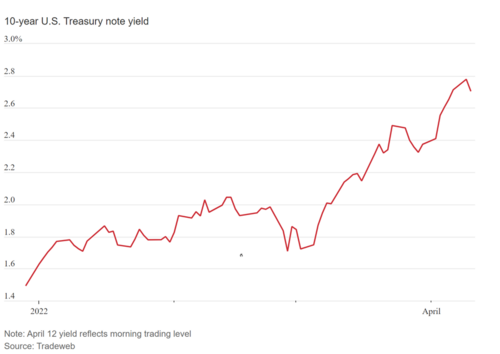

Gold, silver succumb to big drop in crude oil, rise in bond yields

Gold and silver prices are a sharply lower in midday U.S. trading Tuesday, on a big downside price corrections after both metals hit five-week highs on Monday. Solid losses in the crude oil market and rising U.S. Treasury yields on this day also worked against the precious metals market bulls. June gold futures were last down $26.90 at $1,959.60 and May Comex silver was last down $0.775 at $25.37 an ounce.

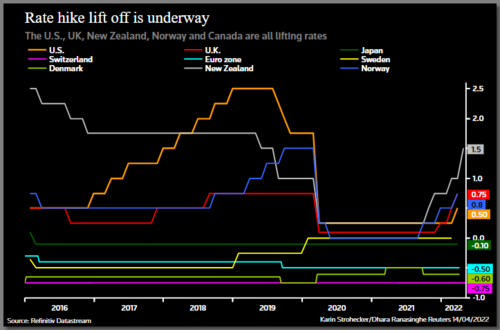

Global stocks markets were mixed to weaker overnight. The U.S. stock indexes are higher at midday. Still, the U.S. stock indexes have become wobbly and are now in near-term price downtrends. Risk aversion in the global marketplace remains extra elevated amid the Russia-Ukraine war that shows no signs of ending. Inflation concerns have also hurt stocks and bonds.

IMF's warning: Russia's war in Ukraine severely hurts global growth, adds to decade-high inflation

IMF's warning: Russia's war in Ukraine severely hurts global growth, adds to decade-high inflation

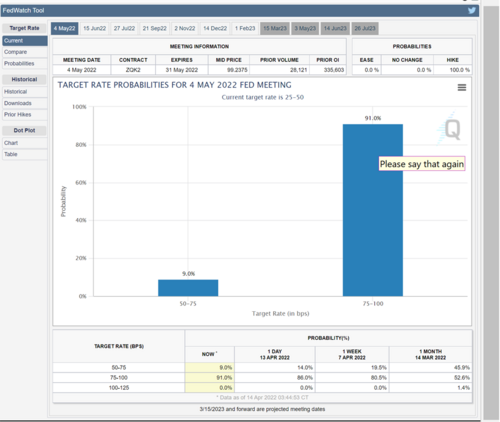

Nymex crude oil futures prices are sharply lower today and trading around $103.00 a barrel. The U.S. dollar index is firmer today and hit a two-year high. The closely watched yield on the 10-year Treasury note is presently fetching 2.898%, near a three-year high.

.gif)

Technically June gold futures bulls still have the firm overall near-term technical advantage. Bulls' next upside price objective is to produce a close above solid resistance at $2,000.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $1,915.00. First resistance is seen at $1,972.50 and then at today’s high of $1,985.10. First support is seen at $1,950.00 and then at $1,940.00. Wyckoff's Market Rating: 7.0Live 24 hours silver chart [ Kitco Inc. ].gif) May silver futures bulls have the firm overall near-term technical advantage and have momentum. Silver bulls' next upside price objective is closing prices above solid technical resistance at the March high of $27.495 an ounce. The next downside price objective for the bears is closing prices below solid support at $24.045. First resistance is seen at $26.00 and then at today’s high of $26.195. Next support is seen at today’s low of $25.21 and then at $25.00. Wyckoff's Market Rating: 7.0.

May silver futures bulls have the firm overall near-term technical advantage and have momentum. Silver bulls' next upside price objective is closing prices above solid technical resistance at the March high of $27.495 an ounce. The next downside price objective for the bears is closing prices below solid support at $24.045. First resistance is seen at $26.00 and then at today’s high of $26.195. Next support is seen at today’s low of $25.21 and then at $25.00. Wyckoff's Market Rating: 7.0.

May N.Y. copper closed down 990 points at 470.20 cents today. Prices closed nearer the session low today. The copper bulls have the overall near-term technical advantage. Copper bulls' next upside price objective is pushing and closing prices above solid technical resistance at the April high of 486.00 cents. The next downside price objective for the bears is closing prices below solid technical support at 450.00 cents. First resistance is seen at 475.00 cents and then at 480.00 cents. First support is seen at today’s low of 468.05 cents and then at the April low of 462.40 cents. Wyckoff's Market Rating: 6.5.

By Jim Wyckoff

For Kitco News

Time to buy Gold and Silver on the dips

David

46%

46% 31%

31% As gold price eyes $2,000 again, its 'big test' is yet to come, says MKS

As gold price eyes $2,000 again, its 'big test' is yet to come, says MKS

'Recession is coming next year': time to sell stocks, buy Bitcoin – Mashinsky

'Recession is coming next year': time to sell stocks, buy Bitcoin – Mashinsky

Palladium price up 8%; lifts precious metals as London bans Russia PGM refineries

Palladium price up 8%; lifts precious metals as London bans Russia PGM refineries