Bitcoin Mining Hardware Market Analysis 2019 – ASICrising GmbH, Bitmain Technologies Ltd.

Global Bitcoin Mining Hardware Market Trends, Size and Segment Forecasts, 2019-2026 published by Market Research Place includes data of the key industry players and their scope in the market. The report offers a comparison of key countries based on contribution to global as well as regional level with types, applications, manufacturers, opportunities, challenges. It delivers a balanced mix of main and subordinate research methodologies for its analysis. recent developments and latest contracts awarded in the market across different regions are demonstrated in the report.

Competitive Analysis:

The research analyses market size and forecast of Bitcoin Mining Hardware by product, region, and application. Market competition situation among the vendors and company profile is featured in the report. A section dedicated to company profiles covers business profiles, SWOT analysis, project feasibility analysis, product portfolio, cost structure, and project feasibility analysis of key manufacturers. The buyer of this report will be able to take accomplished decisions, plan new projects and business strategies evaluate drivers and restraints, know upcoming opportunities and difficulties, and offer you an industry forecast for 2019 to 2026.

The study focuses on industry chain analysis and all variables including upstream and downstream. These comprise equipment and raw materials, industry trends and proposals, raw materials, client surveys, and marketing channels. Furthermore, researchers have performed a top to bottom investigation of the market measure, different geographic locales, premium industry patterns, and real market portions.

Segment by product type, this report focuses on consumption, market share, and growth rate of the market in each product type and can be divided into: Type 1, Type 2, Type 3, Others

Segment by application, this report focuses on consumption, market share, and growth rate of the market in each application and can be divided into: Enterprise, Personal,

Key Takeaways From This Report:

Explore market potential through examining growth rates, price, and volume for products type, end use applications.

Understand the various dynamics influencing the Bitcoin Mining Hardware market –hidden opportunities, key driving factors, and challenges.

The market report estimates the sales and distribution channels across key geographies to boost top-line revenues.

Evaluate the supply-demand gaps, import-export figures and restrictive landscape for prime countries globally for the industry.

The Scope of The Report: This report focuses on the Bitcoin Mining Hardware in the global market, especially in North America, Europe, Asia Pacific, South America and Middle East & Africa

ACCESS FULL REPORT: https://www.marketresearchplace.com/report/global-bitcoin-mining-hardware-market-trends-size-and-128450.html

Market competition by top manufacturers/players includes key players such as Antminer, ASICrising GmbH, Bitmain Technologies Ltd., BIOSTAR Group, BitDragonfly, BitFury Group, DigBig, Ebang, Gridchip, BTCGARDEN, Butterfly Labs, Inc., Clam Ltd, CoinTerra, Inc., Black Arrow, Btc-Digger, Gridseed, HashFast Technologies, LLC, iCoinTech, Innosilicon, KnCMiner Sweden AB, Land Asic, LK Group, MegaBigPower, SFARDS, Spondoolies-Tech LTD, TMR,

The report can reduce risks involved in making decisions and strategies for companies and other individuals who want to enter the Bitcoin Mining Hardware market. Performance of contestant operating in the market with respect to market shares, strategies, monetary benchmarking, product benchmarking and additional is measured. Additionally, the report provides a fast outlook on the market covering aspects such as deals, partnerships, product launches of all key players for 2013 to 2018.

Barry Collins

March 20,

David

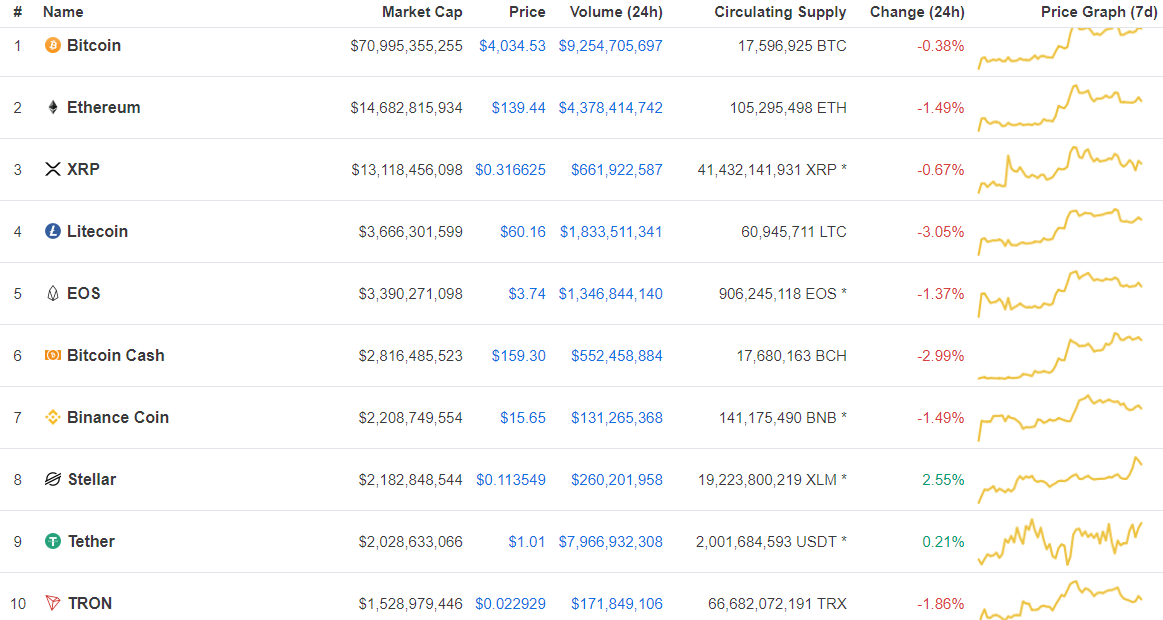

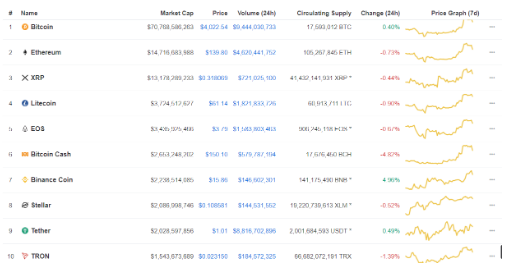

Bitcoin maintains above $4K, most top 100 in red, Kin sees 47% gain

Bitcoin maintains above $4K, most top 100 in red, Kin sees 47% gain

![BITCOIN Bitcoin [BTC] volume drop could be linked with end of VeriBlock](http://seriouswealth.net/wp/wp-content/uploads/2019/03/flying-143507_1280-e1552308659638.jpg)