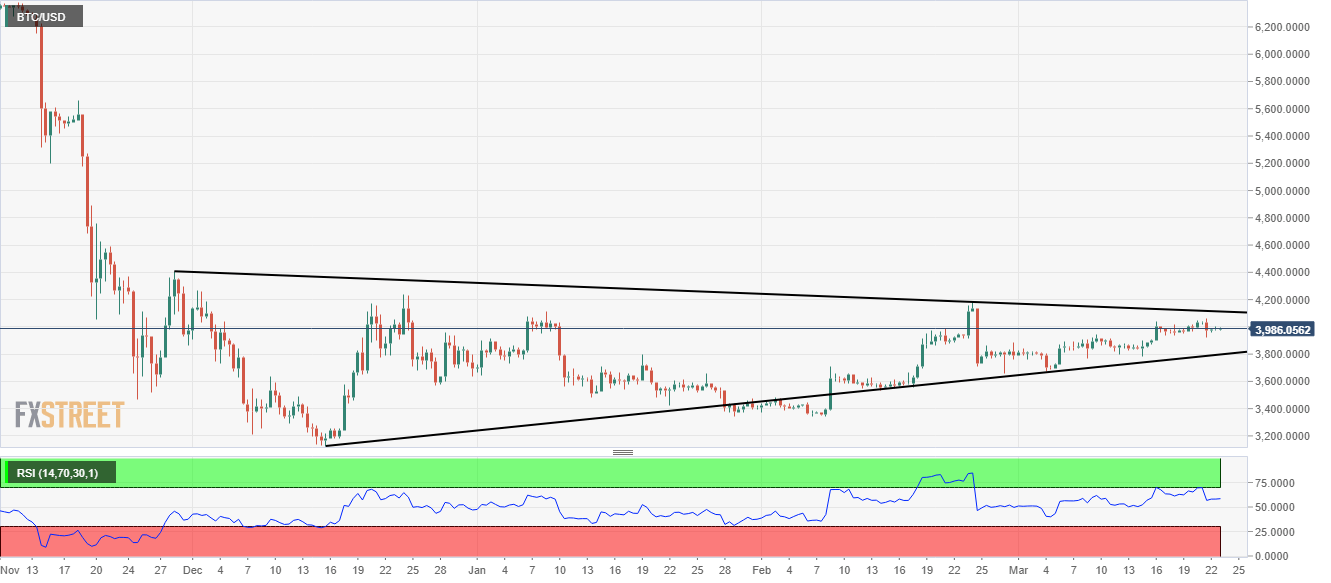

Bitcoin – The Bulls Hit $4,200 but Need $4,500 to Really Shift Sentiment

Bitcoin sees red early on but moving back through to $4,160 levels could signal another run at $4,200 levels later in the day.

Bitcoin slipped by 0.34% on Saturday. Partially reversing a 2.11% gain from Friday, Bitcoin ended the day at $4,165.1.

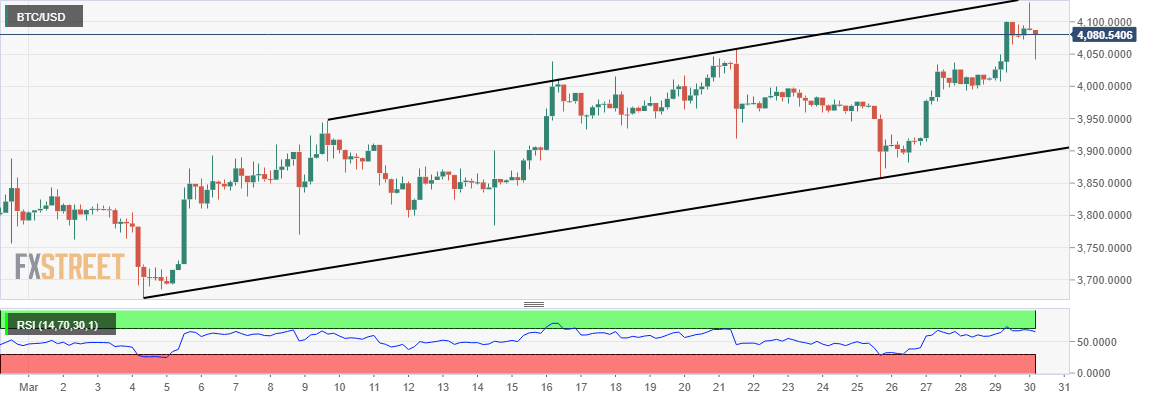

A choppy start to the day saw Bitcoin rise to an early morning intraday high $4,210 before hitting reverse.

Coming within range of the first major resistance level at $4,223.37, Bitcoin fell to an early morning intraday low $4,112. The pullback saw Bitcoin come within range of the first major support level at $4,108.47 before steadying.

For the Bitcoin bulls, it was the first visit to $4,200 levels since 24th February. For the current week, Bitcoin was up 8.68% Monday through Saturday.

Elsewhere

Across the top 10 cryptos, the majority of the majors were in the red on the day. EOS had the heaviest losses, down by 3.66%, with Litecoin and Bitcoin Cash ABC falling by 1.66% and 1.67% respectively.

While Ethereum and Stellar’s Lumen also saw red, it was a different story for Binance Coin, Cardano’s ADA and Ripple’s XRP. Leading the pack on the day was Binance, which rallied by 2.54%. Cardano’s ADA and Ripple’s XRP both rose by 0.93%.

In spite of the day’s rally, Binance was in the red for the current week. In contrast, Cardano’s ADA was the pacemaker, rallying by 17.4% to the end of Saturday. Coming in a close second was EOS, which was up by 14.68%, in spite of Saturday’s 3.66% reversal.

On the news wires,

News of Bithumb falling victim to another hack had limited influence on EOS. The reversal in EOS on Saturday was likely to be down to profit taking rather than investor reaction.

Fortunately for Bitcoin and the broader market, the $12.5m hack was relatively modest, and more importantly reported to be an inside job.

The good news is that the EOS coins stolen actually belonged to Bithumb and not investors. An inside job would have muted a broad-based market reaction. Bithumb was one of a number of Crypto exchanges that was given a clean bill of health by the Korea Internet & Security Agency.

Following a series of hacks in South Korea, the Cyber agency carried out a review of security measures implemented by exchanges last year. If the latest theft is an inside job, then there will be little for the SEC to consider as it prepares to deliver its decision on the Bitcoin ETF applications.

The bad news on the Bitcoin ETF decision was that the SEC has yet again delayed the deadline by an additional 45 days. This takes the decision every closer to the anticipated summer rollout of rules and regulations by the G20.

Hopes are for approval of one or possibly two of the ETFs in the coming months. The delay is certainly better than an outright no…

At the time of writing, Bitcoin was down 0.17% to $4,158.0. A bullish start to the day saw Bitcoin rise to a morning high $4,182.9 before easing back. The early moves saw Bitcoin leave the day’s major support and resistance levels untested.

For the day ahead

A move back through to $4,160 levels would support another run at $4,200 levels later in the day. Bitcoin would need support from the broader market, however, to take a run at the first major resistance level at $4,212.73. Barring a broad-based recovery from early losses, Bitcoin will likely struggle on a run at $4,200 on the day.

Failure to move back through to $4,160 levels could see Bitcoin fall deeper into the red. An extended reversal across the broader market would bring the first major support level at $4,114.73 into play.

Barring a crypto meltdown, however, we would expect sub-$4,100 support levels to be left untested on the day.

Bob Mason

in 10 minutes (Mar 31, 2019 5:25 AM GMT)

David