Silver – not a secondary metal

Since the middle of March 2020, the iShares Silver Trust (NYSEARCA: SLV) has already seen rallies of more than 57%.

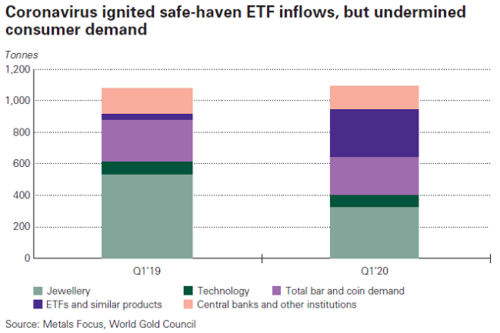

It is now clear that these incredible moves have come as a decisive response to the market’s assessments of the global economic outlook post-coronavirus era.

Ultimately, the recent rallies in SLV suggest precious metals assets still hold the top position as the most important safe-haven instruments.

One of the many misconceptions about the proper way to trade in silver markets lies in the fact that so many investors view silver assets as nothing more than a secondary precious metal. However, recent trend movements in the iShares Silver Trust (NYSEARCA:SLV) suggest that these long-term views might be ready for a revision.

In recent weeks, market uncertainties revolving around the destructive coronavirus pandemic have inspired incredible rallies in this space, as SLV has posted gains of more than 57% since March 18th, 2020. As we will see, several key events occurred on this day and all of this new bullish activity lends credence to SLV as a true value play that is also capable of posting sustained gains as long as macroeconomic disruptions continue to devastate global markets.

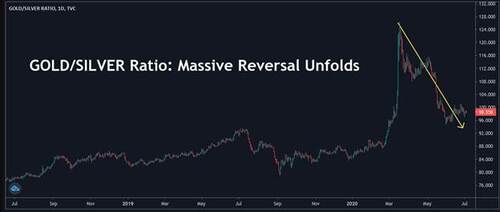

Trends in the gold/silver ratio have recorded massive reversals after reaching record highs on March 18th, 2020. This reversal occurred as the market’s underlying silver prices fell to $11.94 and one troy ounce of gold was worth nearly 127 troy ounces of silver. The gold/silver ratio has already fallen back into the 90s, so it is now clear that trend momentum favors a bullish outlook for SLV in comparison to the SPDR Gold Trust (NYSEARCA:GLD). Of course, we maintain a bullish viewpoint on both instruments but the potential for upside in the iShares Silver Trust remains clear given the underlying reversals we have recently seen in the ratios that guide GLD and SLV valuations.

Source: Author via TradingviewMarket performances during the second-quarter period seem to be validating these assertions and this adds even greater potential for SLV to outperform versus most of the fund-based trading instruments currently found in the commodities space. Macroeconomic correlations are significant here because they give traders an indication of which asset classes are likely to benefit from continued volatility in broader markets.

Fund flow activities largely support these assertions, as the iShares Silver Trust has benefitted from net inflows of $2.8 billion over the last one-year period. Here, it is important for investors to note the periods of strongly bullish activity (which are relatively widespread). The most significant bearish periods occur near the end of 2019 but this is a time frame that was characterized by rallies in stocks and a generalized sense of complacency throughout the financial markets. Of course, things quickly changed as we entered the year 2020 and this is when the iShares Silver Trust was able to resume with its prior bullish trends. This activity makes it more difficult for bearish investors to dismiss silver assets as an industrial metal that is incapable of posting rallies whence above-average levels of volatility become visible in stock markets.

.jpg)

Whenever investors are making an attempt to understand prevalent misconceptions in the financial markets, it is critical to analyze multiple asset classes and determine whether traditional correlations remain valid. In this case, it is quickly becoming obvious that SLV has an excellent opportunity to become something more than simply a “secondary” asset that always fails to receive as much attention as GLD. In reality, recent price rallies in the iShares Silver Trust have made it clear that long-term trends have reached extreme levels and are ready to reverse.

With recent trend reversals in the gold/silver ratio gaining in momentum, we could see SLV bulls in a strong position to outperform relative to many of their commodities counterparts. Since the middle of March 2020, the iShares Silver Trust has already experienced rallies that would have been thought of as impossible just a short time ago and we recommend that precious metals investors learn how to trade CFDs in silver markets. Bullish investors have been decisive in response to updated assessments of the global economic outlook for the post-coronavirus era and recent rallies in SLV show that all precious metals assets still hold a commanding position as the market’s most important safe-haven instruments.

By Richard Cox

Contributing to kitco.com

David

.png)

.png)