Bitcoin (BTC) Price Watch- Hovering at Make-or-Break Levels

Bitcoin Price Key Highlights

-

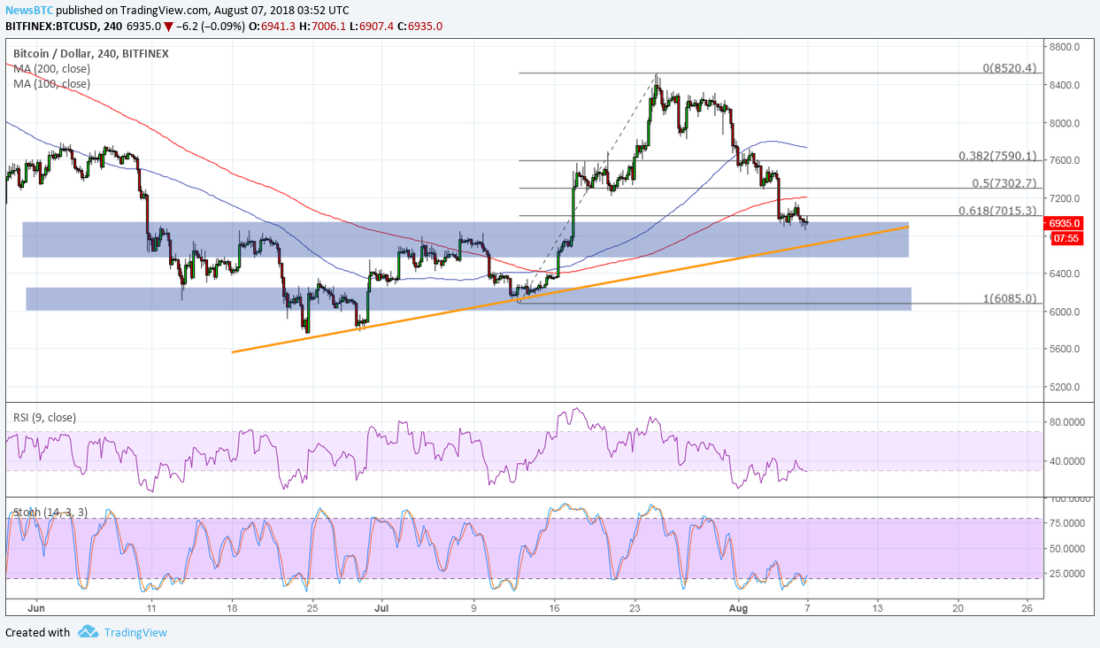

Bitcoin price is still in correction territory as it hangs around the area of interest around $6,800 to $7,000.

-

Several inflection points are in confluence on this area, and a bounce could allow the uptrend to resume.

-

However, a break below this key level could mean a continuation of the longer-term selloff.

Bitcoin price continues to test the area of interest where bulls are expected to join in and confirm that it has bottomed out.

Technical Indicators Signals

The 100 SMA is above the longer-term 200 SMA still, indicating that the path of least resistance is to the upside. In other words, there’s still a strong chance for the uptrend to resume. However, the gap appears ready to narrow, possibly indicating slower bullish momentum.

Price is also starting to break below the 61.8% Fibonacci retracement level and the $7,000 major psychological mark, which means that bullish energy at that area still isn’t strong enough to let the climb resume. The line in the sand might be the rising trend line connecting the lows since July as a break below this could expose bitcoin price to a drop to the floor at $5,800.

RSI is slowly making its way up after spending some time in the oversold region. This suggests that sellers are taking a break but buyers are also struggling to get back on their feet. Similarly stochastic is making another attempt to pull out of the oversold region to signal that buyers are taking over.

here have been reports confirming that Goldman Sachs is taking a stake on the cryptocurrency industry, reviving hopes of stronger institutional interest. Recall that updates like these have propped up bitcoin price in the past weeks, but it seems that traders aren’t reacting as much to the latest news.

Still, it’s worth noting that Bloomberg reported on how Goldman Sachs is considering a plan to offer custody for crypto funds, which would involve holding securities tied to these assets in order to reduce client risk and guard themselves from potential security attacks on exchanges.

SARAH JENN | AUGUST 7, 2018 | 4:16 AM

David