Gold prices soar as investors fearing more bank meltdowns move into safe havens

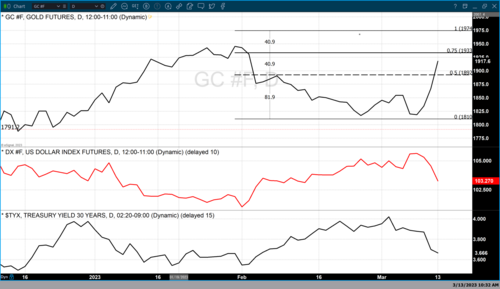

Gold has gained almost $100 in the last two days of trading. Gold futures basis most active April contract opened at $1835 on Friday and closed at $1867. Today gold opened at $1877 and as of 5:30 PM EST is currently fixed at $1917.30 after factoring in today’s gain of $50.10 or 2.66%.

Gold’s dramatic rise is largely the byproduct of a potential banking crisis with two banks showing “systemic risk” according to bank regulators. California’s Silicon Valley Bank and Signature Bank of New York required immediate action over the weekend to protect depositors’ capital. The banking meltdown resulted in the two-year Treasury yields having the largest three-day decline since black Monday in 1987.

The Federal Deposit Insurance Corporation Improvement Act of 1991 granted the Treasury Secretary after consulting the president to take steps to protect uninsured depositors in the presence of systemic risk. Originally this legislation was a component of the banking act of 1933 which created the FDIC.

Gold’s dramatic gain over the last two days was a combination of investors and large money managers flocking to gold as a haven asset, dollar weakness, and the belief that the Federal Reserve could pivot its aggressive interest rate hikes.

According to Burton Schlichter, Vice President of global clearing and execution at StoneX Financial said, “After the news on Friday about the uncertainty of customer funds at SVB Bank we noticed some traders covering short positions and some reversing their positions heading into the weekend.” StoneX currently serves more than 32,000 commercial, institutional, and payments clients, and more than 330,000 active retail accounts across 180 countries.

Market participants are under the assumption that the Federal Reserve may pivot by not implementing the anticipated ¼% rate hike at the March FOMC meeting. Some investors are under the assumption that the Federal Reserve might pivot and cut rates. This seems to be based on unrealistic optimism and conjecture rather than facts.

Tomorrow the government will release the latest inflation numbers vis-à-vis the CPI (Consumer Price Index) which combined with last week’s jobs report will be used by the Federal Reserve to make it’s final decision that will be announced on March 22 when the FOMC meeting concludes

By Gary Wagner

Contributing to kitco.com

David