Bitcoin breakout coming? The cryptocurrency is already up 220% this year

-

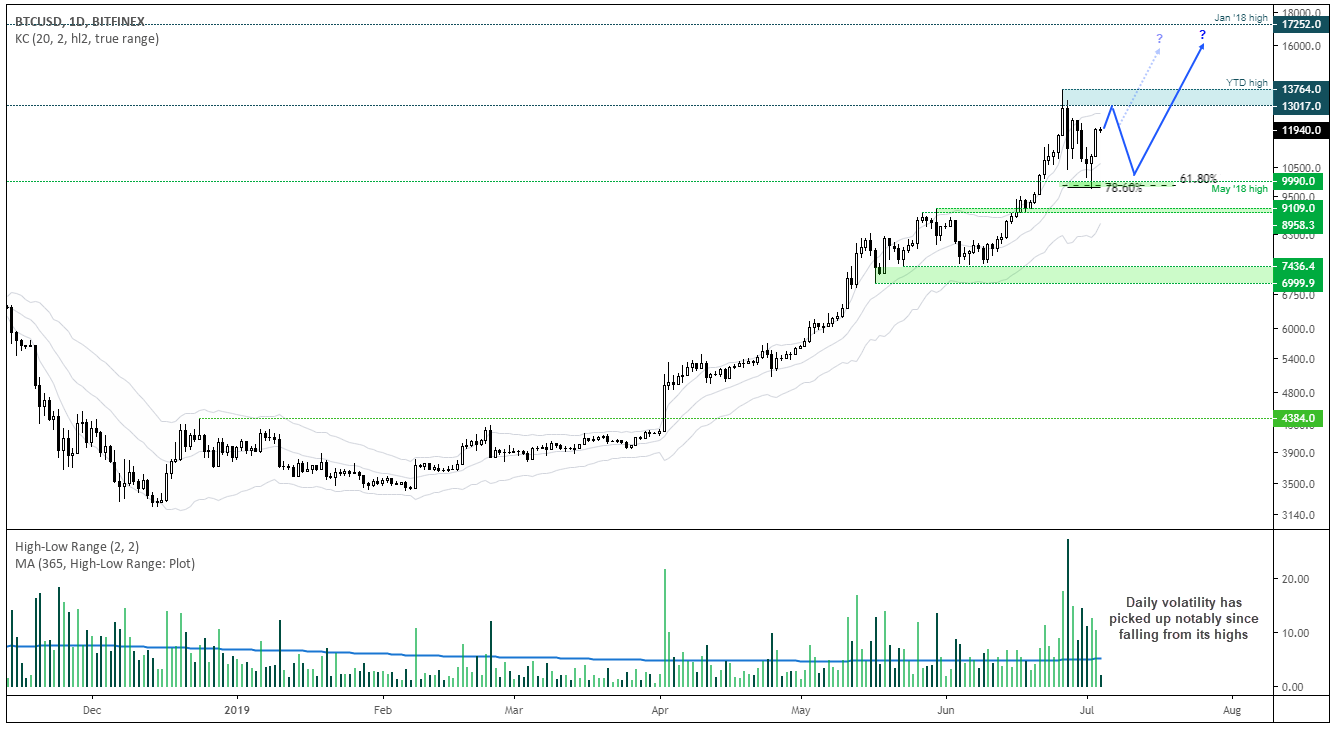

Bitcoin’s followed a similar trend since mid-February and has breached yearly highs at least once every month

-

Bitcoin broke above its upper band limit for the first time this year in early February

Bitcoin bulls looking for a catalyst that could extend its colossal rally may want to turn to technical analysis favored by some traders for a dose of good news.

Following an increase in prices over the last two days, Bitcoin has surged above its upper Vera band limit, which identifies upward or downward trends. The move indicates a sharp rise could be on the horizon as the token continues to trade above that limit.

