Tough talk by Chairman Powell signaling more rate hikes over a longer time span

As expected, the Fed announced its decision to raise its benchmark rate by 50-bps. This takes the central bank’s “Fed funds” rate to between 425 – 450 bps (4 ¼% – 4 ½%). However, it was Chairman Powell’s comments regarding his policy outlook during the press conference that garnered the most attention. Market participants and analysts were looking for insight into the forward guidance of the Federal Reserve as it pertains to their monetary policy, inflation, and future rate hikes. Which revealed that the Federal Reserve will continue its policy of monetary tightening by continuing to raise rates in 2023.

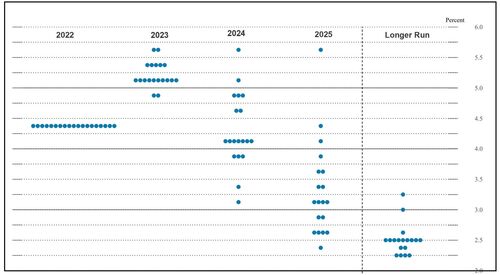

The Federal Reserve released a statement as well as its summary of economic projections for 2023 through 2025 after today’s FOMC meeting. One component of their economic projections was the most current “dot plot” which reveals assessments made by each Fed official. When the Fed is fully staffed the dot plot will contain 19 individual projections.

2023 – All of the 19 Federal Reserve members who added their “dot” to the Fed’s projections reflected higher interest rates in 2023. The majority of members (10 votes) anticipate rates to be at 5 ¼%, with four members anticipating rates to go to 5 ½%, two members anticipating rates at 5 ¾% and two members anticipating rates at 4 ¾%.

2024 -seven members anticipate that interest rates will remain elevated above the current rate of 4 ½%, with the remaining 12 members anticipating rate reductions from ¼% to 1 ½%.

2025 – all Federal Reserve members anticipate that fed funds rates will be 4 ½% to 3% by the end of 2025.

Chairman Powell delivered a strong message reinforcing the information contained in their economic outlook and the Fed’s policy outlook saying, “Fed policymaker projections are best assessment of where Fed policy rates will be.”

Chairman Powell’s press conference

Chairman Powell acknowledged that the last two CPI reports were promising but incomplete. “Data we have received so far on inflation for October and November do show a welcome reduction in price pressures; need substantially more evidence though to be confident inflation coming down.” He also said that “recent data gives us greater confidence in our forecast.”

His statements supported the Federal Reserve’s resolve and commitment to keep interest rates at their current level and higher until the Fed reaches its inflation target of 2%. Addressing the possibility of a recession he simply said “no one knows if we are going to have a recession or not.”

Today’s FOMC meeting statement, economic projections, and press conference resulted in declines in the dollar, US equities, and precious metals. As of 5:20 PM EST gold futures basis, the most active February 2023 contract is currently fixed at $1818.80 after factoring in today’s decline of $6.70 or 0.37%. Concurrently the dollar declined by 0.33% and is currently fixed at 103.595. Dollar weakness added $6.70 to the price of spot gold and normal trading indicated that traders moved gold pricing lower by $9.40, according to the Kitco gold index.

It was clear that Chairman Powell's statements today delivered a hard-hitting truth to Americans that inflation will remain persistent for longer than anticipated and interest rates will follow the same course.

By Gary Wagner

David