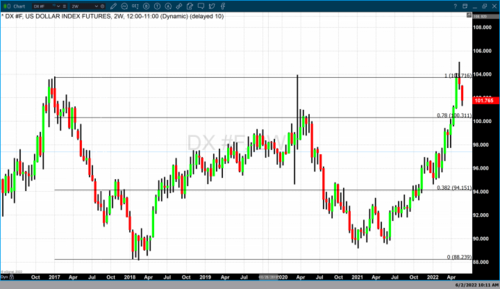

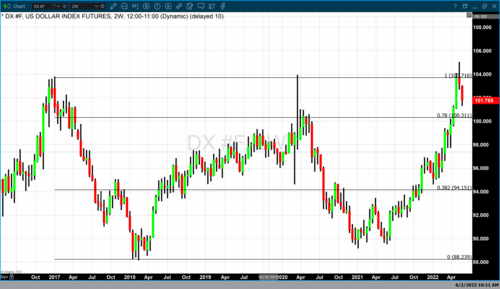

Gold loses early gains as greenback, U.S. Treasury yields push higher

Gold prices are modestly down in midday U.S. trading Monday, while silver is holding mild gains. Both metals lost altitude in morning trading as the U.S. dollar index rallied to its daily high, while U.S. Treasury yields resumed their upward advance. The yield on the 10-year U.S. Treasury note is now fetching 3.02%. August gold futures were last down $4.70 at $1,845.50. July Comex silver futures were last up $0.212 at $22.115.n ouces

Global stock markets were mostly up overnight. U.S. stock indexes are higher at midday. Trader and investor risk appetite is a bit keener to start the trading week, amid easing Covid restrictions in China.

Two key data points of the week are the European Central Bank’s regular monetary policy meeting Thursday, at which the central bank is expected to lay out plans for tightening its monetary policy. On Friday the U.S. consumer price index report for May is set for release. The CPI is expected to be up 8.2%, year-on-year, after a rise of 8.3% in April.

Emerging market central banks represent new demand for gold as they de-dollarize – Société Générale

Emerging market central banks represent new demand for gold as they de-dollarize – Société Générale

The key other outside market today sees Nymex crude oil prices a bit weaker and trading around $118.50 a barrel.

.gif)

Technically, August gold futures bears have the overall near-term technical advantage but the bulls are still working on a fledgling price uptrend. However, they need to show fresh power soon to keep it alive. Bulls' next upside price objective is to produce a close above solid resistance at $1,900.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $1,800.00. First resistance is seen at today’s high of $1,861.20 and then at $1,875.00. First support is seen at last week’s low of $1,830.20 and then at $1,825.00. Wyckoff's Market Rating: 3.5

.gif)

July silver futures bears have the overall near-term technical advantage. However, the bulls are working on a fledgling price uptrend on the daily chart. Silver bulls' next upside price objective is closing prices above solid technical resistance at $23.00 an ounce. The next downside price objective for the bears is closing prices below solid support at $21.00. First resistance is seen at today’s high of $22.565 and then at $23.00. Next support is seen at $21.785 and then at last week’s low of $21.41. Wyckoff's Market Rating: 3.5.

July N.Y. copper closed down 375 points at 443.40 cents today. Prices closed near mid-range today. Prices have backed well down from last Friday’s five-week high. The copper bulls still have the overall near-term technical advantage. A three-week-old price uptrend is in place on the daily bar chart. Copper bulls' next upside price objective is pushing and closing prices above solid technical resistance at 465.00 cents. The next downside price objective for the bears is closing prices below solid technical support at last week’s low of 425.90 cents. First resistance is seen at 450.00 cents and then at last week’s high of 457.70 cents. First support is seen at today’s low of 443.65 cents and then at 435.00 cents. Wyckoff's Market Rating: 6.0.

By Jim Wyckoff

For Kitco News

Time to buy Gold and Silver on the dips

David

Is global 'slavery' coming? Gold guards against 'total control' – Bob Moriarty

Is global 'slavery' coming? Gold guards against 'total control' – Bob Moriarty

.gif)

Tennessee removes sales tax on gold and silver, only eight states to go

Tennessee removes sales tax on gold and silver, only eight states to go.png)

.png)