Gold hits 12-mo. high, falls back a bit on profit taking

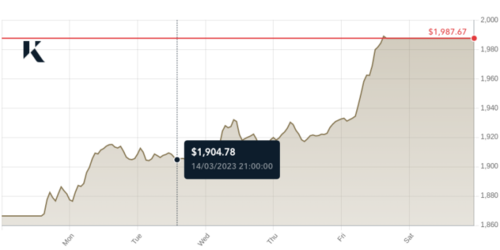

Gold and silver prices are slightly up in midday U.S. trading Monday, with gold notching a 12-month high of $2,014.90 overnight, basis April Comex futures, and silver a six-week high. Some normal profit-taking pressure and chart consolidation are seen on the price pullbacks from the overnight highs. Still, safe-haven demand for the metals is present in a shaky general marketplace amid the U.S. and European banking crisis. The technical charts are also bullish for gold and silver, which continues to invite chart-based speculators to the long sides. April gold was last up $1.70 at $1,975.30 and May silver was up $0.108 at $22.565.

Global stock markets were mixed to lower overnight. U.S. stock indexes are higher near midday. Banking stocks across the globe dropped Monday. Risk aversion is again keener early this week. The Swiss banking firm UBS acquired Credit Suisse over the weekend to try to stabilize the European banking system, following the collapse of two big U.S. banks in early March. The move did little to boost trader and investor confidence. "There is a general sentiment that is trending increasingly negative," said one market analyst. Said noted investor Mark Grant on CNBC when asked about the banking crisis: "It's going to get worse. It's going to be messy."

Now focus is on the Federal Reserve's FOMC meeting that begins Tuesday and concludes Wednesday afternoon. There is still some debate in the marketplace regarding whether the Fed will raise its main interest rate by 25 basis points or stand pat amid the U.S. and European banking crisis. Most market watchers, however, are leaning toward a 0.25% rate increase. The 0.5% rate hike by the European Central Bank last week makes a 0.25% increase by the FOMC more likely.

.gif) Once $2,000 breaks, gold is off to the races – Willem Middelkoop

Once $2,000 breaks, gold is off to the races – Willem Middelkoop

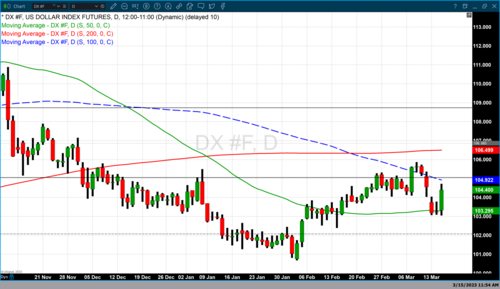

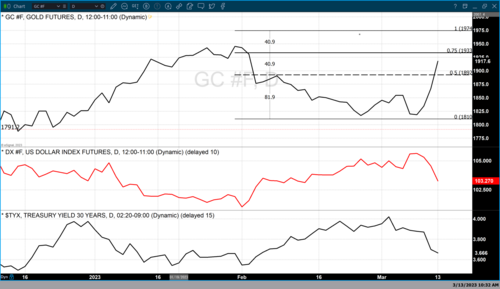

The key outside markets today see the U.S. dollar index lower. Nymex crude oil futures prices are lower, hit a 15-month low and are trading around $66.25 a barrel. The benchmark 10-year U.S. Treasury note yield is presently fetching 3.4%.

There was no major U.S. economic data released Monday.

Technically, April gold futures prices hit a 12-month high early on today. Bulls have the solid overall near-term technical advantage. Bulls' next upside price objective is to produce a close above solid resistance at the all-time high of $2,078.80. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $1,900.00. First resistance is seen at $2,000 and then at today's high of $2,014.90. First support is seen at today's low of $1,970.00 and then at $1,950.00. Wyckoff's Market Rating: 8.5

May silver futures bulls have the overall near-term technical advantage. Prices are in a fledgling uptrend on the daily bar chart. Silver bulls' next upside price objective is closing prices above solid technical resistance at $23.50. The next downside price objective for the bears is closing prices below solid support at $21.00. First resistance is seen at today's high of $22.855 and then at $23.00. Next support is seen at today's low of $22.35 and then at $22.00. Wyckoff's Market Rating: 6.5.

May N.Y. copper closed up 565 points at 394.90 cents today. Prices closed near the session high and scored a bullish outside day up. The copper bears have the overall near-term technical advantage. Prices are in a two-month-old downtrend on the daily bar chart. Copper bulls' next upside price objective is pushing and closing prices above solid technical resistance at the March high of 417.25 cents. The next downside price objective for the bears is closing prices below solid technical support at 372.00 cents. First resistance is seen at today's high of 396.10 cents and then at 400.00 cents. First support is seen at today's low of 385.50 cents and then at the March low of 382.20 cents. Wyckoff's Market Rating: 4.0.

By

Jim Wyckoff

For Kitco News

David

.png)

.png)

.png)

.png)

.gif) Global stock markets were mixed to weaker overnight. U.S. stock indexes are narrowly mixed at midday.Silver mines will likely be bought by automakers like Tesla, silver to $125 per ounce – Keith Neumeyer

Global stock markets were mixed to weaker overnight. U.S. stock indexes are narrowly mixed at midday.Silver mines will likely be bought by automakers like Tesla, silver to $125 per ounce – Keith Neumeyer