Biggest gold price losses to hit market in mid-2022, here's why

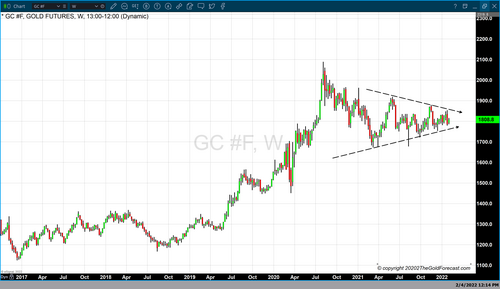

Gold prices could be looking at sideways price action for the rest of the year. The biggest test comes in mid-2022 when inflation begins to stabilize and markets absorb higher interest rates, according to DailyFX.com senior strategist Christopher Vecchio.

After a quick rally above $1,850 an ounce, gold could already be running out of steam, Vecchio told Kitco News, pointing to a move in the U.S. Treasury yields.

"I don't necessarily have a lot of faith in gold's move higher," he said. "Underlying fundamentals remain a significant concern. We've seen the U.S. Treasury yields, both nominally and in real terms, move significantly higher at the start of 2022. Historically speaking, gold prices tend to go down when real yields go up. And in an environment defined by tighter monetary policy over the course of this year, real yields will continue to move higher."

Vecchio sees gold ending the year at $1,800 an ounce, which is about where it is trading now. At the time of writing, April Comex gold futures were last at $1,801.40, up 0.28% on the day.

"I don't see that gold has a legitimate path higher from here. The fiscal and monetary stimulus impulses are fading rapidly in the United States and in other Western economies. The UK, for example, has already embarked on austerity on the fiscal side. And the Bank of England is looking like they're going to move forward with three or four hikes this year. Here in the United States, we see that it's increasingly unlikely that the Democratic Congress is able to find consensus around a new fiscal stimulus plan, like the Build Back Better program," Vecchio described.

With tighter monetary policy and no major fiscal spending projected for the rest of the year, the outlook for gold looks very neutral.

"As we near those midterm elections, it's going to be increasingly difficult to expect a scenario where we get any sort of big fiscal stimulus out of the U.S. If Republicans do take back control of the House, of the Senate, we go back to a situation we had in the early 2010s when you had a Democrat in the White House and Republicans in control of Congress. Gold prices peaked in 2011. And then they were on a steady decline for about five or six years," Vecchio said.

This environment encourages investors to sell gold during rallies, especially if the Fed succeeds in controlling the four-decade high inflation. The senior strategist estimates inflation to balance out by the end of the year as the Fed proceeds with four rate hikes in March, June, September, and December.

Vecchio is not ruling out inflation returning back under 3% by the end of 2022. "As vaccination rates continue to pick up and more lethal strains of COVID are being replaced with more manageable strains, consumers should shift their spending back towards services and away from goods. And as that spending shift occurs, the supply chain bottlenecks will ease. It would not surprise me if by the end of 2022 we're looking at headline inflation in the U.S. back under 4% or perhaps even 3%," he said.

This macro outlook undercuts gold's appeal as an inflation hedge in the long term, with investors no longer looking for safe havens and opting for assets with exposure to global growth conditions.

"If gold couldn't rally in an environment where we had U.S. government debt surging year-over-year and the Fed pumping trillions of dollars into markets. Then why would it be able to do so in the exact opposite environment where we don't have that fiscal stimulus, where the Fed is tightening and withdrawing its asset purchase program," Vecchio noted.

Expect 'much higher' commodity prices if Russia-Ukraine crisis escalates – ING

Gold's Q1 potential

Despite the neutral long-term view on gold, Vecchio said there is a chance to see $1,870 an ounce levels in the first quarter.

"Market chatter of a potential 50 basis point hike in March is misplaced," he stated. "As the market relaxes those very extreme expectations, there is room for gold to continue to move up, which is why I am looking for a potential peak around $1860, $1870 before more selling kicks in."

The markets get jittery around the early stages of the Fed's tightening cycle, which could be bad for equities but good for the precious metals. "It does create a decent environment here for the first quarter. But as we make our way into the middle part of the year, particularly in the second half of the year, that's where I think that that gold could really see its losses accumulate," Vecchio clarified.

Risks to the outlook

One potential upside price risk to Vecchio's outlook is the Fed kicking off quantitative tightening too soon and walking into a policy trap.

"It's a three-step process. First, we taper QE, then we move on to rate hikes, and in the late part of the rate hike cycle, we begin quantitative tightening — the balance sheet reduction," he said. "For the Fed to do all three in a very short period of time, it could prove significantly de-stabilizing to financial markets. You could have a knock-on effect where you potentially see spikes in unemployment. The Fed is then forced into a policy mistake where, in the very short term, you still have relatively high measures of inflation and unemployment rates are going back up. That's when the stagflation fears begin to creep in."

Vecchio described this risk as an unlikely one, stating that he would be shocked to see the Fed move forward with balance sheet reduction at any point in 2022.

Another potential upside risk to the senior strategist's gold outlook is a new COVID strain that proves to be just as transmissible but more lethal than Omicron, causing more supply chain problems. "New lockdowns restrictions on social activity would push people into spending more money on goods than services," he said.

Also, escalating geopolitical tensions between Russia and Ukraine or China and Taiwan could trigger another rally in gold. "Any sense that it will be more than just a war of words and we see boots on the ground or ships at sea, that is something that could stoke significant demand for safe havens like gold and silver," Vecchio said.

By Anna Golubova

For Kitco News

Time to buy Gold and Silver on the dips

David

(2).gif)

.gif)