Gold traders are buying the rumor, will they sell the fact?

During this election year there has been a multitude of events which have created a climate of uncertainty. In the short-term market participants are awaiting tomorrow’s data when the U.S. Labor Department releases the jobs report for the month of August. Economists are currently forecasting that the nonfarm payroll numbers will indicate an increase of 875,000 new jobs being created last month. They are also forecasting that the unemployment rate will move from 8.4% down to 8.2%.

For the most part this forecast has been factored into current pricing in the financial markets. If the actual data indicates that the forecasts are accurate, we would expect to see very little response in either the precious metals or U.S. equities. However, if the actual numbers are well off the projections we could see sizable moves in both the risk-on and safe haven asset classes.

There are two key interim-term issues which market participants will focus upon. First is whether or not Secretary of the United States Treasury, Steven Mnuchin will be able to reach an agreement with Nancy Pelosi and the Congress in regards to another extremely needed stimulus package to help revitalize the contracting economy in the United States. There is no doubt that tomorrow’s jobs report will be an important factor in the outcome of the current negotiations.

Possibly the most important Interim-term concern on the minds of market participants is the upcoming presidential election. Traders, investors, and market participants are waiting the results as to who will win the presidential election which will be held next month. Depending on the outcome of the election, it is most assuredly going to affect market sentiment, and market participants may need to adjust, or rebalance their overall portfolio.

Then there is the long-term concern; the contracting global economy, which is a direct result of the pandemic which came to a head in March of this year. This pandemic continues to wreak havoc having a detrimental impact on the physical health and financial health of citizens worldwide.

While I cannot predict the outcome of these key and critical events, I am reminded of that classic adage; by the rumor, sell the fact.

Gold and Silver futures along with spot pricing benefited with a strong upside move as market sentiment is once again focused upon the safe haven asset class, and at least for today it was all about gold and silver rather than dollar strength.

As of 4:30 PM EST the most active December 2020 gold contract gained $16.20 and is currently fixed at $1,911.70. Physical gold gained $20.27 and is currently fixed at $1,905.70 per ounce.

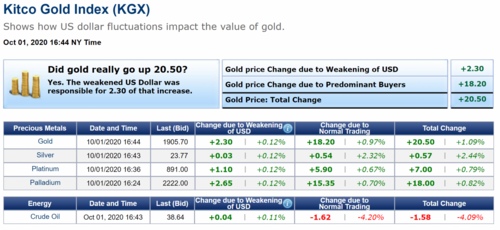

According to the KGX (Kitco gold index) spot gold gained $20.50. U.S. dollar weakness was only a minor component of today’s price change accounting for only $2.30 of the gain. The remaining gain of $18.20 is directly attributable to bullish market sentiment leading to buying in the market.

Our technical studies indicate that there is resistance at $1,920, the former record high that was achieved in the middle of 2011. With major resistance occurring at that key psychological level; $2000 per ounce. In the opinion of this author it is not if, but when, gold prices can effectively trade above that price point and change the major resistance level to a new level of support.

By Gary Wagner

David