Strong Bullish sentiment in gold as Powell talks down inflation threat

The rising inflation threat is creating some significant bullish sentiment in the gold market, even as Federal Reserve Chair Jerome Powell tries to talk down those growing concerns

Early Friday, gold prices rose to a six-week high, pushing above $1,800 an ounce; however, most of those gains proved to be short-lived after Powell reiterated his stance that the U.S. central bank is on track to start reducing its monthly bond purchase. He added that he expects the tapering to be completed by mid-2022.

He noted that although there is a growing risk that supply-chain issues could keep inflation pressures elevated through 2022; however, he added that his base case is for the supply bottlenecks to be resolved and for inflation to push back to 2%.

Before Powell's comments, analysts were significantly bullish on gold with many looking for prices to test major resistance at $1,830 an ounce.

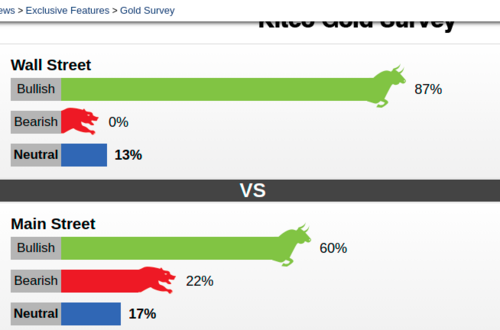

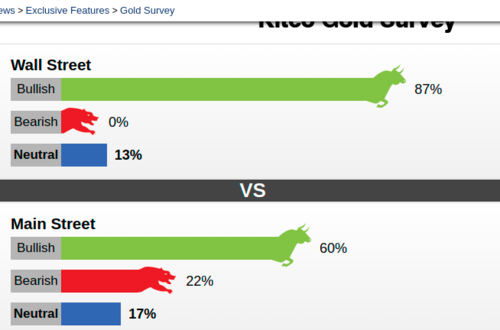

This week 15 Wall Street analysts participated in Kitco News' gold survey. Among the participants, 13 or 87%, called for gold prices to rise. At the same time, two analysts, or 13%, were neutral on gold in the near term. No analysts were bearish on gold.

Meanwhile, A total of 598 votes were cast in online Main Street polls. Of these, 360 respondents, or 60%, looked for gold to rise next week. Another 134, or 22%, said lower, while 104 voters, or 17%, were neutral.

Although the precious metal is down from its session highs, it is still on track to end its second week with gains. December gold futures last traded at $1,797.30 an ounce, up 1.63% from last week.

Although some analysts are bullish on gold, they don't see the market attracting major capital until resistance at $1,835 is broken.

"With gold's push back above $1,800 you have to be bullish on gold," said Ole Hansen. "But I also reserve the right to be disappointed given gold's lackluster performance so far this year."

Hansen added that a break above $1,835 could create enough momentum in the market to push prices back to $2,000 an ounce.

David Madden, market analyst at Equiti Capital, said that Friday's initial rally in gold pushed prices above a critical downtrend from last year's record highs. He said that he sees gold pushing back to $1,830 but doesn't expect that level to break.

He noted that the U.S. dollar. Which has been in a strong uptrend since May has been a significant headwind for gold. He added that he doesn't expect that trend to change anytime soon.

"The Federal Reserve is keen to tighten interest rates and that will support the U.S. dollar," he said.

Colin Cieszynski, chief market strategist at SIA Wealth Management said that he is bullish on gold as inflation rises.

"We may see central bankers start to walk back their previous "transitory inflation" statements and start to reduce stimulus. Although winding down the paper printing party is a positive for paper money, that could take several months, so I think gold can still benefit in the short term," he said.

Darin Newsom, president of Darin Newsom Analytics, said that he could see higher gold prices next week; however, he added that a lot depends on the U.S. dollar and if support at 93.50 in the U.S. dollar index will hold.

"The US dollar index looks to be approaching a possible short-term bullish turn as it tests support at this week's low of 93.50. If this holds and the dollar rallies, gold could put an early top in next week," he said.

By Neils Christensen

For Kitco News

Buy, Sell Gold and Silver, with Free Storage and Monthly Yields

David