Gold's not afraid of the Fed or seven rate hikes

The humanitarian crisis caused by Russia's invasion of Ukraine continues to build. According to the United Nations 816 civilians have been killed and 1,333 more have been wounded in the fighting.

It looks like, the war is not going to end anytime soon and people will continue to suffer. At the same time the gold market is starting to lose its geopolitical safe-haven premium. Analysts have said that it looks like the conflict will be contained within the country.

At the same time, the impact of the war in Eastern Europe will be felt worldwide and will continue to roil commodity markets. At the start of the week, the International Monetary Fund, warned that the war would lower global growth expectations and increase consumer prices.

"The war may fundamentally alter the global economic and geopolitical order should energy trade shift, supply chains reconfigure, payment networks fragment, and countries rethink reserve currency holdings. Increased geopolitical tension further raises risks of economic fragmentation, especially for trade and technology," the IMF warned.

So even as gold's safe-haven premium starts to wane, there are still plenty of reasons for investors to have the precious metal in their portfolio.

"You don't know when the next geopolitical event will happen. You don't know when the next inflation threat hits, so having long-term exposure to commodities and gold makes sense," said Kristina Hooper, chief investment strategist at Invesco, in an interview with Kitco News.

Many analysts have pointed out that rising inflation remains the biggest reason why investors should hold some gold. Some analysts have recommended an overweight position in the precious metal of between 10% and 15%.

Gold has proven its value as a diversified asset – Invesco's Hooper

Gold has proven its value as a diversified asset – Invesco's Hooper

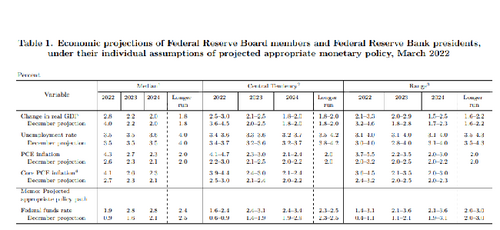

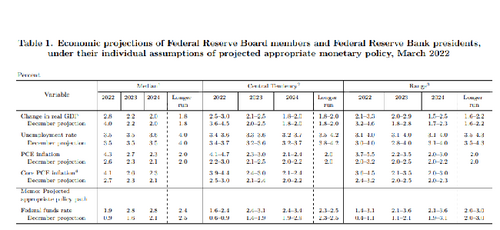

Adding to the bullish sentiment in gold is that fact that Federal Reserve has unveiled a clear monetary policy plan. Many analysts have noted that gold traditionally performs poorly ahead of a new tightening cycle but rallies higher once the path has been laid out.

We can see the underlying strength in the gold market. Prices have managed to hold support above $1,900 an ounce even as the U.S. central bank looks to raise interest rates seven times this year and could start to reduce its balance sheet at the next meeting.

Inflation is the biggest reason why gold has been able to withstand the Federal Reserve's new tightening cycle. The latest CPI numbers showed annual inflation rising 7.9% in February.

"If indeed the Federal Reserve does follow through with its plan that will put interest rates at 1.75% by the end of the year. Interest rates will remain under 2% this year. I don't think markets have much to worry about," said George Milling-Stanley, chief gold strategist at State Street Global Advisors. "Now that we've got the reality of the first-rate and we know what's in store for next nine months, we will focus much more closely on inflation numbers. That's probably the right thing to be focusing on."

By Neils Christensen

For Kitco News

Time to buy Gold and Silver on the dips

David

What's this year's 'potential end game'? Gold price at $2,500, oil price at $50 – Bloomberg Intelligence

What's this year's 'potential end game'? Gold price at $2,500, oil price at $50 – Bloomberg Intelligence

Gold price and risk: metal off daily lows but surging yields, risk sentiment, and oil price crash weigh

Gold price and risk: metal off daily lows but surging yields, risk sentiment, and oil price crash weigh.gif)

.gif)

.gif) Consolidation after rising above $2,000 an ounce is a good thing for gold, said RJO Futures senior market strategist Frank Cholly.

Consolidation after rising above $2,000 an ounce is a good thing for gold, said RJO Futures senior market strategist Frank Cholly.

Gold prices could hold around $2,000 for the next two years – ABN AMRO

Gold prices could hold around $2,000 for the next two years – ABN AMRO.gif)

.gif)