Miners are taking advantage of higher gold price, more projects kicking off in Q4 – Metso Outotec

Mining companies are taking advantage of higher gold prices this year, especially when it comes to silver and gold projects, according to Metso Outotec.

More new projects are starting to take off in Q4, Metso Outotec's President of North and Central America Giuseppe Campanelli and VP of metals sales for North and Central America Tim Robinson told Kitco News.

"Our customers, especially on the gold and silver side, are looking to ramp up as fast as they can. They want to take advantage of the fact that gold prices are high. Maybe smaller projects are faster to execute and get into operation. That seems to be a little bit of a trend," Campanelli said.

Throughout the COVID-19 crisis, miners have managed to maintain production level while following through on new social distancing measures.

"Our customers are doing a fantastic job of managing COVID as best they can, maintaining production levels, trying to ensure that their operations are ongoing by social distancing, and securing their supply chain," Campanelli said. "They're turning profit and I think we have a very strong role to play to help them."

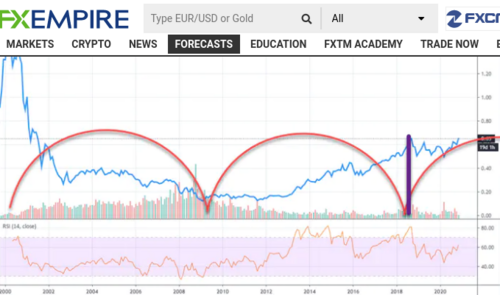

The coronavirus crisis has created a lot of uncertainty globally, Campanelli stated, adding that precious metals prices have benefited greatly from that uncertainty.

"Gold is a hedge against uncertainty. So gold prices skyrocketed, silver prices as well. The precious metals are benefiting from that quite heavily," he said. "But we're also seeing lofty commodity prices for base metals. Copper prices are fairly strong as well as iron ore. This is great for our customers and we have been supporting them as they ramp up production to take advantage of the spike. There are many interesting projects on the go at the moment."

Initially, COVID has triggered a delay in financing but the actual work has never stopped, Robinson highlighted.

"COVID did affect some of the gold projects with regards to financing, where the banks couldn't visit the sites however, this did not stop the preparation work for these projects," he said. "It did delay projects being executed this year but we are seeing some movement in Q4 and that's all really positive and bodes well for 2021.

Social distancing and remote monitoring

Social distancing was one new major change that needed to be introduced at mine sites this year, which has successfully been implemented, Campanelli said.

"Our customers are limiting heavily who can go to site. They're trying to social distance and run their operations," he noted. "That changed significantly how we interact with our customer. We've moved through virtual communication. There's only so much you can do virtually. They still have a need for our services and people are going there to help them, but it's limited and on the need-to-go basis."

Digital solutions and remote monitoring have become very popular this year, helping the mining industry deal with the current coronavirus situation, Campanelli pointed out.

"We've been further developing our virtual communication channels to perform remote inspections and support them remotely. We have remote monitoring centers that we call Performance Centers, in Santiago, Chile and Changsha, China," he said.

This was already a trend already pre-COVID, Campanelli added. "It's becoming increasingly difficult for our customers to operate their sites. As ore grades decline, mines are more remote and are deeper in the ground … Our equipment is digitalized meaning, we can extract information on equipment and process performance."

The data received is then used to project what's going to happen next and advise what adjustments could be made.

Outlook on mining

The outlook for the mining industry remains positive going forward, especially when it comes to gold and precious metals throughout North and Central America, Robinson added.

"We're quite busy with the initial phases of projects, in particular, gold projects. In terms of that, they haven't stopped, they're preparing for execution. That's really positive," he described.

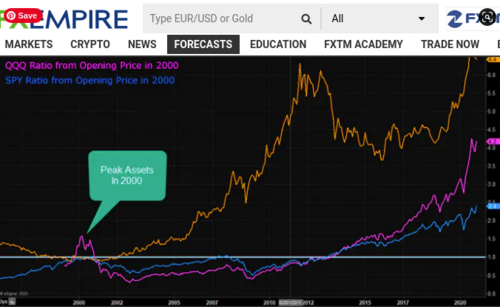

On the base-metal side of things, there were more delays this year because base metals projects have larger scale and larger capital because of the tonnage that goes through the plant, Robinson pointed out.

"It's a little bit different on the base metals side," he said. "The capital that's required for some of the larger base metals projects is more significant than gold. The difference between this year and the years before is that we've seen good prices on gold and good prices on copper and everybody's excited about that, but it's delayed decision-making."

Going forward, gold does not need to maintain its new highs in order for most of the projects to make money, Robinson said. "Gold projects haven't been based on $1,900 per ounce gold. They've been justified on earlier prices. We are confident on these projects being executed net year," he noted.

There is also a lot of innovation happening in the mining space. Robinson highlighted energy comminution technology, tailings management, EV battery material processing technology, sustainable metals recycling and BIOX technologies.

"BIOX technologies, for example, is biological leaching of refractory oars. It's been around for some time, but not necessarily in this region. We've got operations using this technology in Africa, in Australia, and in central Asia. But there's a lot of interest in the technology in North America," Robinson said.

Merger news

According to its website: "Metso Outotec is a frontrunner in sustainable technologies, end-to-end solutions and services for the minerals processing, aggregates, metals refining and recycling industries globally."

This summer, Metso and Outotec completed their merger, which has created "a truly end-to-end portfolio of solutions covering a more significant part of the customer's flow sheet," said Campanelli.

The merger has also allowed Metso Outotec to take on more complex challenges and more risks.

"Now, we have the ability to deliver a much larger scope. We can be more responsible for what's being fed into the equipment and how it's processed later on," Campanelli described. "From the services side … we take on more of the responsibility and really help our customers optimize their plants, optimize their downtime, and the reliability of their equipment."

By Anna Golubova

For Kitco News

Kinesis Money

David