Gold price tumbles 2% as Trump calls off stimulus talks with Democrats

Gold plunged along with stocks after U.S. President Donald Trump called off stimulus negotiations with the Democrats “until after the election.”

The yellow metal once again fell below its key $1,900 an ounce level that it was trying to breach on a sustainable basis this week. At the time of writing, December Comex gold futures were trading at $1,881.50, down 2.01% on the day.

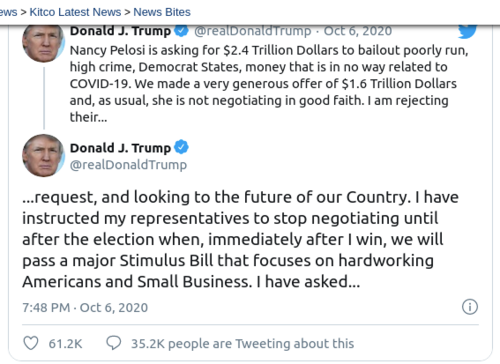

“I have instructed my representatives to stop negotiating until after the election when, immediately after I win, we will pass a major Stimulus Bill that focuses on hardworking Americans and Small Business,” Trump said on Twitter.

After the announcement, stocks took a big hit while the U.S. dollar climbed. The Dow was down more than 220 points, and S&P 500 was down more than 28 points at the time of writing. The U.S. dollar index, on the other hand, climbed from daily lows of around 93.35 to 93.67.

In this scenario, it is not a surprise the gold fell as the precious metal has been trading in tandem with stocks lately, TD Securities head of global strategy Bart Melek told Kitco News on Tuesday.

“Gold for the last little while has been trading like a risk asset, and that has been true today,” Melek said. “The dollar also heard what Trump said, and we saw a large jump in the U.S. dollar, which is a big offset for gold.”

What this market reaction tells investors is that there is an expectation of disinflationary pressures down the road, Melek pointed out.

“If we don’t see the government add to fiscal expenditures, that means you will have folks who will start running out of money. This might get chronic — they will spend less, and Q4 GDP will be nasty,” noted Melek. “That is the opposite of what Powell suggested. We need more, and we are getting less.”

Trump’s announcement comes after Federal Reserve Chair Jerome Powell warned that the economic recovery remains incomplete and could trigger “recessionary dynamics” if the spread of the coronavirus is not controlled and economic growth is not sustained.

Powell made his remarks during a speech to the National Association for Business Economics on Tuesday morning.

Powell also highlighted that there is more risk in “doing too little” than “overdoing” it.

“Too little support would lead to a weak recovery, creating unnecessary hardship for households and businesses,” Powell said. “The risks of overdoing it seems, for now, to be smaller. Even if policy actions ultimately prove to be greater than needed, they will not go to waste. The recovery will be stronger and move faster.”

In the short-term, no additional stimulus until after the election is not a great story for gold, added Melek. “Real rates going higher here and the dollar strengthening and volatility moving higher as well,” he said.

However, after the election, the environment once again becomes favorable to gold no matter who wins, Melek explained.

“After the election, we will get massive amounts of fiscal stimulus no matter who wins. We will not get much tax increases from the Democrats. And the Republicans are on record that they want to cut taxes. From both sides, we will get massive deficits, central bank accommodation and gold will ultimately do well as we try to get into positive inflation territory,” he said.

.gif)

By Anna Golubova

For Kitco News

David