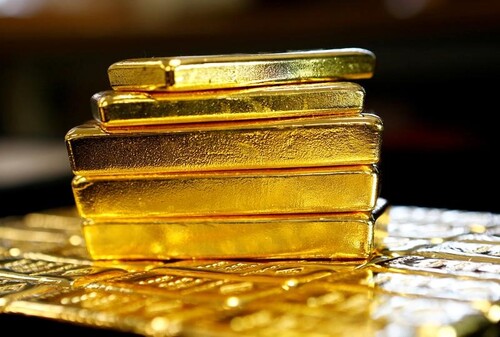

Gold steadies as coronavirus fears counters China economic data

* Coronavirus death toll crosses 900

* Dollar touches 4-month peak By Asha Sistla Feb 10 (Reuters) – Gold prices held steady on Monday, as rising concerns over the severity of the coronavirus outbreak and its impact on the global markets offset slight pressure from positive economic data from China and the United States.

Spot gold was little changed at $1,569.05 per ounce by 0313 GMT. U.S. gold futures were flat at $1,572.70. A team of international experts led by the World Health Organization left for Beijing to help investigate the epidemic that claimed more than 900 lives in mainland China, surpassing the death toll from the SARS epidemic. Asian shares fell on market fears over the fallout from the epidemic. "There's still a great deal of uncertainty around the (virus) impact and we're seeing rising deaths and infections. The economic impacts are still unclear. If that's the case, we'll continue seeing reasonable support for gold," said Michael McCarthy, chief market strategist at CMC Markets. However, he said that a rise in China's January producer and consumer prices "minutely hurt" gold. Also capping gold's gains, the dollar touched a four-month peak earlier in the session against a basket of rival currencies after robust U.S non-farm payrolls data on Friday. The U.S. Federal Reserve said the U.S. economy slowed last year on weak global growth, but the likelihood of recession has declined.

The central bank flagged as risks the fallout from the coronavirus, "elevated" asset values and near-record levels of low-grade corporate debt. "Investors should continue to favour more defensive fixed income and, therefore, long gold positions until the impact of nCoV on growth becomes apparent," Stephen Innes, chief market strategist at AxiCorp, said in a note. Holdings of the world's largest gold-backed exchange-traded fund SPDR Gold Trust rose 0.13% to 916.08 tonnes on Friday, its highest since Oct. 29. Palladium advanced 0.6% to $2,329.83 an ounce, silver edged higher by 0.2% to $17.70, and platinum rose 0.6% to $970.83.

(Reporting by Asha Sistla in Bengaluru; Editing by Arun Koyyur)

Sunday February 09, 2020 22:52

David

.gif)