Gold Price to New Heights ?

Since its low in November 2022, the price of gold in dollars has climbed nearly +15% (compared to +4.5% in euros). The rising cost of gold production and the declining profitability of mining companies largely explain this movement. As early as November 2022, we were insisting on the strong probability of an effective gold reversal in 2023. This movement has now been confirmed. But will this rise be enough to drive new highs?

Throughout this publication, we will see that despite the slight drop in the dollar price of gold in 2022, demand is clearly on the rise. At the same time, production costs are rising and mining companies are less profitable. This context largely explains the strong rebound of gold. But what is most impressive is the appetite of central banks for gold, whose demand has increased at a rate not seen since 1967… Behind the structural changes in the market, gold seems to hide a geopolitical confrontation of considerable magnitude.

Strong increase in demand for gold in 2022

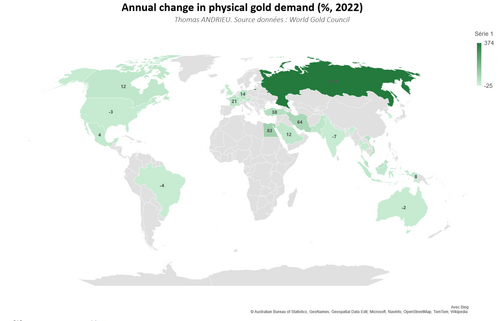

Contrary to what many had suggested, demand for gold was boosted considerably in 2022. Demand for the physical metal increased by 18% between 2021 and 2022, while supply increased by only 2%. The stability of the gold price in 2022 once again shows the lack of a link between the price and actual demand.

We should also note the particular case of Russia. The demand for coins and bars in Russia jumped by 374% in 2022 to 25 tons! This is a very significant increase for the reasons we know. In France, the increase in demand for coins and bars is still 21%, or 14% in Germany. The chart shows a clear interest in gold in European countries, mainly due to the fall of the euro in 2022. But the interest in gold is even stronger in the Middle East and Russia, driven by a desire for monetary independence.

Central banks are massively buying gold

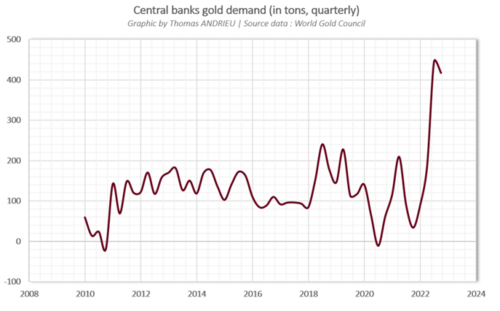

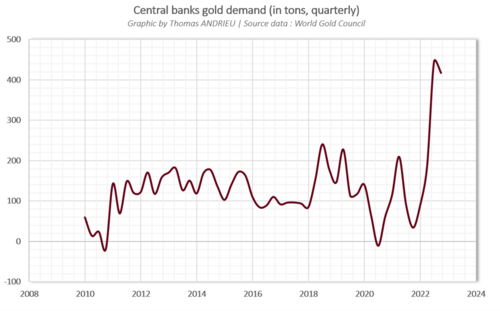

One thing that catches our attention is the sudden and massive revival of interest in the yellow metal by central banks. Central bank demand for gold jumped 152% between 2021 and 2022! This is simply the largest amount of gold ever purchased by central banks in one year in decades. The equivalent of 1,135 tons.

These massive purchases are questionable, as they run counter to the trend observed in recent years. In 2019 and 2020, central bank demand had fallen by 7.7% and 5.8%, respectively. Central banks' purchases are taking place against a backdrop of balance sheet reduction, which seems contradictory. Turkey has thus increased its gold reserves by 147 tons in 2022, followed by 62 tons for China, and 44 tons for Egypt.

According to the World Economic Forum, the pace of gold accumulation by central banks is unprecedented since 1967! In a WEF article published on November 10, 2022, the WEF states that: “Gold is regarded as an effective inflation hedge, although some analysts believe this to be true only over extremely long time horizons stretching over a century or more.”

Gold is primarily considered in the same way as foreign exchange reserves. In order for the balance of payments between countries to be balanced, central banks must change their reserves. Foreign exchange reserves thus tend to decrease when a country experiences either capital outflows, a deterioration of its trade balance, or a decrease in prices. It is understandable why, in an inflationary context, the demand for foreign exchange reserves increases, and with it, the demand for gold. The case of Turkey, which has seen inflation rise to over 80%, is revealing. Faced with a rising dollar, many central banks are buying gold to ensure liquidity on the international scene. The real interest of gold for central banks is, above all, to guarantee a source of confidence and independence.

David