Gold closes at its highest value this year, although traders bid it lower

Gold futures and spot pricing closed moderately higher today. However, traders and investors bid the precious yellow metal lower with dollar weakness accounting for all of today's gains. As of 4:40 PM EST gold futures basis, the most active February contract is currently up $5.80 or 0.32% and fixed at $1875.60. Concurrently, the dollar is trading 0.68% lower on the day with the dollar index currently fixed at 102.945. Simply comparing the percentage gain in gold (+0.32%) against the percentage decline in the dollar (-0.68%) reveals that there was selling pressure in gold futures today.

The same is true for spot or physical gold. According to the KGX, (Kitco Gold Index) spot gold is currently fixed at $1870.80 after factoring in today's gain of $5.10. However on closer inspection dollar weakness resulted in gains of $12.90 per ounce, and selling pressure took gold lower by $7.80 resulting in today's moderate gain.

A case can be made for the selling pressure in gold on a fundamental and technical basis. Reuters News reported a comment made by Mary Daily the president of the San Francisco Federal Reserve Bank who said, "The Fed should try to bring inflation down "as gently as we can," but it also "absolutely" needs to make sure high inflation does not become embedded."

This suggested that the Fed might raise rates by 50- bps, rather than 25 bps which was the anticipated rate hike that the Federal Reserve would enact at the next FOMC meeting (January 31 – February 1). During a webcast interview with the Wall Street Journal daily she left open that possibility. "I can give you arguments for either side."

She confirmed the current outlook by the Federal Reserve that ultimately interest rates need to go to between 5.00% and 5.25% and remain there to bring inflation to the Federal Reserve's target of 2%.

Traders and investors are viewing the potential for a 50-bps hike as reflected by the selling pressure in both gold futures and spot pricing. However, according to the CME's FedWatch tool, there is a 79.2% probability that the Federal Reserve will raise rates by ¼% and a 20.8% probability that they will raise rates more aggressively by 50 bps.

Market participants will look at the December reading of the CPI (Consumer Price Index) this Thursday to gain more insight into the Federal Reserve's 2023 monetary policy.

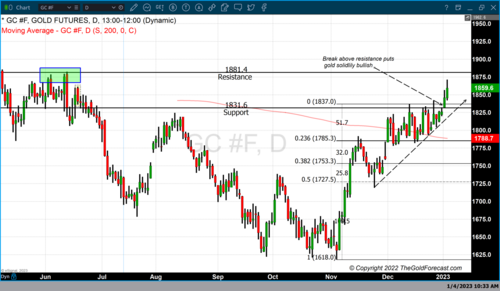

Technical studies also suggest that gold prices could correct

Today gold futures traded to an intraday high of $1886 before settling approximately $10 lower at the time of this writing. Our technical studies indicate that gold futures could find potential resistance at $1881 which is based upon a top that occurred at the end of June 2022. Gold futures did trade above that price point but closed below it suggesting possible resistance at the top created in June.

By Gary Wagner

Contributing to kitco.com

David

.png)

More price upside likely for silver in 2023

More price upside likely for silver in 2023

Silver price to beat gold in 2023? Precious metal plays catch-up on strong demand, ETFs remain missing puzzle piece

Silver price to beat gold in 2023? Precious metal plays catch-up on strong demand, ETFs remain missing puzzle piece