Gold, silver surge as USDX sinks, U.S. Treasury yields slip

Gold and silver prices are sharply higher in midday U.S. trading Thursday, boosted by a solidly lower U.S. dollar index and a dip in U.S. Treasury yields on this day. August gold was last up $24.60 at $1,983.00 and July silver was up $0.796 at $24.325.

The marketplace is starting to zero in on next week's FOMC meeting of the Federal Reserve. The majority of the marketplace thinks the Fed will pause in its interest-rate-tightening cycle. But now many market watchers think the U.S. central bank will follow the Bank of Canada's recent moves. The BOC this week raised interest rates by 0.25% after a four-month pause. The BOC's move “brings home the reality that a pause needn't be a pivot. It can also be a way to slow down increases while fresh data come in,” said a Wall Street Journal story today.

Asian and European stock markets were mostly weaker overnight. U.S. stock indexes are firmer at midday.

In other news, the Euro zone reported its first-quarter GDP was revised down to -0.1% from the fourth quarter. Meantime, the fourth-quarter GDP was revised down to -0.1%. That means the Euro zone technically entered a recession in the first quarter, albeit just barely.

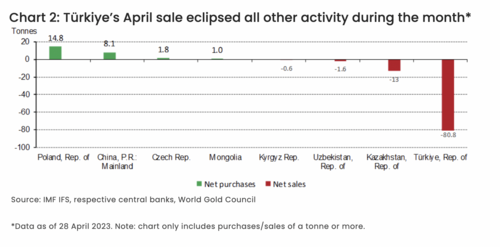

The Turkish lira hit a new record low against the U.S. dollar, prompting some worries of a possible currency contagion at some point, if the lira continues to weaken.

Stocks will end 2023 higher, but 'Fed has gone too far' – David Nelson

Stocks will end 2023 higher, but 'Fed has gone too far' – David Nelson

The key outside markets today see the U.S. dollar index sharply down. Nymex crude oil prices are sharply lower and trading around $70.00 a barrel. Meantime, the benchmark 10-year U.S. Treasury note yield is presently fetching 3.73%.

Technically, August gold futures bulls have the overall near-term technical advantage amid recent choppy trading. Bulls' next upside price objective is to produce a close above solid resistance at $2,000.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at the May low of $1,949.60. First resistance is seen at this week's high of $1,986.50 and then at $2,000.00. First support is seen at 1,970.00 and then at this week's low of $1,953.80. Wyckoff's Market Rating: 6.5

July silver futures prices hit a four-week high today. The silver bulls have regained the overall near-term technical advantage. Silver bulls' next upside price objective is closing prices above solid technical resistance at $25.00. The next downside price objective for the bears is closing prices below solid support at the May low of $22.785. First resistance is seen at today's high of $24.46 and then at $24.75. Next support is seen at $24.00 and then at today' low of $23.51. Wyckoff's Market Rating: 6.0.

July N.Y. copper closed up 195 points at 377.55 cents today. Prices closed nearer the session high today and closed at a four-week high close. The copper bears still have the overall near-term technical advantage. However, a six-week-old downtrend on the daily bar chart has been negated. Copper bulls' next upside price objective is pushing and closing prices above solid technical resistance at 400.00 cents. The next downside price objective for the bears is closing prices below solid technical support at the May low of 354.50 cents. First resistance is seen at this week's high of 381.15 cents and then at 385.00 cents. First support is seen at today's low of 373.45 cents and then at this week's low of 368.60 cents. Wyckoff's Market Rating: 4.0.

By

Jim Wyckoff

For Kitco News

David

(1).gif) Plenty of value in gold as WisdomTree forecasts $2,285 by Q1 2024

Plenty of value in gold as WisdomTree forecasts $2,285 by Q1 2024

Bitcoin voters could decide close U.S. elections as bipartisan political support grows – Lyn Alden

Bitcoin voters could decide close U.S. elections as bipartisan political support grows – Lyn Alden

The gold market posted its first monthly loss since February, wrapping May down about $36. As markets eye the crucial Congress vote to lift the debt ceiling, some Federal Reserve speakers are pushing for a "hawkish pause" at the June 13-14 meeting.

The gold market posted its first monthly loss since February, wrapping May down about $36. As markets eye the crucial Congress vote to lift the debt ceiling, some Federal Reserve speakers are pushing for a "hawkish pause" at the June 13-14 meeting.