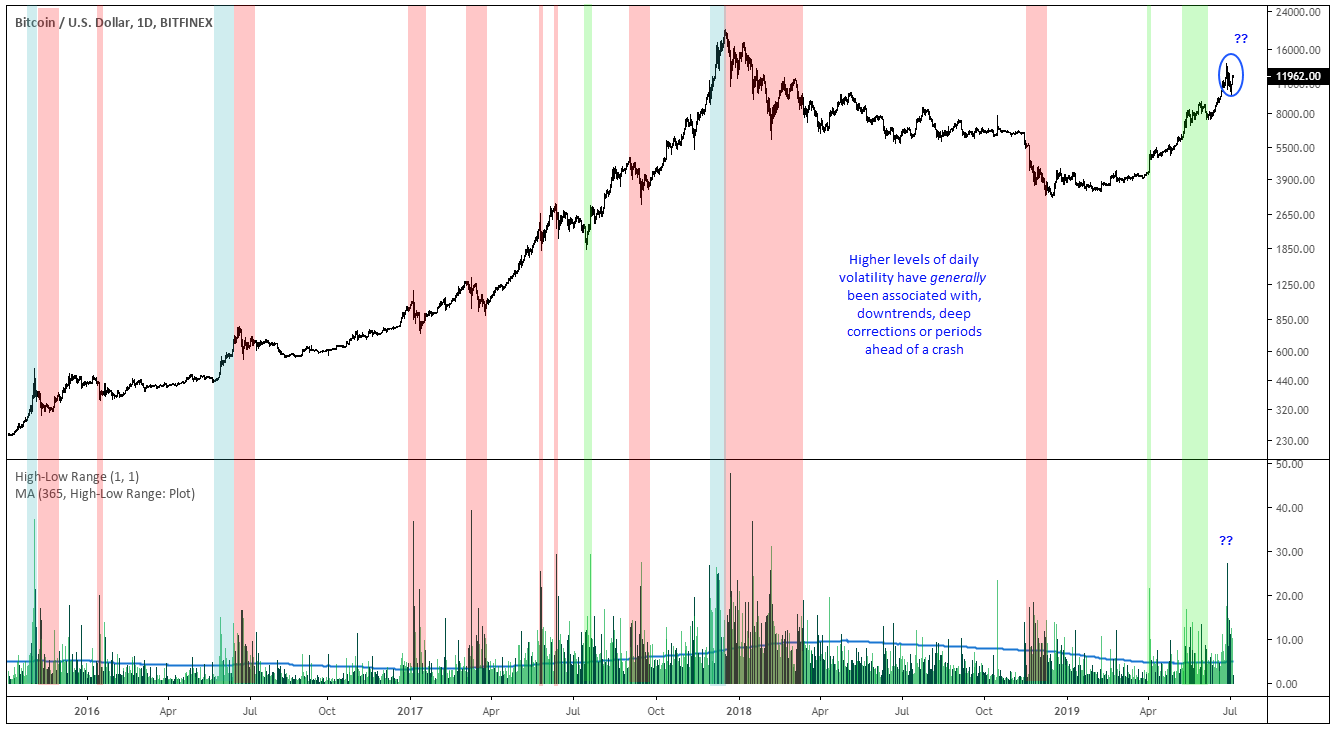

Bitcoin’s followed a similar trend since mid-February and has breached yearly highs at least once every month since then. The cryptocurrency broke above its upper band limit for the first time this year in early February, for instance, and reached a fresh yearly high shortly afterward. It happened again in mid-June, and Bitcoin hit its 2019 high of $13,851 just three days later. Overall, Bitcoin is up more than 220% this year.

“Bitcoin looks like it could be coiling for a big breakout as institutional interest for blockchain technology shows no signs of slowing down," said Edward Moya, chief market strategist at Oanda Corp. in New York. “The bubble-like gains this time are driven on solid institutional interest and while security is still a big risk, it appears Bitcoin has overcome many of its initial growing pains."

It’s a drastic turnaround from where it was just six months ago, when prices languished around $3,500 and many left the space for dead following its spectacular 2018 crash. But excitement over wider mainstream acceptance, among other things, has heightened the buzz around cryptocurrencies — and prices have skyrocketed since then.

“The revival has been a natural reaction to changing crypto-friendly atmosphere in mainstream finance and pro-market forces," said Christel Quek, chief commercial officer at Bolt Global, a mobile streaming platform and wallet, adding that the entry of companies including Facebook Inc. and JPMorgan Chase & Co. into the cryptosphere has contributed to that wider acceptance. “The support from mainstream entities will propel digital tokens forward."

Bitcoin rose 7.9% to $11,899 as of 11:53 a.m. in New York on Monday. Rival coins also gained, with Ethereum up nearly 8% and Monero rising more than 13%.

Source Livemint

David