Gold price has room to move lower after market rocked by Friday’s employment data – analysts

The gold market is seeing some stability at the start of the new trading week as prices try to recover from Friday's roughly 3% selloff.

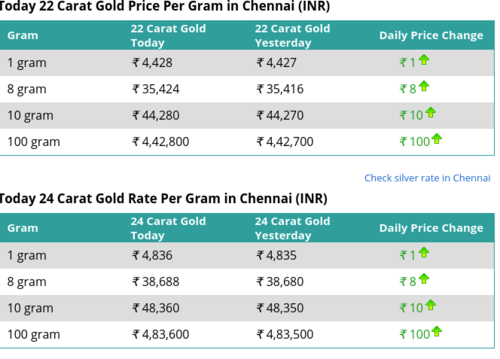

August gold futures last traded at $1,689.50 an ounce, up 0.39% on the day.

The precious metal took a significant hit Friday. It saw a substantial break below critical support at $1,700 an ounce after employment data showed that the U.S. economy created 2.5 million jobs in May. The data were a massive surprise as economists were expecting to see job losses of 7.5 million.

Although some investors see Friday's drop as a buying opportunity, analysts are warning that prices could continue to fall as equity markets and bond yields continue to move higher.

Given Friday's selloff, many analysts are expecting gold prices to test the next major support area between $1,645 and $1,650 an ounce.

"Our base case is that the yellow metal is in a $50 range on both sides of $1700. It frayed the upper end in mid-May, but it has now fallen for three consecutive weeks and finished last week at six-week lows. There is little to hang one's hat on until the $1650 area," said Marc Chandler, chief market strategist at Bannockburn Global Forex in a note Sunday.

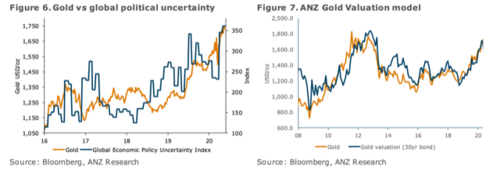

Chandler added that momentum indicators continue to point to lower prices in gold in the near-term. He also said that gold's correlation to equities has turned negative as risks-off sentiment flows through financial markets.

In a report published Saturday, Nick Cawley, strategist at DailyFX.com, said that he is also watching $1,645 level for gold. He added that bond yields and resilient strength in the U.S. dollar could dull the precious metal's luster.

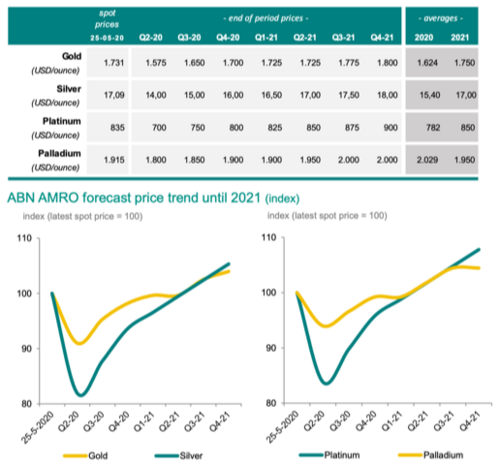

"Gold has been a major beneficiary of a weak dollar and low U.S. interest rates over the last three weeks and this looks likely to change in the short-term. The yield on the 10-year U.S. benchmark is nearing 1%, up from 0.65% a week ago, dulling the appeal of the precious metal, while the U.S. dollar basket may have found a temporary base around 96.50 after having fallen by four big figures since mid-May," he said.

However, Cawley added that there is enough market uncertainty to support gold's long-term uptrend.

"Relations between the U.S. and China continue to sour and look set to get worse… while the economic impact of the COVID-19 virus will be felt for years to come. These market negatives are not expected to disappear any time soon and will underpin gold in the weeks and months ahead," he said.

Martin Murenbeeld, president of Murenbeeld & Co., is also looking past gold's selloff Friday. Despite the significantly better-than-expected employment report, he said that nothing has radically changed for the economy.

"No central bank will reduce its stimulus on account of these first signs of economic bottoming," he said. "Second, no government is even remotely thinking of pulling back on its fiscal stimulus, regardless of how good the economic data might be in the coming months," he said. "In short, the good news for gold is that monetary and fiscal stimulus will carry on regardless of the state of the economy for the rest of this year and next. This then sets up the possibility that inflation will finally pick up one or two years hence."

By Neils Christensen

For Kitco News

David