Bitcoin is challenging gold – Gold price outlook is 'no longer overwhelmingly bullish,' says UOB

Why has the gold price rally stalled, and is bitcoin to blame? Singapore's United Overseas Bank (UOB) says the massive surge in crypto's popularity could be partly responsible, but it is far from being the sole cause.

One of the reasons why November was such a difficult month for gold was a clear loss of interest in the precious metal, especially when it came to ETFs, which saw a hefty reverse in inflows.

"Heavy redemptions have replaced the strong inflows, cumulating in the heavy outflow of about 4 million ounces of gold from the ETF tonnage across November. This drying up of gold ETF demand was seen as a key reason for gold price weakness across November," UOB head of markets strategy, Heng Koon How, and markets strategist, Quek Ser Leang, wrote on a report on Monday.

Gold ETFs witnessed an impressive rise in demand this year, which seems to have peaked in October, the strategists said.

"The COVID-19 pandemic … boosted the safe-haven demand for gold … From just a minuscule 4% of total demand in 4Q19, gold ETF demand jumped to as high as 55% of total demand by 2Q20," they said. "Unfortunately, total gold ETF tonnage appears to have topped out just above 110 million ounces by late October this year."

A possible explanation behind this drop in ETF demand could be bitcoin's record-high rally, which intensified last month with the cryptocurrency hitting a new record high of $19,850 on November 30.

"There is an increasing challenge from bitcoin as the 'new digital gold'," the strategists pointed out. "From its low of around the USD 10,000 level in early Sep, Bitcoin double in value to just under USD 20,000 by late Nov."

Wider acceptance and a surge in demand from investment managers have been driving the recent rally in the cryptocurrency.

"As Bitcoin rallied from strength to strength, various commentators have started to declare that Bitcoin is the "new digital gold" and suggested that investors switch their investments from gold to Bitcoin. We do not know for sure the precise amount of this allocation switch into Bitcoin, but this may well be one possible explanation for the contraction in gold's ETF tonnage in recent weeks," the strategists explained.

On top of the bitcoin distraction, central banks have put their gold buying on pause in the last few months, which UOB describes as a "disturbing development" that could be impacting the overall sentiment.

"From a net purchase of 120 and 111 tons each across 1Q20 and 2Q20 respectively, global central banks net purchase of gold flipped into an unexpected net sale of 12 tons in 3Q20," the report said. "This may well be due to the higher gold price over the past few years. In addition, with the broad USD weakness, central banks, particularly from EM and Asia, may well revert to more USD allocation in order to limit the extent of appreciation of their respective domestic currencies."

Longer-term, however, UOB projects to see a resumption in buying as central banks need to periodically allocate some reserves into gold for diversification.

In light of all of this, UOB has lowered its 2021 price outlook for gold to just $2,000 by the end of next year. Earlier, the bank projected to see $2,200 gold by the second quarter of 2021.

“Our updated gold forecasts are now USD 1,850 / oz for 1Q21, USD 1,900 / oz for 2Q21, USD 1,950 / oz for 3Q21 and USD 2,000 / oz for 4Q21,” the bank said.

However, UOB still describes its outlook as a positive one in the medium term but does admit that it is "no longer overwhelmingly bullish."

The macro drivers are still supportive of higher gold prices, which include loose monetary policies around the world.

"The U.S. Federal Reserve and other leading global central banks continue their ultra-easy monetary policy, aggressive quantitative easing, and unprecedented expansion of their balance sheets. This is a very important positive medium-term driver for gold and it will not go away anytime soon," the strategists reminded their clients.

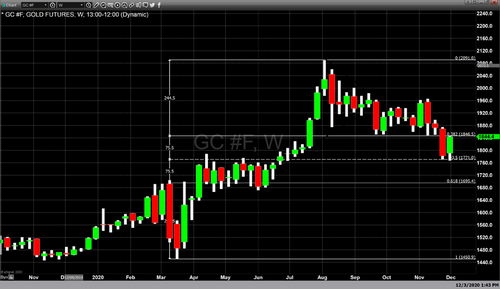

From a technical perspective, a steeper drop to $1,670 support seems to be ruled out for now as gold prices managed to rebound back $1,860 an ounce on Monday. But, it is still uncertain whether or not gold can hold here. At the time of writing, February Comex gold futures were trading at $1,866, up 1.41% on the day.

"Odds for a deeper decline towards the long-term support at $1,670 have diminished, but it is too soon to expect a major reversal," the report noted. "On a shorter-term note, $1,720 can be viewed as a strong support level. Overall, while we maintain our positive medium-term outlook for gold, we need to take note of near term challenges as well as the weaker technical outlook."

On the way to $2,000, gold will encounter several key resistance levels, including $1,899, $1,930, and $1,965, the strategists added.

By Anna Golubova

For Kitco News

Kinesis Money

David