Bitcoin Price Prediction – Good Crypto Market Entry Time for Investors to Buy BTC with USD?

The cryptocurrency market started on week 21 of the year 2019 with a sharp correction in its prices, as many had expected, after high peaks of the year in all the protagonists of the ecosystem. At the time of writing a large red tide is dyed on the green sea that prevailed in the main crypts of the top 10 of the market.

The market has returned to levels of $ 240 billion and Bitcoin has lost control when it went down to 56.9%, after being at 60% a couple of days ago.

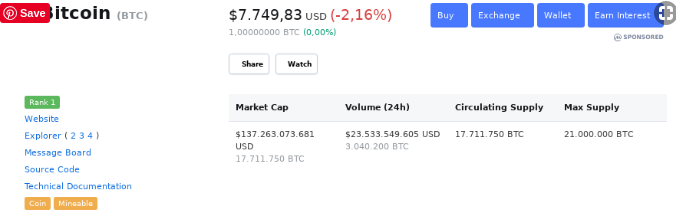

At the time of writing its spot price for trading in the BTC/USD pair it is $ 7,937.83 USD, with a contraction of -2.16% in the last 24 hours. Its volume has fallen from levels close to 23 trillion dollars, almost 50% less than what was moving a couple of days ago. Earlier today it was down around $7,749 after testing $8,250 over the weekend again.

A strong sale of assets in BitMex for almost $200 million and the possible delay in the decision of VanEck ETFs, have led to a retreat of nervous investors, while the big ‘whales' wait in the rear with massive orders of the purchase at lower prices of the cryptocurrency.

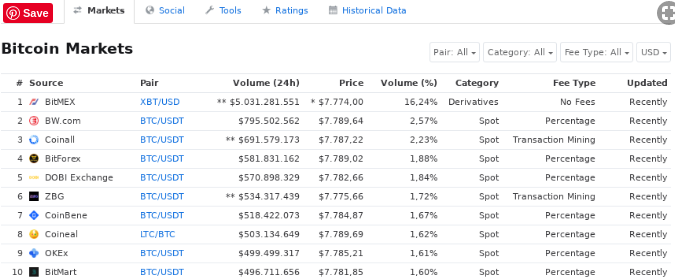

BitMex's XBT / USDT pair continues to dominate the scene with 16.24% contribution to the cryptocurrency market with its BTC derivative products and is the main indicator of the price, well above BW.com and Coinall, which follow it very closely away with 2.57% and 2.23% respectively.

In the short term, BTC price presents an interesting scenario for this current week. His upward trajectory projects us a sharp change in his current level to close levels @ $7100 to then resurface in a bullish race back to the @ $8000.

In short, we would be talking about a winning position for those who manage to enter on time, up to 15% profit.

The support is maintained in the moving average of prices for 100 days, which if broken could ensure compliance with the respective wave.

MACD has made a bearish cross, with red bars in the negative direction gaining position, indicating the path that BTC will follow in the coming days.

The Momentum indicator, on the other hand, has entered the descent zone but maintains a soft, almost horizontal slope that indicates that the fall of a prolonged bear market is not yet feasible in the cryptocurrency.

In the medium term, the cryptocurrency is totally bullish. His parable projected even though it was broken this weekend, it seems that we are in the presence of a new similar and bullish projection. The price levels are projected between support below the 7k line and a maximum resistance close to 10k. A difference of almost 30 percent is enough for a crypto asset for everything it represents.

The 30-day EMA indicator is medium-term support, which is still far from being beaten.

RSI for its part has not left the purchase zone and maintains a bullish position in the area to the rear to return to overbought levels when the bulls take control of the market again.

Aroon Uptrend has begun to descend but without force, and its counterpart still shows no signs of recovery, so the bullish moment still lasts in the medium term for the main cryptocurrency.

In general BTC and the crypto market are giving signals to those who did not have a clear picture of when to take positions in the main crypto markets. Decisions such as the ETF underway to be approved or rejected by VanEck, which expires this Tuesday, May 21, may mean the start of a bullish or bearish rally for BTC in the coming weeks.

By Daniel Jimenez – May 21, 2019

David