Central bank gold demand has slowed but hasn’t disappeared – WGC

Central bank gold demand has been slowly declining through 2020, with July net purchases falling to their lowest level since December 2018. However, the World Gold Council said this sector remains an essential pillar of support for the gold market.

WGC said that foreign exchange reserve data from the International Monetary Fund shows that central banks collectively bought 8.2 tonnes of gold in July. So far, in 2020, central banks have bought just over 200 tonnes of gold.

In a recent interview with Kitco News, Shaokai Fan, head of central bank relations at the World Gold Council, said that although central bank demand has slowed through the summer, he doesn't expect that this sector will be net sellers anytime soon.

"The fundamental reasons central banks have been buying gold for the last ten years have not really gone away at all," he said.

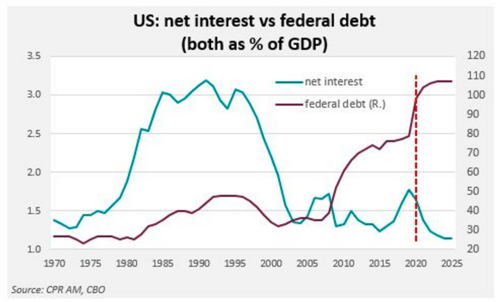

"You have to remember that central banks are still looking to diversify their reserve assets away from the U.S. dollar, especially emerging market central banks, whose portfolios are dominated by the U.S. dollar," he added. "Another thing, it hasn't changed, are the lower negative interest rates that a lot of central banks are facing on their sovereign bond portfolios."

While central banks may not be buying as much gold as they did in the past two years, data from the World Gold Council shows that they have a tighter grip on their gold. In a report published at the start of the month, the WGC noted that the gold lease rate, the rate central banks lease their gold out at has consistently been declining.

The report noted that the lease rate between 2010 and 2019 averaged 0.24%, down from an average of 0.54% seen in the previous ten years. From 1989 and 1999, the least rate averaged 1.4%.

Fan said that it's not surprising that central banks would want to hold on to their gold in an era of rising uncertainty.

"I'm sure that many central banks who hold gold would love to earn more yield on their gold, but ultimately yield a return is not really the main driver for why they hold gold," he said. "They really focus on safety and liquidity. They have gold for when it might be needed for some unforeseen event in the future."

By David Lin

For Kitco News

David

.gif)

.gif)