Bitcoin Elliott Wave Analysis – Close to Ending 5 Waves

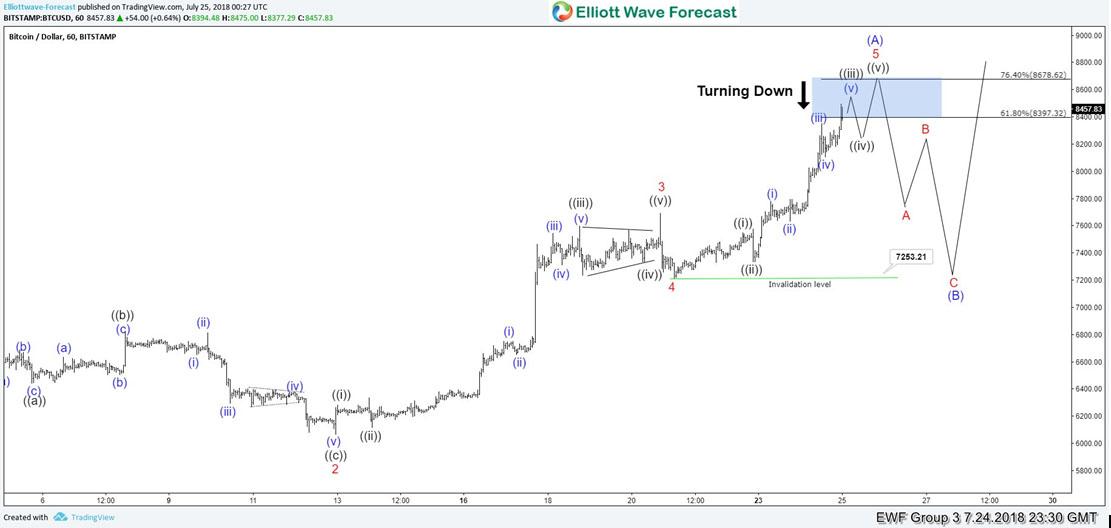

Bitcoin Ticker symbol: $BTCUSD short-term Elliott wave analysis suggests that the decline to $6072 low ended Minor wave 2 pullback. The internals of that pullback unfolded as Elliott wave Flatcorrection where Minute wave ((a)) ended in 3 swing at $6445.31 low. Minute wave ((b)) bounce ended in 3 swing at $6820 high and Minute wave ((c)) ended in 5 waves structure at $6072 low.

Above from there, the Bitcoin’s rally to $7696.88 high ended Minor wave 3. The internals of that rally higher unfolded as Elliott wave impulse structure where Minute wave ((i)) ended in 5 waves at $6337.25, Minute wave ((ii)) ended at $6121.01, Minute wave ((iii)) ended in 5 waves at $7599.98, Minute wave ((iv)) ended at $7338.91 and Minute wave ((v)) of 3 ended at $7696.88 high.Down from there, the pullback to 7253.21 low ended Minor wave 4.

The rally higher in Minor wave 5 is nesting higher as impulse structure looking to extend higher 1 more time approximately towards $8678.62 0.764% Fibonacci extension area of Minor 1+3 to end the Minor wave 5. The move higher should also complete cycle from 6/29 low in intermediate wave (A) of a possible Zigzag structure. Afterward, the instrument is expected to do a pullback in intermediate wave (B) in 3, 7 or 11 swings to correct cycle from 6/29 low before another extension higher in intermediate wave (C) is seen. We don’t like selling it.

David

![Bitcoin [BTC] below $5000 is a good buy, says El-ErianPriyamvada Singh](http://seriouswealth.net/wp/wp-content/uploads/2018/06/bitcoin-3137984_1280-e1530285287908.jpg)

![87.5% of all Bitcoins [BTC] will be mined by 2020 â Here's why it matters!](http://seriouswealth.net/wp/wp-content/uploads/2018/05/xiang-gao-403143-unsplash-e1527343243626.jpg)